- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Should You Be Adding Chewy (NYSE:CHWY) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Chewy (NYSE:CHWY). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Chewy

Chewy's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Chewy to have grown EPS from US$0.12 to US$0.87 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

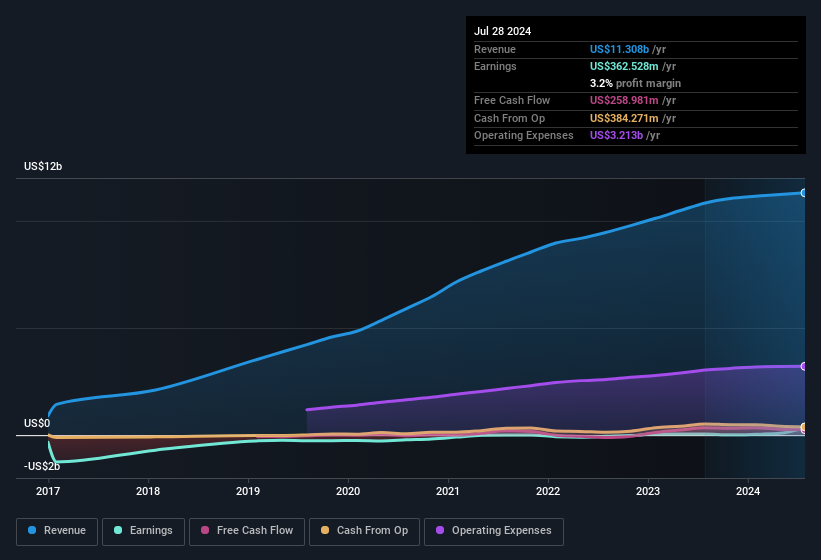

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Chewy maintained stable EBIT margins over the last year, all while growing revenue 4.4% to US$11b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Chewy's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Chewy Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first, there weren't any reports of insiders selling shares in Chewy in the last 12 months. But the really good news is that Independent Director James Star spent US$551k buying stock, at an average price of around US$19.95. Big buys like that may signal an opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Chewy bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth US$381m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does Chewy Deserve A Spot On Your Watchlist?

Chewy's earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Chewy deserves timely attention. It is worth noting though that we have found 1 warning sign for Chewy that you need to take into consideration.

Keen growth investors love to see insider activity. Thankfully, Chewy isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CHWY

Outstanding track record with excellent balance sheet.