- United States

- /

- Specialty Stores

- /

- NYSE:FL

Foot Locker's (NYSE:FL) Decline Looks Fundamentally Exaggerated

It is rare for companies to experience a double-digit decline in a day, but when they happen, the investors certainly take notice.

Among such examples is Foot Locker, Inc. (NYSE: FL), which declined 30% on the latest news, spooking the market with the latest guidance.

View our latest analysis for Foot Locker

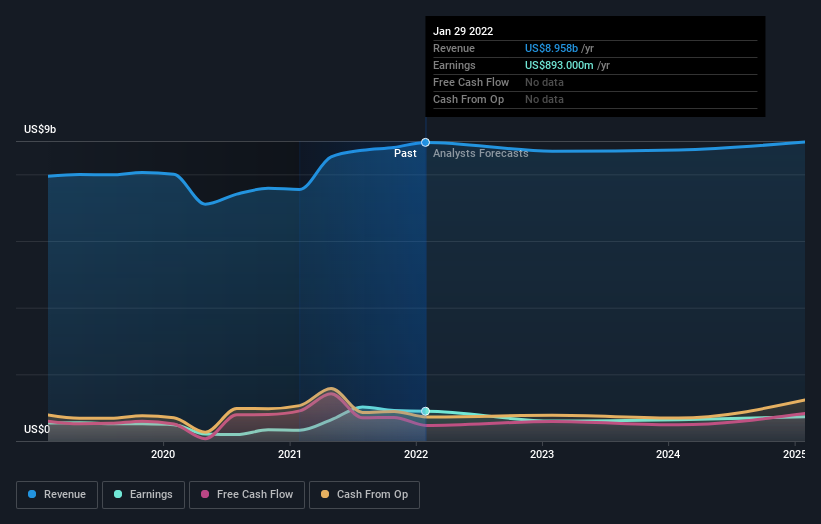

Full-year 2022 results:

- EPS: US$8.60 (up from US$3.10 in FY 2021).

- Revenue: US$8.96b (up 19% from FY 2021).

- Net income: US$893.0m (up 177% from FY 2021).

- Profit margin: 10.0% (up from 4.3% in FY 2021). The increase in margin was driven by higher revenue.

Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 1.6%.

Over the next year, revenue is expected to shrink by 2.9% compared to a 12% growth forecast for the retail industry in the US. Over the last 3 years, on average, earnings per share have increased by 29% per year, but its share price has fallen by 23% per year, which means it is significantly lagging earnings.

Other Highlights:

- FY 2022 Guidance Sales: - 4-6%

- FY 2022 Comparable Sales: - 8-10%

- FY 2022 EPS: US$4.25-US$4.60 vs. US$6.44 consensus

One of the main reasons for such an outlook is that Nike, one of Foot Locker’s suppliers, is moving to a direct digital selling strategy, limiting the sales to 55%. For comparison, in 2020, Nike accounted for 75% of total sales.

What kind of growth will Foot Locker generate?

Future outlook is an important aspect when buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price.

Foot Locker is expected to deliver a negative earnings growth of -18%, which doesn’t help build up its investment thesis. While this brings some risk in the near term, it is hard to justify the severe decline of the share price.

Management Pushing the Value Thesis

Management stepped in, declaring the US$0.40/share quarterly dividend. This hike equals a 33.3% increase. The yield is now over 4%, and the dividend has been restored to the pre-pandemic levels.

Furthermore, the board has authorized a new share buyback program to repurchase up to US$1.2b of common stock. Since the current market cap is US$2.92b, this is a significant move. Additionally, they stated that the CapEx plan for 2022 is US$275m, which includes new store openings, ongoing technology, and omnichannel investments, as well as new facilities in Reno, NV, and Houston, TX.

Currently, with a P/E ratio of 3.3 and a P/S ratio of 0.3, the company looks like a value story. The stock is now trading at the level from 10 years ago. Yet, its financial position is exceptional as it has virtually no debt and US$800m cash at hand.

At this point, it wouldn’t be surprising to see a bid for the company from a conglomerate like Berkshire Hathaway or from Nike that would benefit from the integration.

For further research, we found 3 warning signs for Foot Locker (1 is significant!) that we believe deserve your full attention. If you are no longer interested in Foot Locker, you can use our free platform to see our list of over 50 other stocks with high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:FL

Foot Locker

Through its subsidiaries, operates as a footwear and apparel retailer in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives