- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Is Chewy Stock Still Attractive After Recent 15.9% Jump in 2024?

Reviewed by Bailey Pemberton

Thinking about what to do with Chewy stock? You are definitely not alone. Over the past year, shares have climbed an impressive 35.4%, and so far in 2024 the stock has delivered a solid 15.9% return. Yet, like many companies in the e-commerce sector, Chewy’s story has been one of big swings both up and down. Just last week, the stock gained 3.4%, helping to offset some choppiness experienced since late spring. If you have been tracking Chewy over the longer term, the picture is less clear, with the price down more than 33% from five years ago, reflecting shifting market expectations and persistent debates over pet spending habits.

These recent moves come as the market digests ongoing signals that pet care demand remains resilient despite broader market ups and downs. The company’s valuation is a hot topic, and it is more complicated than simply looking at this month’s price chart. By conventional yardsticks, Chewy scores a 2 out of 6 for being undervalued, which means that it only screens as undervalued in two major categories. However, there is more to stock valuation than checking boxes, and some metrics might matter more than others depending on your perspective as an investor.

Here are the main ways analysts assess Chewy’s valuation. At the end, consider a broader approach that reaches beyond the usual checklists.

Chewy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Chewy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common valuation tool that estimates a company’s value by projecting future cash flows and discounting them back to today’s dollars. This method is particularly useful for companies like Chewy, where long-term growth and profitability are top priorities for investors.

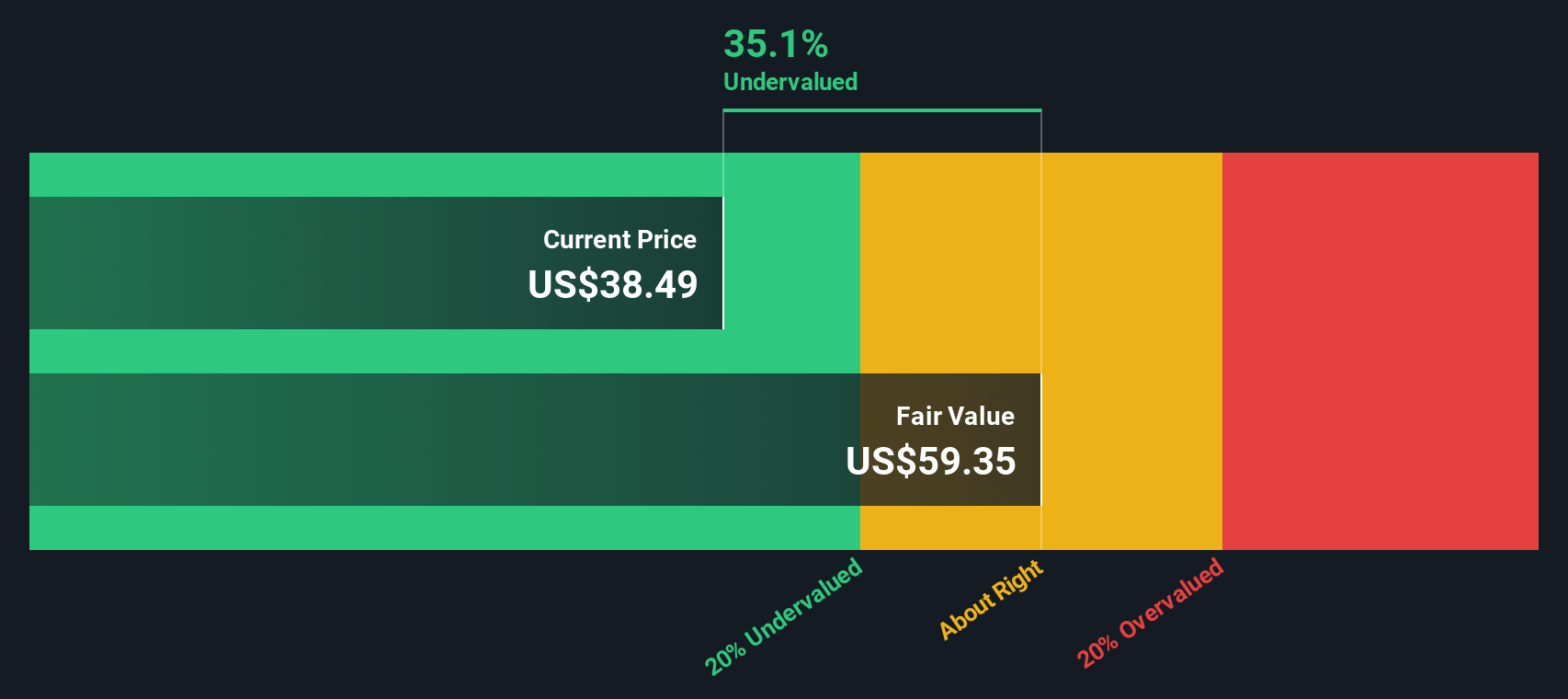

Chewy’s most recent reported Free Cash Flow (FCF) stands at $447.4 Million. Analysts forecast steady growth in Chewy’s cash generation, with estimates projecting FCF to reach $1.25 Billion by 2030. While analysts directly estimate cash flows for the next five years, Simply Wall St also extends projections further into the future to capture a more comprehensive view of potential performance.

Based on these projections, the DCF model calculates Chewy’s intrinsic value at $58.85 per share. This estimate implies a 33.3% discount from the current market price and suggests that the stock is trading well below what its cash flows indicate it could be worth. For value-oriented investors, this points to a meaningful opportunity.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Chewy is undervalued by 33.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Chewy Price vs Earnings (PE)

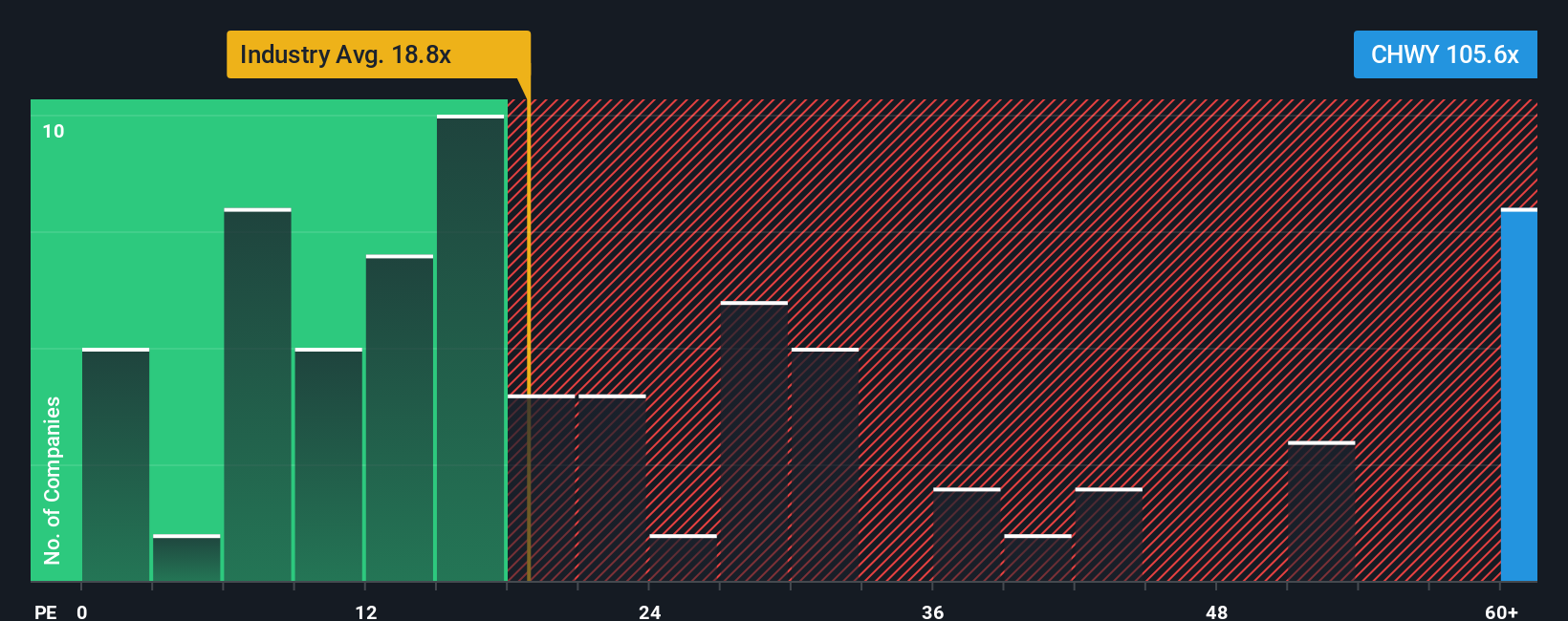

The price-to-earnings (PE) ratio is widely used to value profitable companies because it shows how much investors are willing to pay for each dollar of earnings. For companies like Chewy, which are recording consistent profits, the PE ratio gives a straightforward picture of how the market views future growth and business risks.

What is considered a “normal” PE ratio often depends on growth prospects and risk. Fast-growing or low-risk companies typically command higher PE multiples, while those with uncertain outlooks tend to trade at lower PE ratios. Chewy currently trades at a PE ratio of 107.7x, which is notably higher than both the specialty retail industry average of 17.2x and the average among its peers of 23.9x.

Simply Wall St’s “Fair Ratio” attempts to address the limitations of simple peer or industry comparisons. The Fair Ratio, calculated at 29.5x for Chewy, reflects a blend of factors unique to the company, such as expected earnings growth, profit margins, industry landscape, company size, and risk profile. This method makes the Fair Ratio a better benchmark for investors.

Comparing Chewy’s current PE of 107.7x to its Fair Ratio of 29.5x suggests the stock is trading at a significant premium to what its fundamentals justify, even after accounting for its growth potential and unique risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chewy Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, such as Chewy, tied directly to your forecast for its future revenue, earnings, margins, and ultimately, what you think is a fair value for the stock.

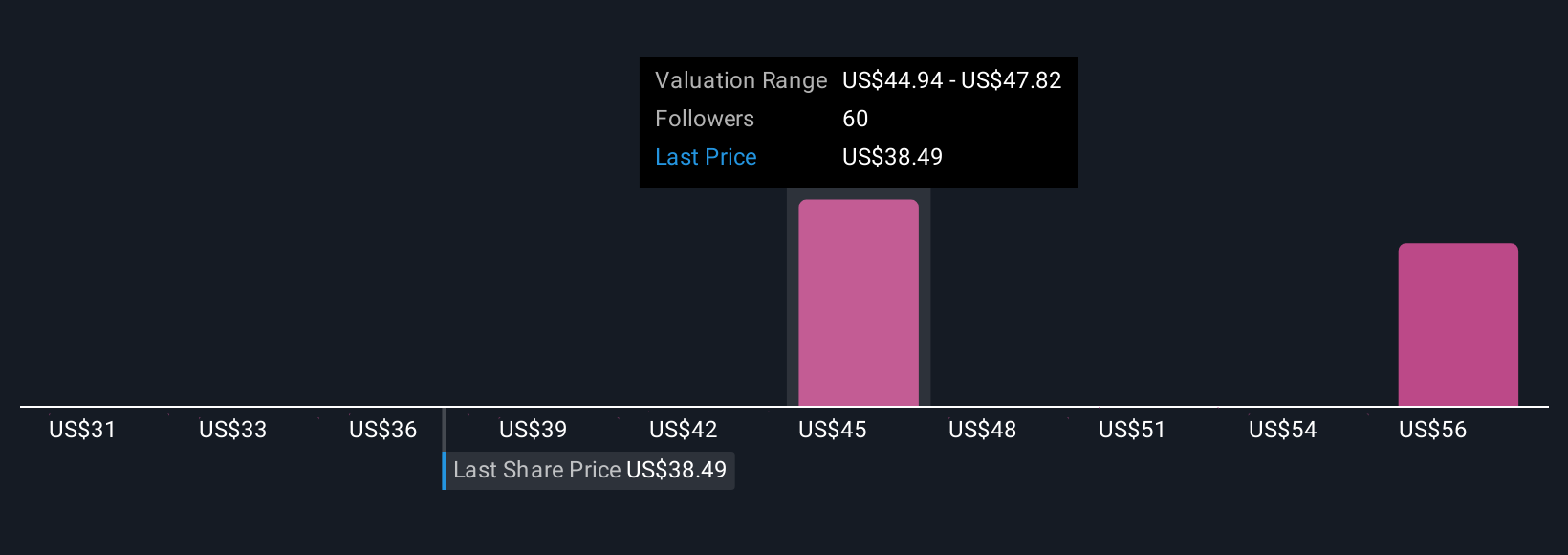

This approach goes beyond just numbers in a checklist. Narratives help you connect the big picture of Chewy’s strategy, market trends, and unique catalysts to concrete financial predictions and what you consider a “fair” price today. Narratives are easy to create and update, and you can find them on Simply Wall St’s Community page, where millions of investors share their perspectives.

Because Narratives compare your fair value to Chewy’s current share price, you get a dynamic view of when the stock is attractive to buy or risky to hold, especially as new information like earnings releases or breaking news automatically updates your Narrative.

For example, right now, some investors believe Chewy’s real value could be as high as $52.00 if new vet clinics and an ad platform boost margins, while others see risks and set fair value closer to $33.00. Whichever story you believe, a Narrative lets you turn your perspective into a clear, actionable investment outlook.

Do you think there's more to the story for Chewy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives