- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Should Strong Autoship Sales and Cash Flow Shift the Profitability Outlook for Chewy (CHWY) Investors?

Reviewed by Sasha Jovanovic

- In recent news, Chewy reported strong operational results, with its Autoship subscription sales accounting for US$2.58 billion in Q2 2025, representing 83% of total net sales, and outlined projected full-year 2025 net sales of US$12.5 billion to US$12.6 billion.

- A notable insight is that Chewy's Autoship program and reinvestment of profits have underpinned faster net sales growth than competitors, with high return on equity and robust free cash flow supporting optimism about future profitability.

- We will now examine how the ongoing strength of Chewy’s Autoship program could reshape the company’s investment narrative and outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Chewy Investment Narrative Recap

To hold Chewy stock, you need to believe in the resilience of its Autoship subscription engine and its capacity to continue delivering recurring revenue and free cash flow, even when reported profit margins soften. The latest results affirm Autoship’s dominance and cash generation, but short-term stock catalysts remain the stability and growth of active customers, while the risk of slow customer acquisition still looms large. The recent news does not materially shift these immediate catalysts or risks, although it underlines the significance of subscription retention.

Chewy’s recent announcement raising full-year 2025 net sales guidance to US$12.5 billion–US$12.6 billion directly reinforces the key catalyst: strong top-line growth driven by Autoship and customer retention. This update strengthens confidence in recurring revenue, providing a direct link to the current investment narrative that emphasizes sustainable expansion and stable cash flows, critical factors as customer growth rates stay moderate.

But on the flip side, investors should be aware that if those active customer growth trends...

Read the full narrative on Chewy (it's free!)

Chewy's narrative projects $15.1 billion revenue and $467.3 million earnings by 2028. This requires 7.7% yearly revenue growth and an $79.1 million earnings increase from $388.2 million.

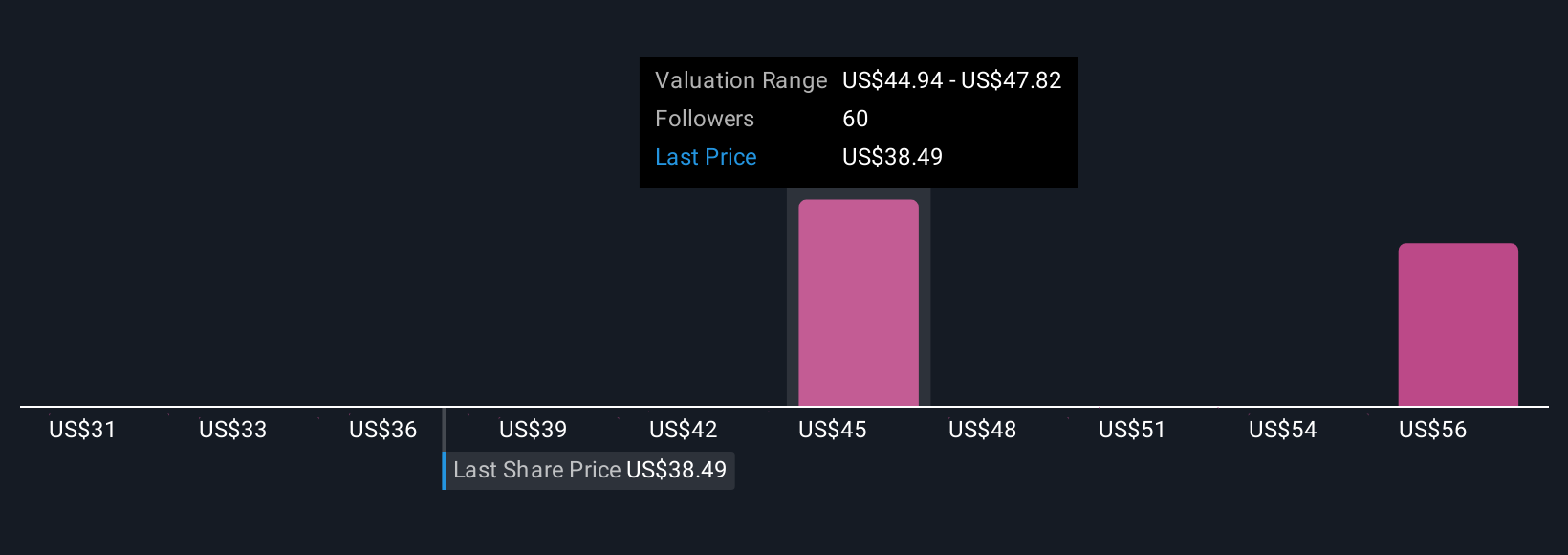

Uncover how Chewy's forecasts yield a $45.45 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community range between US$30.53 and US$59.21, showing substantial differences in growth expectations. While some participants project considerable upside, many are closely watching Chewy’s dependence on Autoship subscriptions as a double-edged sword for future performance.

Explore 10 other fair value estimates on Chewy - why the stock might be worth 20% less than the current price!

Build Your Own Chewy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chewy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chewy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chewy's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives