Is Coupang’s Share Price Justified After 45% Rally and Record Profit Growth?

Reviewed by Bailey Pemberton

If you have Coupang stock on your radar, you’re definitely not alone. Investors everywhere have been buzzing about this e-commerce giant, especially as its share price continues to defy expectations. Just take a look at the numbers. In the past week, Coupang inched up by 0.5%. The real story comes from its longer-term momentum. We're talking a gain of 12.0% over the past month, a substantial 45.2% year-to-date, and 26.0% over the last year. For context, since its debut, Coupang has soared an impressive 75.5%. That's not your everyday performance, and it’s sparking some serious questions about whether this run reflects true underlying value or if hype is outpacing business fundamentals.

So what might be behind these moves? There has been a noticeable shift in how investors are weighing risks and rewards in global e-commerce. Market developments over the past year have highlighted Coupang’s ability to expand its market share amid economic uncertainty, showing resilience where other players have wavered. This perception of stability and growth potential has drawn greater attention from both institutional and retail investors, fueling upward pressure on the share price.

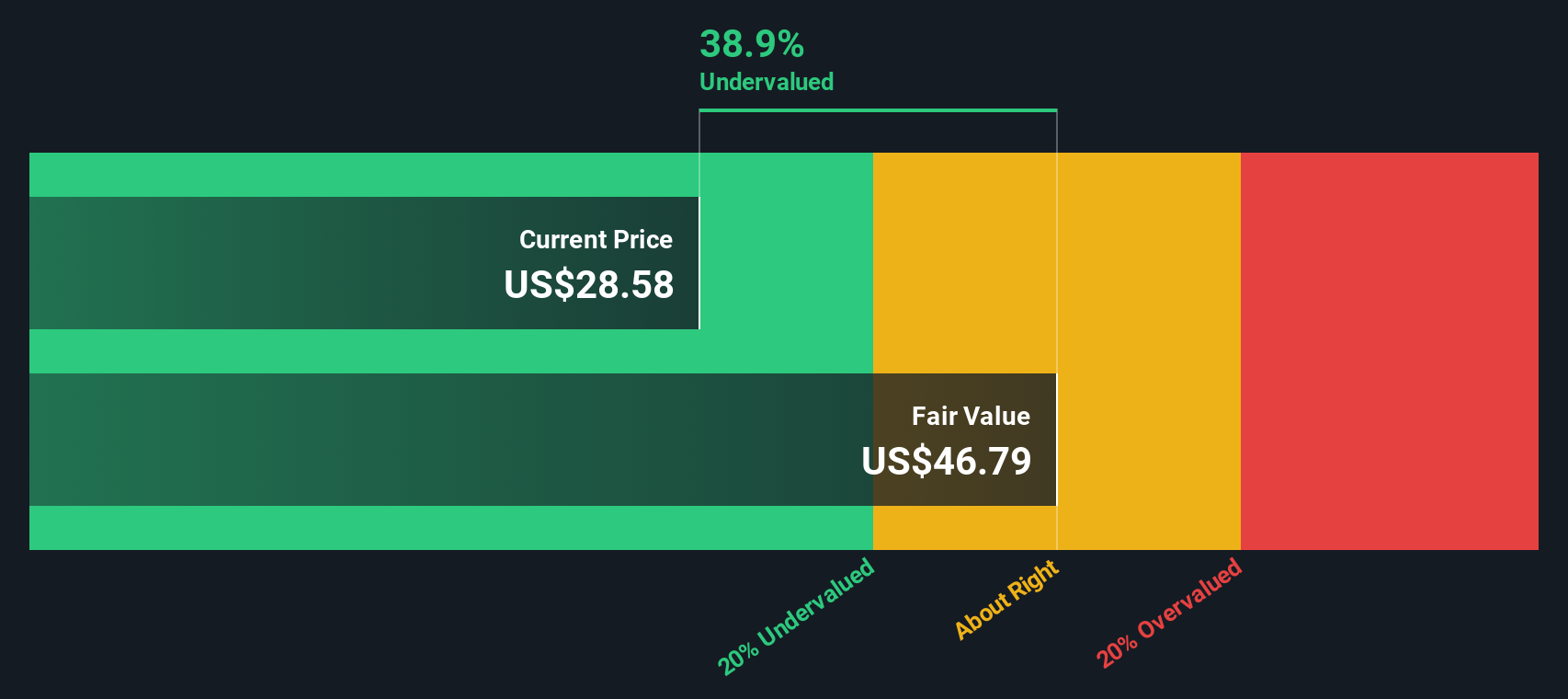

But let's be real: even with all the hype and recent gains, what really matters is whether the stock is fairly valued right now. That’s where things get interesting. Coupang currently scores a 4 out of 6 on a key valuation scale, which means it’s considered undervalued in four important checks. In the next section, I’ll break down what those checks are and how they stack up against traditional valuation methods. Keep reading to learn about a smarter way to understand Coupang's valuation that most investors overlook.

Approach 1: Coupang Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a cornerstone of fundamental analysis, allowing investors to estimate a company's value by forecasting its future cash flows and discounting them back to today's dollars. This approach helps reveal what the market should be willing to pay, based on the business's underlying earning power.

For Coupang, the DCF analysis starts with its most recent annual Free Cash Flow of $833.5 Million. According to analyst estimates and projections, Coupang's Free Cash Flow is expected to grow rapidly, reaching approximately $2.8 Billion by 2027 and climbing to nearly $6.7 Billion in 2035. The first five years of projections are based on analyst consensus, while future numbers are extrapolated based on current growth trends.

By adding the discounted values of each year's future cash flow, the DCF model calculates Coupang’s intrinsic value per share at $47.88. Compared to Coupang’s current share price, this represents a 32.4% discount, suggesting the stock is significantly undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coupang is undervalued by 32.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Coupang Price vs Sales

For high-growth companies like Coupang that are rapidly scaling but reinvesting most of their profits, the Price-to-Sales (P/S) multiple is a useful gauge of relative value. This metric is especially relevant when net income is less meaningful due to early-stage investments or expansion. Sales revenue offers a clearer snapshot of business momentum for these firms.

Growth companies command higher P/S ratios if investors believe their revenues will climb faster or be less risky than peers. A low ratio may signal lackluster prospects or elevated risk. Coupang currently trades at a P/S multiple of 1.83x. To put this in context, the industry average for Multiline Retail stocks sits at about 1.45x, while the peer average is 3.69x. This places Coupang just above its industry average but notably below most comparable peers.

The Fair Ratio, calculated by Simply Wall St, refines this benchmark by accounting for Coupang’s unique mix of growth, profit margins, risk factors, industry position, and market capitalization. Unlike a blunt comparison against averages, the Fair Ratio sets a more tailored standard for what Coupang’s P/S should be, given its business profile and potential. In Coupang’s case, the Fair Ratio lands at 2.15x. With Coupang’s actual P/S at 1.83x, the stock appears undervalued on this basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coupang Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, an approach that helps investors put a story behind the numbers. A Narrative is simply your personal view or thesis about a company like Coupang, combining your expectations about its future growth, margins, and fair value into a single, shareable projection. Instead of relying only on standard ratios or consensus price targets, Narratives link a company's story, such as its logistics innovations or expansion strategy, to a forecast and real-time fair value, making your reasoning more transparent and actionable.

With Narratives, you can easily articulate why you think Coupang is worth more or less than the current market price, and update your stance as new information like earnings or news emerges. This dynamic approach is accessible on Simply Wall St's Community page, used by millions of investors, and helps you decide if it's time to buy or sell based on your calculated Fair Value versus the latest price. For example, some investors see Coupang reaching as high as $39 per share (if international expansion outpaces expectations), while others set fair value closer to $26.2 (if competition or profits disappoint). Your Narrative lets you confidently back your view with real numbers.

For Coupang, we'll make it really easy for you with previews of two leading Coupang Narratives:

Fair Value: $34.52

Stock is currently 6.2% undervalued versus its narrative fair value

Assumed Revenue Growth: 14.0%

- Technology-led efficiency, smart capital allocation, and automation are expected to drive operating leverage, margin expansion, and long-term earnings growth for Coupang.

- Growth in spend per customer, new geographies (including Taiwan), and diversified revenue streams position Coupang to outpace traditional retail and unlock high-margin opportunities.

- Risks include scaling inefficiencies, ongoing high expenses, market concentration in Korea, and margin pressures from expansion and new ventures.

Fair Value: $27.25

Stock is currently 18.8% overvalued versus its narrative fair value

Assumed Revenue Growth: 12.0%

- Strong revenue growth and dominant logistics give Coupang an edge, but consistent profitability remains elusive. Operational setbacks such as those from recent acquisitions have challenged performance.

- Intense competition from local players (Naver, Gmarket), global giants (Alibaba, Amazon), and new joint ventures threaten Coupang’s leading position in South Korea.

- Regulatory risks, legal challenges, and high operating expenses, alongside expansion uncertainties, could continue to pressure margins and stock valuation.

Do you think there's more to the story for Coupang? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives