- United States

- /

- Specialty Stores

- /

- NYSE:FL

Foot Locker, Inc.'s (NYSE:FL) Popularity With Investors Under Threat As Stock Sinks 25%

Foot Locker, Inc. (NYSE:FL) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

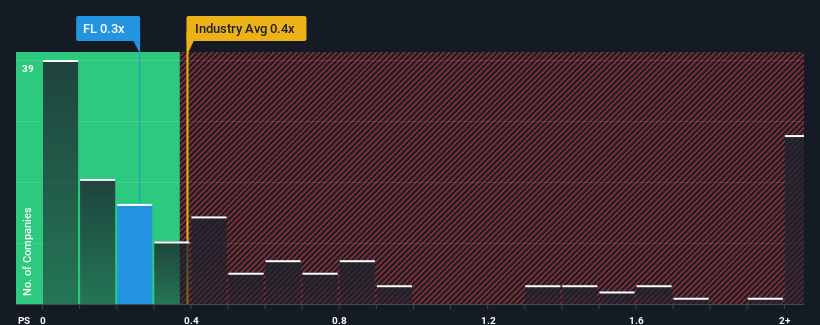

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Foot Locker's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in the United States is also close to 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Foot Locker

How Has Foot Locker Performed Recently?

Foot Locker hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Foot Locker's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Foot Locker?

Foot Locker's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.6%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.1% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.4% as estimated by the analysts watching the company. That's not great when the rest of the industry is expected to grow by 4.3%.

With this information, we find it concerning that Foot Locker is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Foot Locker looks to be in line with the rest of the Specialty Retail industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our check of Foot Locker's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Foot Locker, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Foot Locker, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Foot Locker, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FL

Foot Locker

Through its subsidiaries, operates as a footwear and apparel retailer in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives