- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (CVNA) Valuation in Focus as Turnaround Gains Traction with Improved Credit and Debt Restructuring

Reviewed by Kshitija Bhandaru

Carvana (CVNA) is turning heads once again after bouncing back from the brink. With recent cost-cutting, debt restructuring, and better credit metrics, investors are taking a closer look at the company’s evolving valuation story.

See our latest analysis for Carvana.

Carvana’s stock has been on a rollercoaster, but momentum looks to be building again as operational wins take center stage. With its latest Inspection and Reconditioning Center expansion and improved credit metrics, shares have surged and delivered a standout 1-year total shareholder return of 74%. Even with some recent pullback, long-term investors have been well rewarded, as shown by an incredible 2,394% total return over three years.

If you’re looking for more turnaround stories or standout performers, broaden your search and discover fast growing stocks with high insider ownership.

But after such a dramatic rebound and headline-grabbing gains, the key question is whether Carvana’s stock remains undervalued or if the market has already priced in the company’s turnaround and future growth potential.

Price-to-Earnings of 81.9x: Is it justified?

Carvana trades at a lofty price-to-earnings (P/E) ratio of 81.9x, more than quadruple the average for its industry peers. The company's $333.81 share price currently reflects this premium valuation, signaling that investors anticipate substantial future growth.

The P/E ratio measures how much investors are willing to pay for a dollar of the company’s earnings. This provides insight into market expectations for growth versus risk. For Carvana, such a high multiple suggests that the market is focused on a compelling growth narrative rather than present earnings power.

However, this premium does not exist in isolation. The average P/E ratio across the US Specialty Retail industry stands at just 16.1x. Carvana’s estimated fair P/E, based on deeper financial modeling, is 41.4x. The current P/E more than doubles both of these benchmarks, indicating that the stock is priced for perfection and may be vulnerable if growth projections slip.

Explore the SWS fair ratio for Carvana

Result: Price-to-Earnings of 81.9x (OVERVALUED)

However, risks remain, including any slowdown in revenue growth or missed profit targets. These issues could quickly dampen investor enthusiasm and reset expectations.

Find out about the key risks to this Carvana narrative.

Another View: What Does the SWS DCF Model Say?

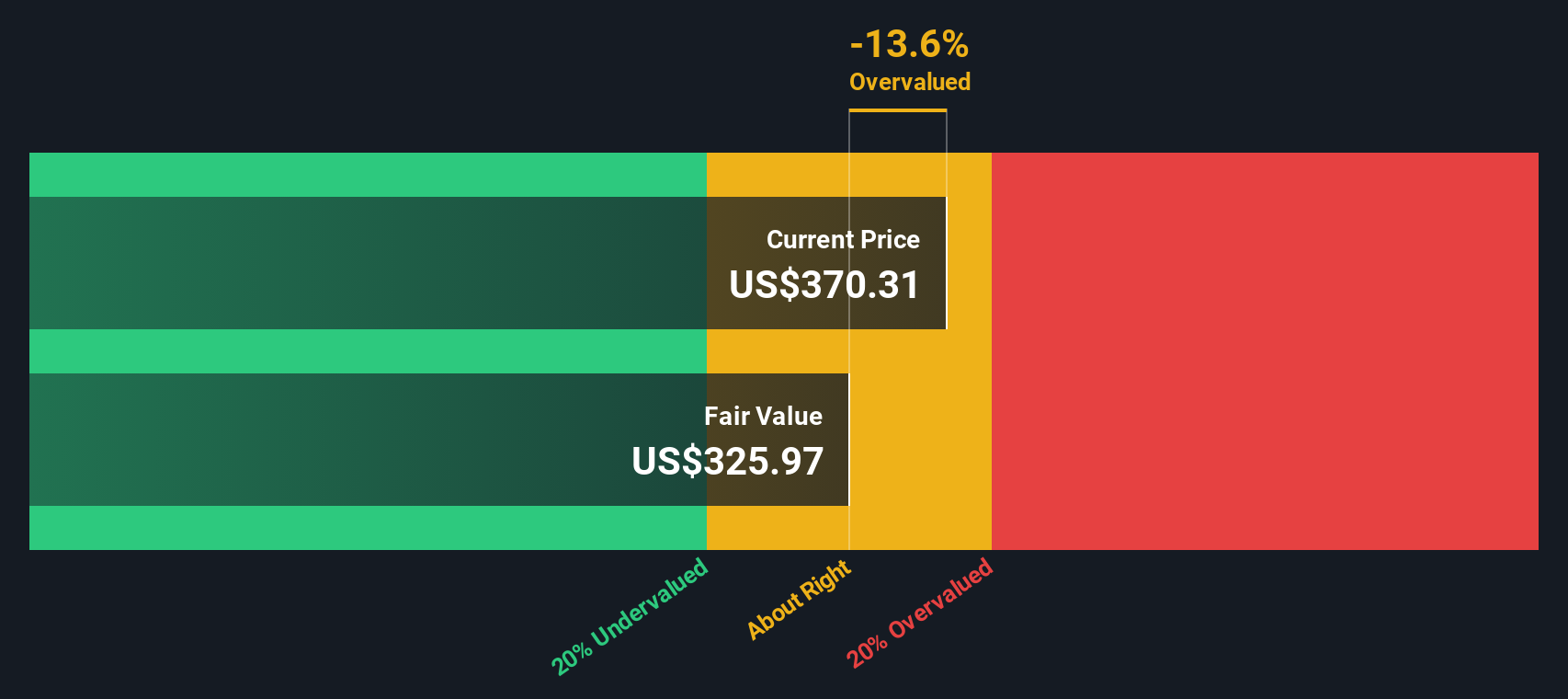

Looking at Carvana through the lens of our DCF model, the story shifts. The SWS DCF model puts the fair value at $329.09 per share, just below the current price of $333.81. This suggests Carvana is trading slightly above its intrinsic value, which raises the question of whether optimism about future growth is overextended.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Carvana for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Carvana Narrative

If you want to look beyond these figures or prefer your own research process, you can craft your personal storyline in just a few minutes. Do it your way.

A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next top stock slip away. The Simply Wall Street Screener uncovers opportunities you might not have considered and gives you powerful tools to act with confidence.

- Uncover high-potential opportunities by scanning these 100+ penny stocks with strong financials, which feature strong fundamentals and unique growth stories often overlooked by the market.

- Boost your portfolio's future by targeting impressive yields through these 18 dividend stocks with yields > 3%, showcasing companies that consistently reward shareholders with attractive dividends over 3%.

- Stay ahead in disruptive innovation by focusing on these 24 AI penny stocks, which are driving the rise of artificial intelligence and machine learning advancements reshaping every industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives