Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Chico's FAS (NYSE:CHS), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Chico's FAS

How Fast Is Chico's FAS Growing Its Earnings Per Share?

Chico's FAS has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Chico's FAS' EPS has risen over the last 12 months, growing from US$0.89 to US$1.06. There's little doubt shareholders would be happy with that 20% gain.

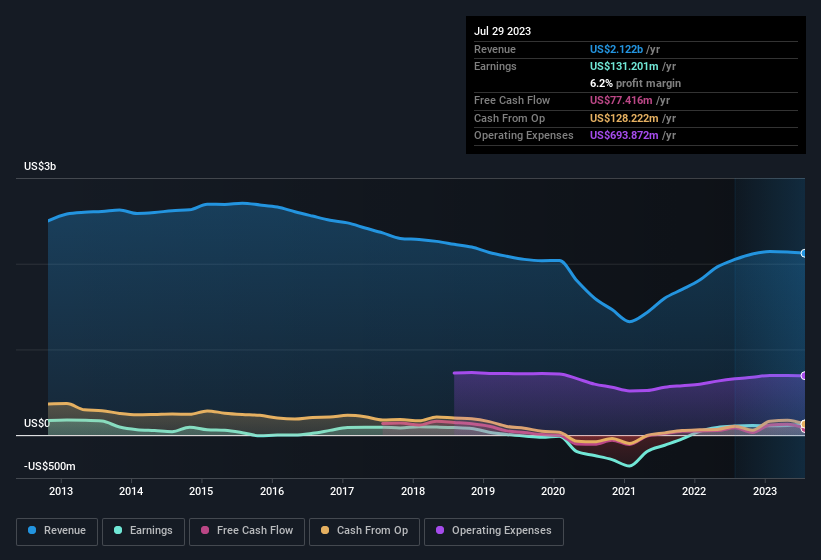

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Chico's FAS maintained stable EBIT margins over the last year, all while growing revenue 3.6% to US$2.1b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Chico's FAS.

Are Chico's FAS Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Chico's FAS followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. To be specific, they have US$38m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 4.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Chico's FAS Deserve A Spot On Your Watchlist?

As previously touched on, Chico's FAS is a growing business, which is encouraging. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Even so, be aware that Chico's FAS is showing 2 warning signs in our investment analysis , you should know about...

Although Chico's FAS certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CHS

Chico's FAS

Chico's FAS, Inc. operates as an omnichannel specialty retailer of women's private branded casual-to-dressy clothing, intimates, and complementary accessories in the United States, Puerto Rico, Virgin Islands; and franchise locations in Mexico and domestic airports.

Flawless balance sheet with proven track record.