- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (CVNA): A Fresh Look at Valuation Following This Year’s Impressive Rally

Reviewed by Simply Wall St

Carvana (CVNA) shares have drawn attention as the used-car e-commerce company continues to navigate a tough macro environment. Investors are watching closely, interested in how market headwinds might influence Carvana’s valuation in the coming period.

See our latest analysis for Carvana.

After a standout rally, Carvana’s share price is up an impressive 87.66% year-to-date, as traders respond to renewed optimism about its growth prospects and improving operational results. While that upward momentum has caught attention, the one-year total shareholder return of 43.81% shows that long-term investors have also enjoyed substantial gains. However, more recent price swings suggest sentiment is becoming more measured.

If Carvana’s surge has you rethinking your approach, now’s a great time to broaden the search and discover fast growing stocks with high insider ownership

But with such strong gains already on the scoreboard, investors are left wondering if Carvana is truly undervalued or if the recent rally means all the future growth is already priced in. This could leave little upside from here.

Most Popular Narrative: 10.7% Undervalued

With Carvana closing at $374.50 and the most widely followed narrative assigning a fair value above $419, expectations for further upside are running high. Some believe operational improvements and sector trends are set to push the share price even higher.

The acceleration in consumer preference for purchasing vehicles online and increased comfort with high-value e-commerce transactions positions Carvana to capture a larger share of the used vehicle retail market, supporting outsized long-term unit and revenue growth. Ongoing advancements in Carvana's data-driven technology, including integration of AI for operational efficiency and customer-facing processes, enable continual process improvement, reducing per-unit costs and fueling net margin expansion.

Want to know why analysts are betting big? The real story lies in bold top-line growth and margin expansion forecasts. These numbers upend expectations for what a used-car retailer can achieve. Just how ambitious are these projections, and what is the logic tying them all together? See which assumptions could rewrite the narrative for Carvana's future valuation.

Result: Fair Value of $419.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a wave of new digital competitors or ongoing industry headwinds could quickly challenge Carvana's growth outlook and put pressure on its recent strong momentum.

Find out about the key risks to this Carvana narrative.

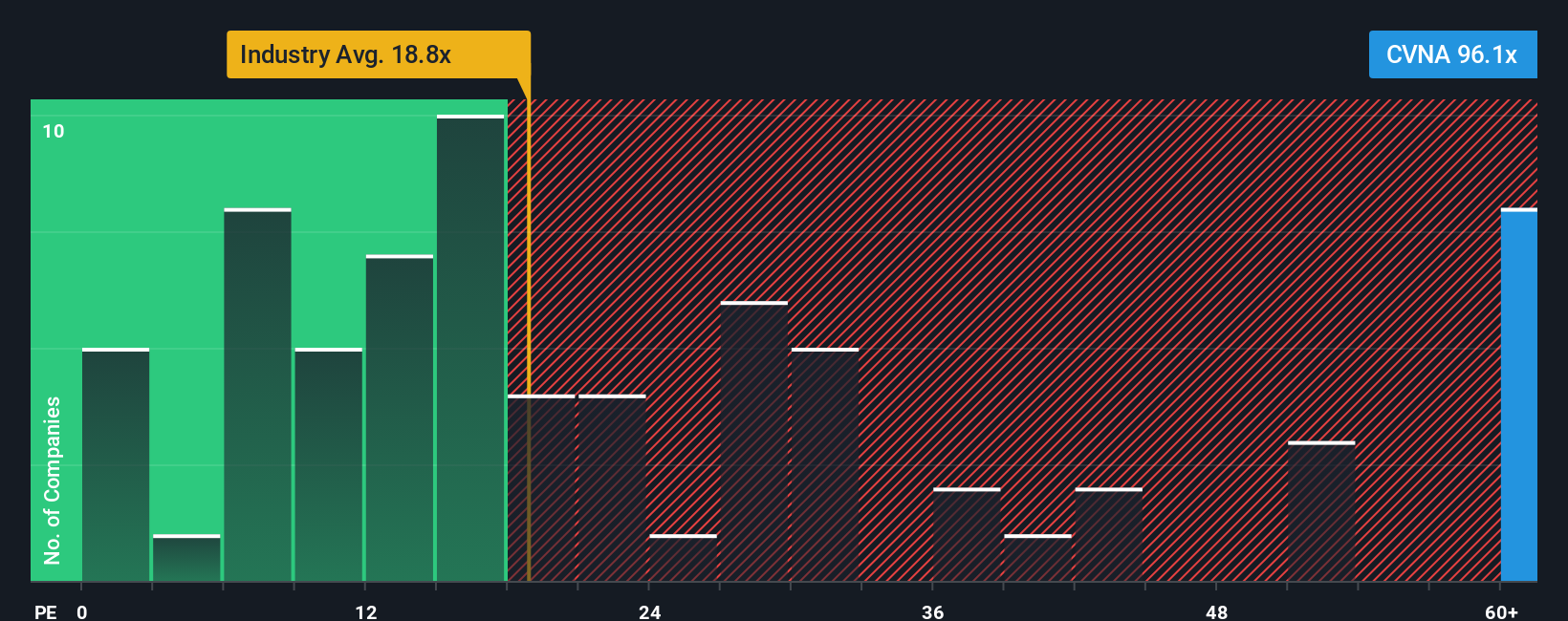

Another View: Valuation by Price-to-Earnings Ratio

While optimism surrounds Carvana's long-term growth, its current price-to-earnings ratio of 84.2x stands well above the industry average of 18x and also exceeds its own fair ratio of 38.6x. This wide gap signals Carvana is priced at a substantial premium, raising real questions about valuation risk if expectations change. Could the market's confidence persist, or is a correction on the cards?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carvana Narrative

If you want a different perspective or would rather dive into the numbers yourself, you can craft your own Carvana story in just a few minutes with Do it your way.

A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just stick to one stock. Raise your investing game by tapping into the bold opportunities waiting in other fast-moving sectors and themes right now.

- Spot stocks with potential for breakout gains. Seize the moment with these 3572 penny stocks with strong financials showing financial strength and exciting growth runway.

- Capitalize on the AI revolution and power up your portfolio with these 25 AI penny stocks shaping the future of automation, analytics, and smart innovation.

- Lock in steady income opportunities. Jump into these 15 dividend stocks with yields > 3% offering yields over 3% and robust fundamentals to support lasting returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.