- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy (CHWY): Evaluating Valuation After Strong Quarter and Strategic Growth Initiatives

Reviewed by Simply Wall St

If you’re wondering what to do with shares of Chewy (CHWY) after the company’s impressive quarter, you’re not alone. The latest quarterly numbers showed strong sales growth and improved gross margin, and Chewy’s management doubled down on this momentum by raising their full-year sales guidance. On top of that, Chewy rolled out its new Get Real fresh dog food line and expanded into premium dog apparel, giving investors plenty to unpack about what comes next.

This string of announcements builds on what has already been a year of significant movement for the stock. Over the past twelve months, Chewy has gained 19%, outpacing most peers as new initiatives and stronger customer engagement have begun to pay off, even as near-term results have seen earnings volatility. The introduction of the Chewy+ membership program, expansion of vet care offerings, and growth in the Canadian market all signal that momentum is very much in play, with customers spending more and sticking around longer.

With the latest jump in sales and a strategic push into new, higher-growth areas, investors have to ask whether the recent optimism has truly unlocked value or if Chewy’s future growth is already reflected at current prices.

Most Popular Narrative: 16% Undervalued

The most widely followed narrative currently values Chewy as being notably undervalued, citing strong conviction in future upside if the firm's expansion and innovation efforts deliver results.

"Chewy's strategic expansions, such as opening new Chewy Vet Care Clinics, are expected to further penetrate the $25 billion vet services market. This is likely to increase revenue and active customer engagement in 2025 and beyond."

Want to uncover the high-stakes assumptions beneath this bullish outlook? The narrative hints at ambitious growth targets and bold profit forecasts that could reshape how investors think about this stock. Are you ready to see which crucial metrics and controversial ratios drive its surprisingly optimistic price target? The full picture may change your perspective on Chewy's long-term value.

Result: Fair Value of $45.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the narrative could shift if Chewy’s heavy reliance on its Autoship program or slower active customer growth begins to impact revenue stability.

Find out about the key risks to this Chewy narrative.Another View: Is the Stock Really a Bargain?

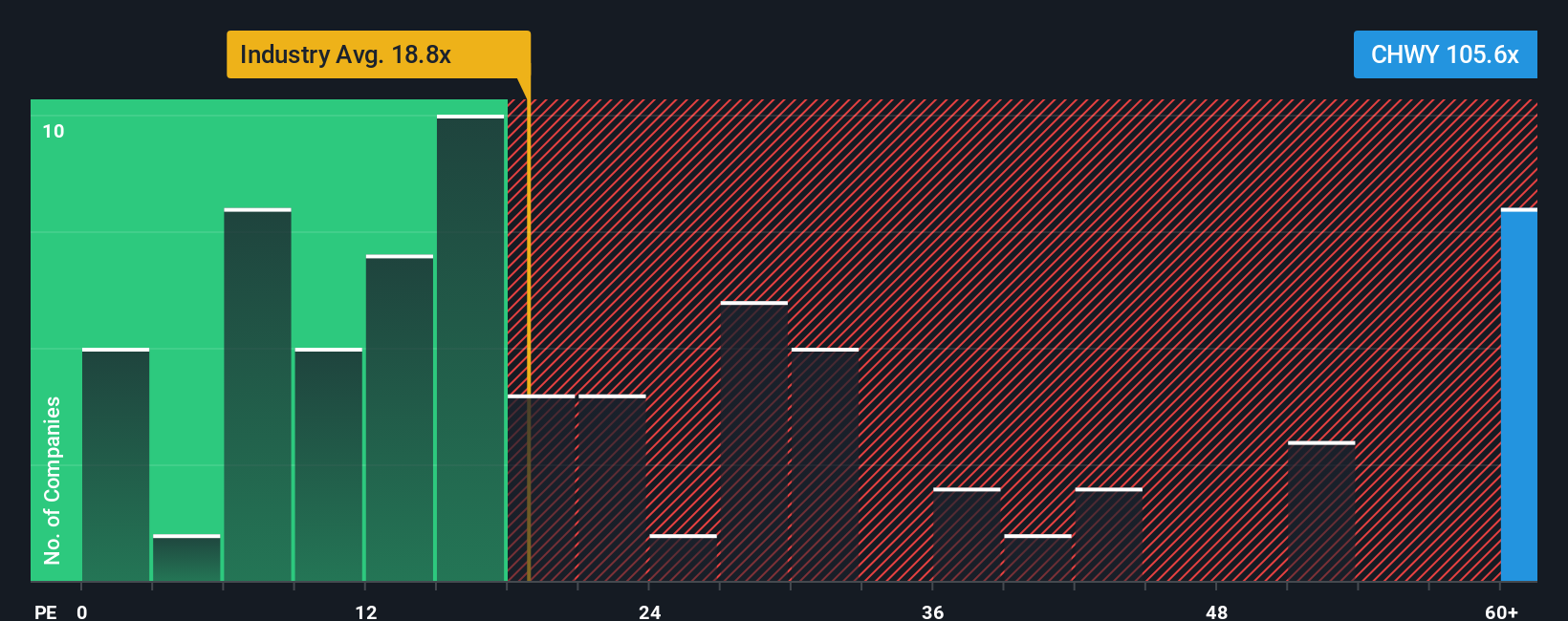

While the earlier outlook points to Chewy being undervalued, a check against market conventions tells a different story. In this perspective, Chewy actually appears expensive compared to the wider industry. Could the market be missing something, or is there risk in paying a premium for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Chewy to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Chewy Narrative

Of course, if you see things differently or want to weigh the evidence yourself, you can craft your own Chewy narrative in just a few minutes: Do it your way.

A great starting point for your Chewy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Ideas?

Why settle for just one opportunity? Use the Simply Wall Street Screener to instantly uncover investments that could reshape your portfolio. Waiting could mean missing out on tomorrow’s biggest winners.

- Tap into powerful growth by checking out AI penny stocks shaping the future with real-world breakthroughs in artificial intelligence and automation.

- Maximize your income potential with dividend stocks with yields > 3% featuring companies offering robust yields above 3% so you don’t leave cash on the table.

- Catch overlooked gems before the masses by exploring undervalued stocks based on cash flows to identify stocks primed for a comeback based on discounted cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives