Coupang (NYSE:CPNG): Assessing Valuation as U.S. Expansion and Tech Investments Drive Fresh Investor Optimism

Reviewed by Kshitija Bhandaru

Coupang (NYSE:CPNG) is attracting fresh attention as it ramps up international expansion. New U.S. partnerships and tech investments are fueling optimism about its growth prospects and operational efficiency improvements among investors.

See our latest analysis for Coupang.

Coupang's latest push into new markets and tech is driving fresh momentum. Its share price is up 40.1% year-to-date. While recent weeks saw some pullback, long-term holders still enjoy a 21.5% total shareholder return over the last year, reinforcing the shift in investor sentiment.

If Coupang's global moves have sparked your curiosity, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

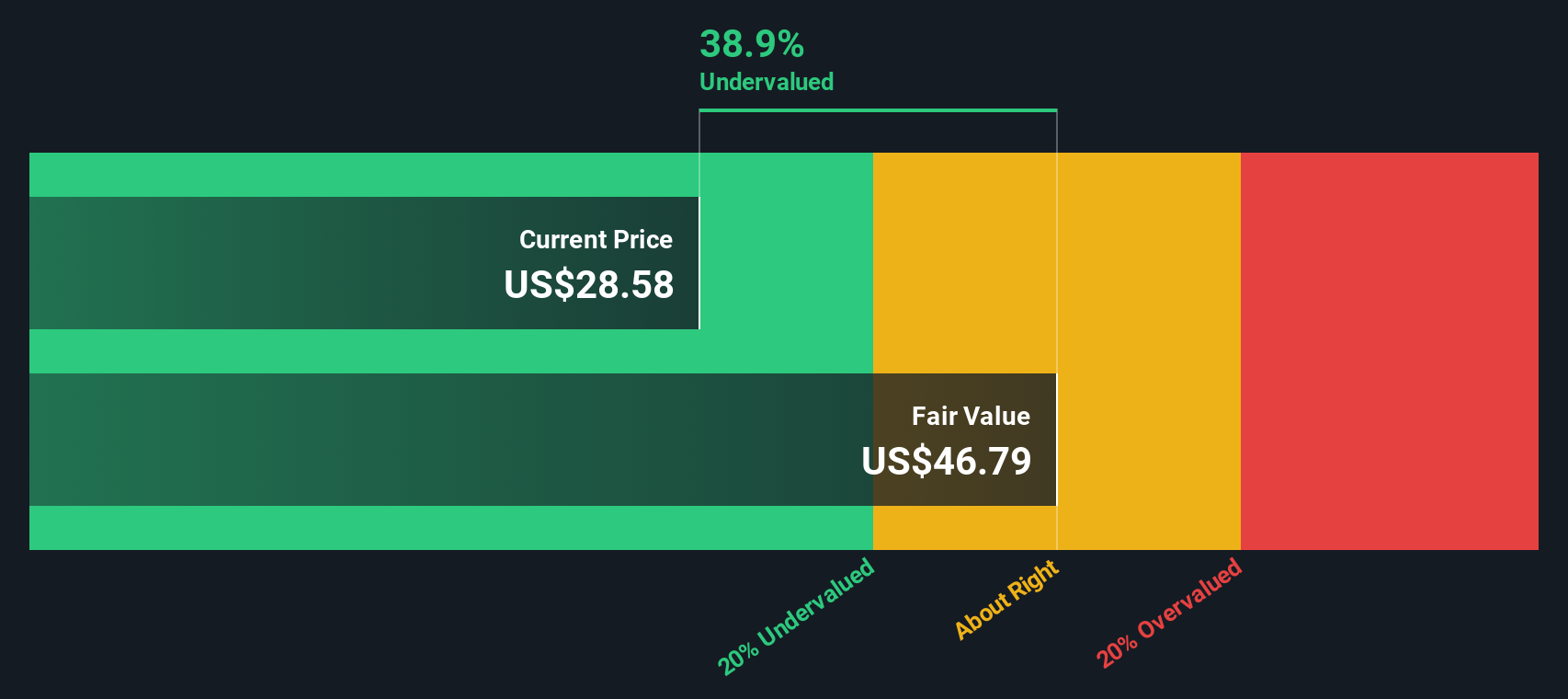

With shares up sharply and analysts pointing to further upside, the question now is whether Coupang is trading below its intrinsic value or if the stock’s rally has already priced in future growth potential. Is this a genuine buying opportunity, or are markets ahead of themselves?

Most Popular Narrative: 9.5% Undervalued

Compared to Coupang's last close of $31.23, the most widely followed narrative calculates a fair value at $34.52, which suggests room for the stock to climb if these projections play out as anticipated. This view stems from ambitious forecasts about sustained technology-driven gains and a rapidly expanding addressable market.

“Ongoing investments in automation, AI, and logistics technology are already driving major improvements in operational efficiency and gross margins, and management sees significant further upside as these technologies are scaled. Over time, this is likely to result in continued margin expansion and growth in earnings.”

Want to know which numbers are fueling this optimism? There are bold assumptions about soaring earnings, fast-growing revenue per customer, and the company’s ability to hit tech-style profit margins. Which forecasts truly shift the needle? The narrative breaks down every big bet. Find out which bets anchor the high valuation and whether they could be achievable.

Result: Fair Value of $34.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher losses in Coupang's new markets or rising operational costs could challenge this optimistic outlook and could reduce profitability.

Find out about the key risks to this Coupang narrative.

Another View: Is Coupang Even Cheaper Than It Looks?

While many investors focus on valuation multiples, our DCF model paints a different picture. It estimates Coupang’s fair value close to $47.70, which is well above its recent trading price. This approach highlights the possibility that Coupang may be even more undervalued than traditional models suggest. Which story will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Coupang Narrative

If you see Coupang’s story differently or want to dig into the numbers yourself, it’s easy to craft your own informed perspective in just a few minutes. Do it your way

A great starting point for your Coupang research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to one opportunity? The market is full of stocks with unique strengths, and smart investors take advantage before trends go mainstream. Don’t wait to see what you could be missing.

- Spot tomorrow’s biggest winners early when you check out these 3577 penny stocks with strong financials that stand out for strong financials and real potential.

- Power up your portfolio by tapping into the explosive growth of artificial intelligence. Take a closer look at these 24 AI penny stocks making waves in cutting-edge tech.

- Lock in potential value plays for your future with these 19 dividend stocks with yields > 3% offering stable yields above 3% and reliable income streams.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives