- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy (CHWY): Valuation Check as Profitability Concerns and Margin Misses Drive Pre‑Earnings Volatility

Reviewed by Simply Wall St

Chewy (CHWY) is back in the spotlight after a fresh round of analyst reports zeroed in on its profitability, with repeated gross margin misses putting extra pressure on the stock ahead of earnings.

See our latest analysis for Chewy.

The latest analyst chatter and profitability worries come after a choppy stretch for the stock, with a 30 day share price return of 3.13% but a 90 day share price return of negative 17.52 percent. This has left longer term total shareholder returns still in negative territory and signals that sentiment has cooled rather than turned decisively bullish.

If Chewy’s swings have you rethinking concentration risk, this could be a good moment to scan for resilience and growth potential in fast growing stocks with high insider ownership.

With analysts divided and the shares trading at a sizable discount to consensus targets despite improving earnings, the key question now is whether Chewy is quietly undervalued or whether the market is already pricing in its future growth.

Most Popular Narrative: 24.5% Undervalued

Chewy’s most followed narrative sees fair value meaningfully above the last close of $33.95, framing today’s price as a potential entry point ahead of earnings.

The company's increased focus on innovation, such as the Chewy+ membership and mobile app improvements, is driving new customer acquisition and higher conversion rates, enhancing both revenue growth and net sales per active customer (NSPAC).

Curious how a subscription tweak, modest margin shifts, and aggressive earnings compounding can justify this gap between price and fair value? The narrative lays out a detailed growth runway, ambitious profitability targets, and a rich future earnings multiple that might surprise you. Dive in to see which specific assumptions have to hold for this valuation story to work.

Result: Fair Value of $44.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reliance on Autoship, along with slower than hoped active customer growth, could easily derail those upbeat margin and fair value assumptions.

Find out about the key risks to this Chewy narrative.

Another View: Expensive on Earnings

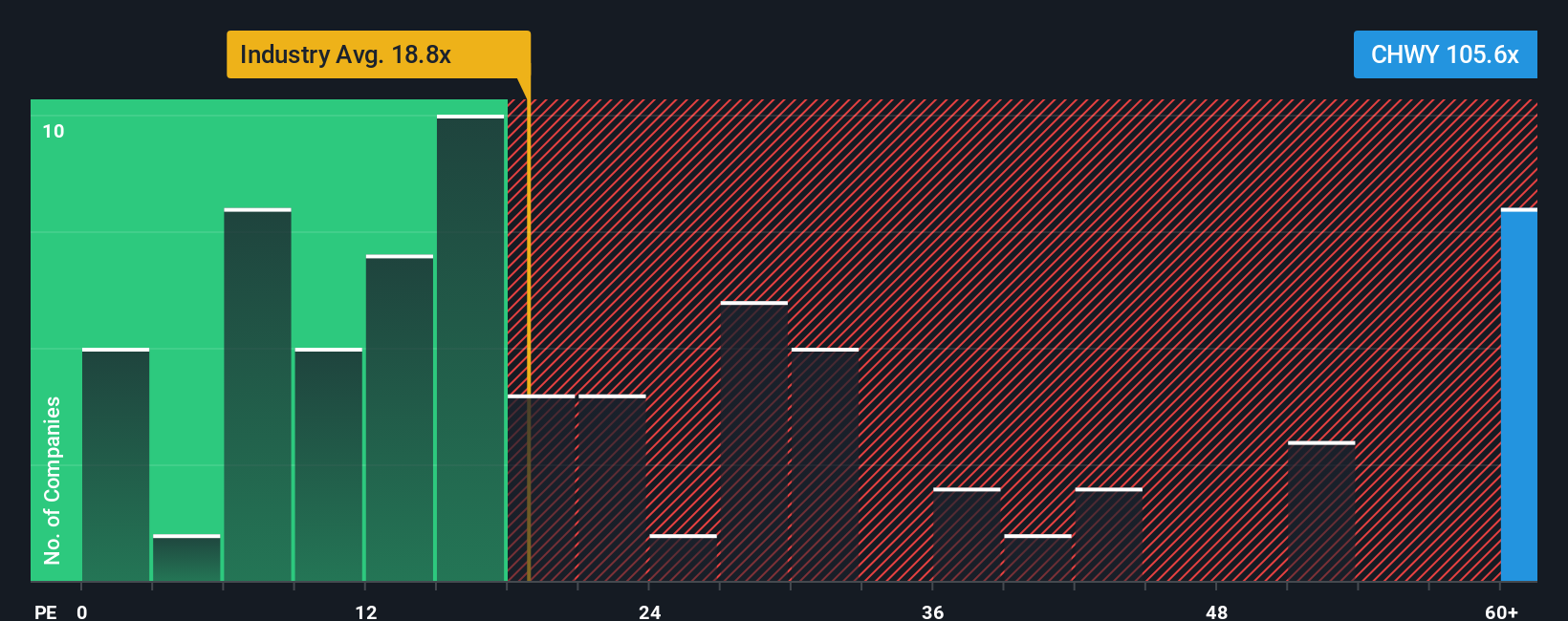

While our narrative fair value points to upside, the earnings multiple paints a tougher picture. Chewy trades at about 93 times earnings, versus roughly 18 times for the US Specialty Retail industry, 24 times for peers, and a fair ratio of 28.5 times. This suggests meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chewy Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes using Do it your way.

A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next edge?

Before you move on, consider strengthening your position by lining up fresh ideas with strong themes, resilient balance sheets, and powerful long term growth drivers.

- Capture rapid innovation by targeting high conviction AI leaders through these 25 AI penny stocks positioned at the front of the next productivity boom.

- Seek attractive entry points with these 919 undervalued stocks based on cash flows, where strong cash flow profiles meet prices that have not yet caught up with fundamentals.

- Explore income-focused opportunities by concentrating on reliable payouts and steady compounding from these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026