- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Will Carvana (CVNA) Same-Day Delivery Drive Lasting Loyalty or Raise Efficiency Questions?

Reviewed by Sasha Jovanovic

- Carvana recently announced the launch of same-day vehicle delivery for select customers in the greater San Diego area, allowing local buyers to receive purchased vehicles on the day their order is placed and sellers to access as-soon-as same-day pickup or drop-off after an online appraisal.

- This expansion leverages Carvana’s e-commerce platform and logistics network, underscoring an ongoing commitment to improving speed and convenience for online car buyers and sellers as the service becomes available in more than 20 states.

- We'll explore how the rollout of same-day delivery in San Diego may influence Carvana's growth outlook and digital customer experience strategy.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Carvana Investment Narrative Recap

To be a Carvana shareholder, you need conviction in the long-term shift to digital car buying and the company's ability to scale its logistics efficiently. The recent expansion of same-day vehicle delivery in San Diego could support sales momentum by enhancing customer convenience, but it does not materially alter the primary near-term catalyst: demonstrating sustained improvements in operating margin. The major short-term risk remains the potential for cost overruns as Carvana ramps up logistics and reconditioning centers, where delays or inefficiencies could pressure profitability.

One recent announcement closely related to this news is the September integration of Inspection and Reconditioning Center (IRC) capabilities at ADESA Golden Gate in California. Bolstering IRC capacity directly impacts Carvana’s ability to provide faster deliveries like those now seen in San Diego, tightly linking this operational investment to customer experience improvements, essential for realizing the potential of ongoing service rollouts as a business catalyst.

However, even as delivery speed drives appeal, investors should also watch for signs of rising logistics costs that could weigh on margins if ...

Read the full narrative on Carvana (it's free!)

Carvana's narrative projects $33.2 billion in revenue and $2.2 billion in earnings by 2028. This requires 26.8% yearly revenue growth and a $1.64 billion earnings increase from the current $563.0 million.

Uncover how Carvana's forecasts yield a $423.60 fair value, a 30% upside to its current price.

Exploring Other Perspectives

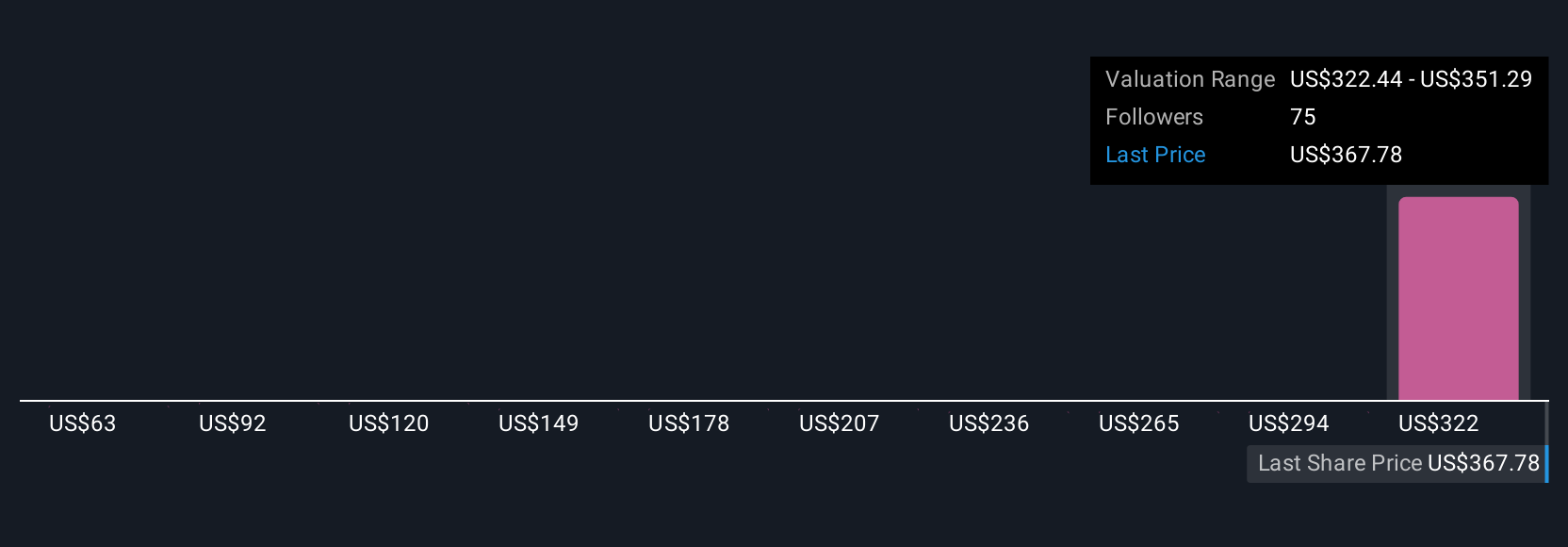

Seventeen Simply Wall St Community member estimates place Carvana’s fair value anywhere between US$62.76 and US$500 per share. While many see opportunity, the risk of operational bottlenecks and margin compression remains a key concern for fundamental performance. Explore how different viewpoints might influence your own expectations.

Explore 17 other fair value estimates on Carvana - why the stock might be worth less than half the current price!

Build Your Own Carvana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives