Coupang’s Valuation in Focus Amid E-Commerce Expansion and 40% Rally in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Coupang stock right now? You are definitely not alone. The company's share price has seen some interesting swings this year, keeping investors on their toes. After a robust rally with a year-to-date return of nearly 40%, and impressive 88.8% growth over three years, the past month has actually been a bit quiet, down 3.7%. In just the last week, shares dipped by 1.3%. For a stock that has regularly grabbed headlines for its breakneck growth, these recent moves might make you wonder if Coupang’s risk profile has changed or if this is just a pause before the next leg up.

It is worth noting that some of the price action has followed news of Coupang’s latest moves in the e-commerce space, including expansions into new product categories and ongoing investments in logistics. These strategic shifts have not just made headlines, but also contributed to a sense that the company is positioning itself for long-term dominance in South Korea and potentially beyond. Although there is no single event responsible for the recent cooling off, the bigger picture is all about whether Coupang’s valuation keeps up with its growth story.

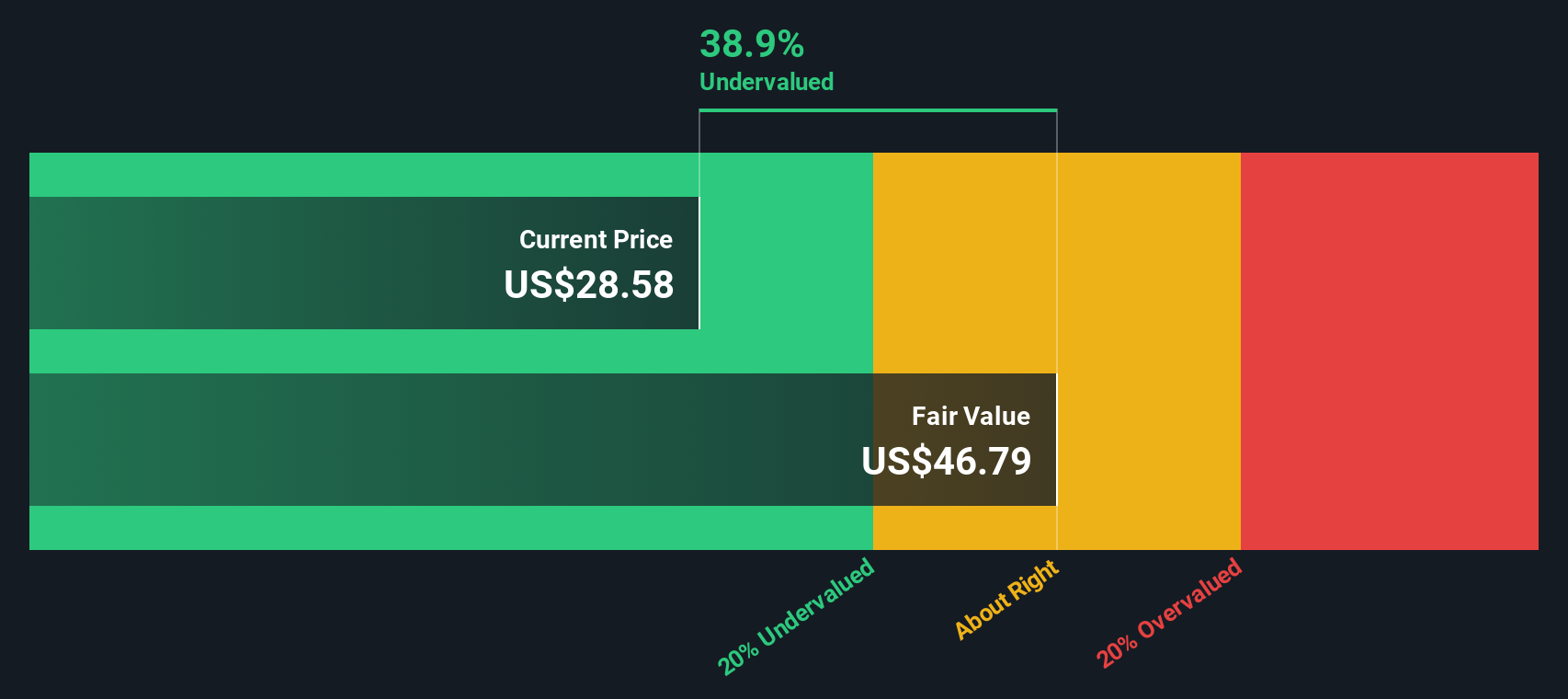

Here is where it gets really interesting: by traditional measures, Coupang scores a solid 4 out of 6 on our value score. This means it is undervalued in two-thirds of the key checks we use. Different valuation models can give you very different answers about what the stock is really worth. In the next section, we will break down what those approaches say and introduce a surprisingly simple but powerful way to look at Coupang’s true value at the end.

Approach 1: Coupang Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects Coupang's future cash flows and then discounts these projections back to the present to estimate what the business is truly worth today. This approach helps investors get past the noise of daily market swings and focus on the long-term earning potential of the company.

Currently, Coupang’s Free Cash Flow stands at $833 Million. According to analyst forecasts and Simply Wall St extrapolations, Coupang’s Free Cash Flow is expected to rise dramatically, reaching nearly $2.8 Billion by the end of 2027 and over $6.7 Billion by 2035. This robust trajectory reflects both analyst optimism for the next several years and long-term estimates based on the company’s growth profile.

After crunching the numbers under the 2 Stage Free Cash Flow to Equity model, Coupang’s intrinsic value is estimated at $47.78 per share. Compared to today’s market price, this analysis suggests the stock is trading at a 34.8% discount, which means it is significantly undervalued by this model's standards.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coupang is undervalued by 34.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Coupang Price vs Sales

The Price-to-Sales (P/S) ratio is a favored valuation metric for fast-growing, profitable businesses in retail and e-commerce. It allows investors to judge how much the market values each dollar of a company’s revenue, which is especially useful for companies like Coupang, where reinvestment for rapid growth may keep earnings artificially low for now.

What counts as a “normal” or “fair” P/S ratio depends on how fast a business is growing, how profitable it is expected to become, and the risks it faces in execution. Higher anticipated growth or robust operating leverage may justify a higher multiple, while elevated risks or slowing momentum can compress valuations closer to the industry average.

Currently, Coupang’s P/S ratio stands at 1.76x, slightly above the Multiline Retail industry average of 1.44x but well below the peer average of 3.40x. Simply Wall St’s proprietary Fair Ratio model, which considers Coupang’s growth profile, profit margin potential, industry dynamics, risk factors, and market cap, pegs a fair P/S multiple for Coupang at 2.13x. This approach goes beyond the use of industry averages and provides a context-rich benchmark that adapts to the company’s specific situation rather than broad market trends.

Given that Coupang’s actual P/S ratio is notably below both its Fair Ratio and peer benchmarks, the stock currently looks undervalued by this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coupang Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story or prediction behind a company's numbers. It is a framework where you connect your view of Coupang’s future (from revenue growth and profit margins, to competitive strengths and risks) to a tailored financial forecast and fair value estimate.

Instead of relying on static numbers, Narratives let you describe why you think Coupang is a buy or sell, linking your assumptions directly to an updated fair value and then comparing it to the current market price. On Simply Wall St's Community page, this process is made simple and accessible for everyone. Millions of investors use Narratives to test their thinking and share perspectives.

What sets Narratives apart is that they update automatically as new data, news, or earnings come in, keeping your valuation dynamic and relevant. For example, one investor might craft a bullish Narrative for Coupang, projecting rapid expansion and a fair value near $39 per share, while another, more cautious user might highlight competition and margin risks, arriving at a fair value closer to $26.2. This empowers you to compare, debate, and decide, all based on your own investment thesis and the latest information.

For Coupang, we'll make it really easy for you with previews of two leading Coupang Narratives:

- 🐂 Coupang Bull Case

Fair Value: $34.52

Current price is 9.8% below this fair value (undervalued)

Projected revenue growth rate: 14.0%

- AI-driven automation and logistics expansion are set to boost efficiency, margins, and long-term earnings in Korea and Taiwan.

- Repeat customer growth and expansion into new verticals (logistics, streaming, food delivery) open paths for top-line growth and diversified revenue streams.

- Main risks involve scaling inefficiencies in new markets, high ongoing expenses, and heavy reliance on the Korean market. This could pressure margins and slow profitability.

- 🐻 Coupang Bear Case

Fair Value: $27.25

Current price is 14.3% above this fair value (overvalued)

Projected revenue growth rate: 12.0%

- Strong domestic market position and logistics network drive growth, but profitability remains elusive as operating losses and cost pressures persist.

- Intensifying competition (local rivals, Alibaba/E-Mart JV, Amazon), regulatory scrutiny, and risks from expansion efforts could erode market share and increase costs.

- Stock may stay volatile as investors weigh growth against profit challenges. Cautious optimism prevails but downside risks remain if profitability improvements do not materialize.

Do you think there's more to the story for Coupang? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives