- United States

- /

- Specialty Stores

- /

- NYSE:CWH

Camping World Holdings (NYSE:CWH) Has Affirmed Its Dividend Of $0.125

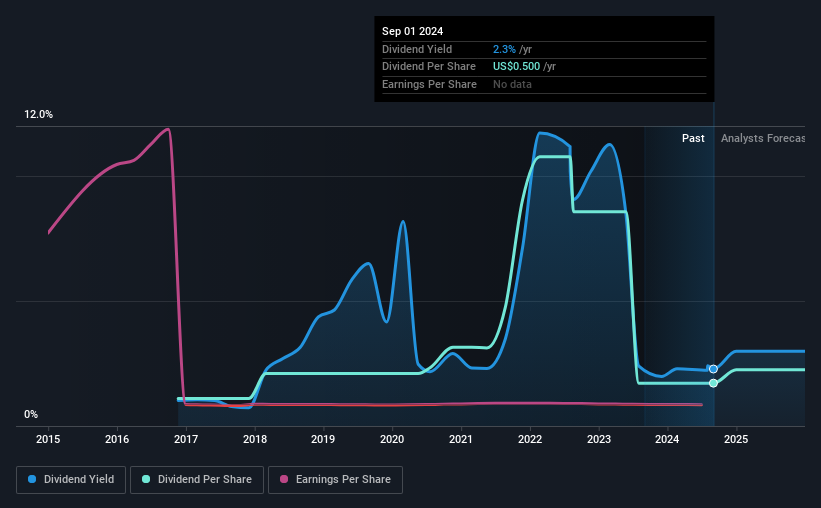

The board of Camping World Holdings, Inc. (NYSE:CWH) has announced that it will pay a dividend of $0.125 per share on the 25th of September. This makes the dividend yield 2.3%, which will augment investor returns quite nicely.

View our latest analysis for Camping World Holdings

Camping World Holdings Doesn't Earn Enough To Cover Its Payments

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Camping World Holdings isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. These payout levels would generally be quite difficult to keep up.

Over the next year, EPS is forecast to expand by 137.5%. If the dividend continues on its recent course, the company could be paying out several times what it earns in the next 12 months, which could start applying pressure to the balance sheet.

Camping World Holdings' Dividend Has Lacked Consistency

Camping World Holdings has been paying dividends for a while, but the track record isn't stellar. This suggests that the dividend might not be the most reliable. Since 2016, the annual payment back then was $0.32, compared to the most recent full-year payment of $0.50. This means that it has been growing its distributions at 5.7% per annum over that time. A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

The Company Could Face Some Challenges Growing The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's encouraging to see that Camping World Holdings has been growing its earnings per share at 11% a year over the past five years. It's not an ideal situation that the company isn't turning a profit but the growth recently is a positive sign. All is not lost, but the future of the dividend definitely rests upon the company's ability to become profitable soon.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. Strong earnings growth means Camping World Holdings has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We don't think Camping World Holdings is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 2 warning signs for Camping World Holdings that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CWH

Camping World Holdings

Together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives