- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy (CHWY) Reports Q2 Sales Growth But Decline In Net Income

Reviewed by Simply Wall St

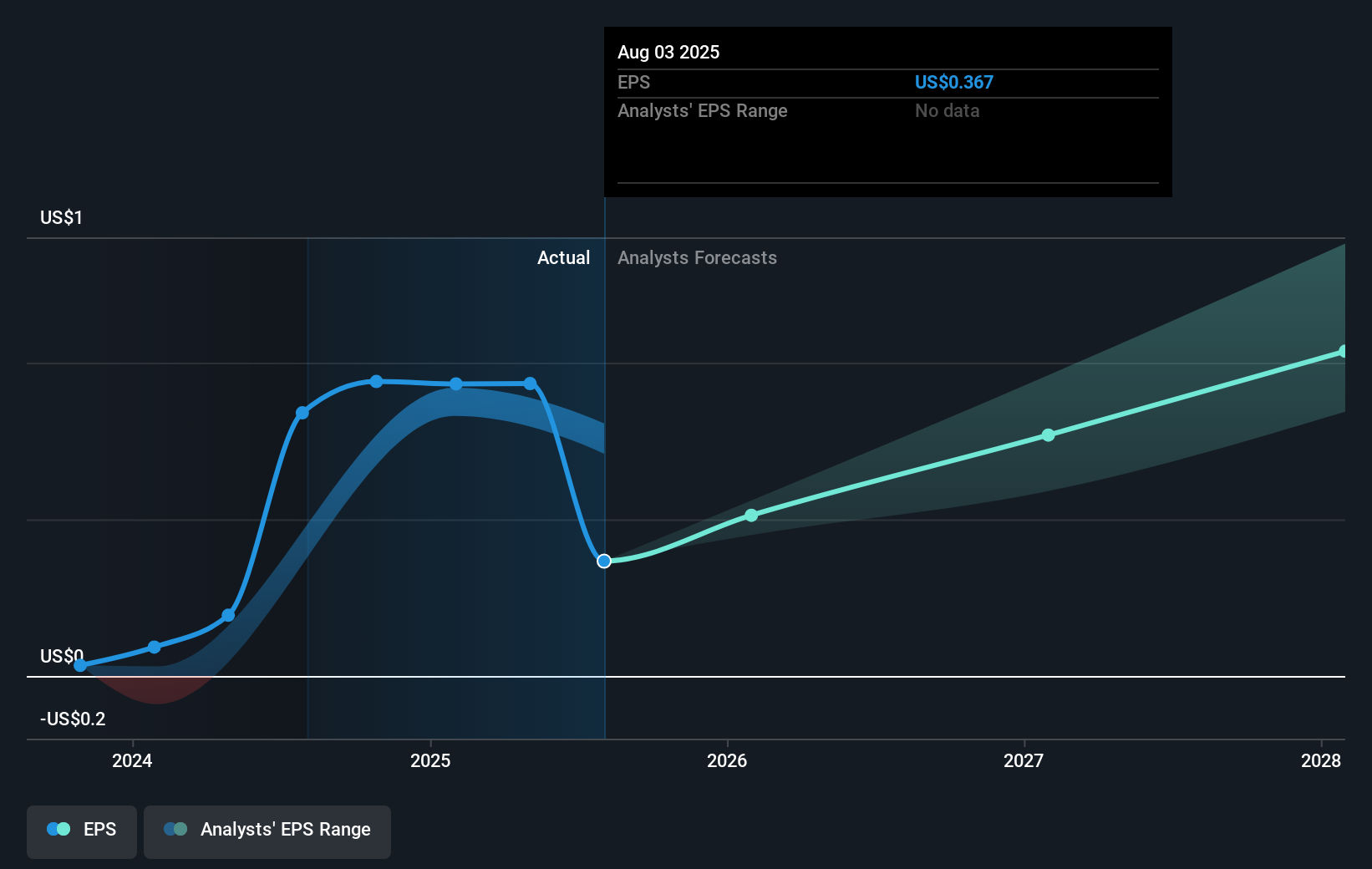

Chewy (CHWY) recently announced earnings for the second quarter and first six months of 2025, with a robust increase in sales but a decline in net income and earnings per share. Over the past month, Chewy’s share price rose 17%, which aligns with broader market trends, where indices such as the S&P 500 and Nasdaq reached new highs. Although their earnings displayed mixed results, the overall growth in sales could have contributed positively to the stock’s performance. This upward momentum in Chewy's share price coincides with favorable market conditions, including lower producer prices and rate-cut expectations.

Buy, Hold or Sell Chewy? View our complete analysis and fair value estimate and you decide.

Chewy's recent earnings announcement, highlighting both a rise in sales and a decline in net income, aligns with the 17% increase in its share price over the past month. This share price movement and broader market trends suggest that investors are focusing more on the company's growth potential rather than short-term earnings fluctuations. The expansion of Chewy Vet Care Clinics and the advancement of its ad platform are anticipated to drive future revenues, making the market optimistic about its growth trajectory. The narrative of focusing on new revenue streams and customer engagement aligns with recent market expectations of the company's potential growth. The revenue growth could benefit from these strategic initiatives, while earnings may face pressure if margins remain compressed.

Over the past year, Chewy delivered a total shareholder return of 50.52%, showing robust performance compared to the US Specialty Retail industry's return of 18.6% in the same period. This performance sets the company apart, indicating strong investor confidence despite some earnings challenges. The company's recent strategies targeting growth in active customers and enhancing margins seem promising, yet caution remains due to reliance on programs like Autoship, and potential economic headwinds impacting cost structures or revenue stability.

With a current share price of US$42.10, Chewy is trading at a 10% discount to the consensus price target of US$46.38. This suggests that analysts foresee potential for further stock appreciation if the company meets earnings expectations. While analyst consensus targets point to future growth, the high Price-To-Earnings ratio relative to industry averages indicates that Chewy's valuation might already reflect these growth assumptions, necessitating continued performance improvements to justify further stock escalation.

Our valuation report here indicates Chewy may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives