- United States

- /

- Specialty Stores

- /

- NYSE:CAL

Investors who have held Caleres (NYSE:CAL) over the last year have watched its earnings decline along with their investment

Caleres, Inc. (NYSE:CAL) shareholders should be happy to see the share price up 12% in the last week. But that doesn't change the fact that the returns over the last year have been disappointing. During that time the share price has sank like a stone, descending 62%. The share price recovery is not so impressive when you consider the fall. Arguably, the fall was overdone.

The recent uptick of 12% could be a positive sign of things to come, so let's take a look at historical fundamentals.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

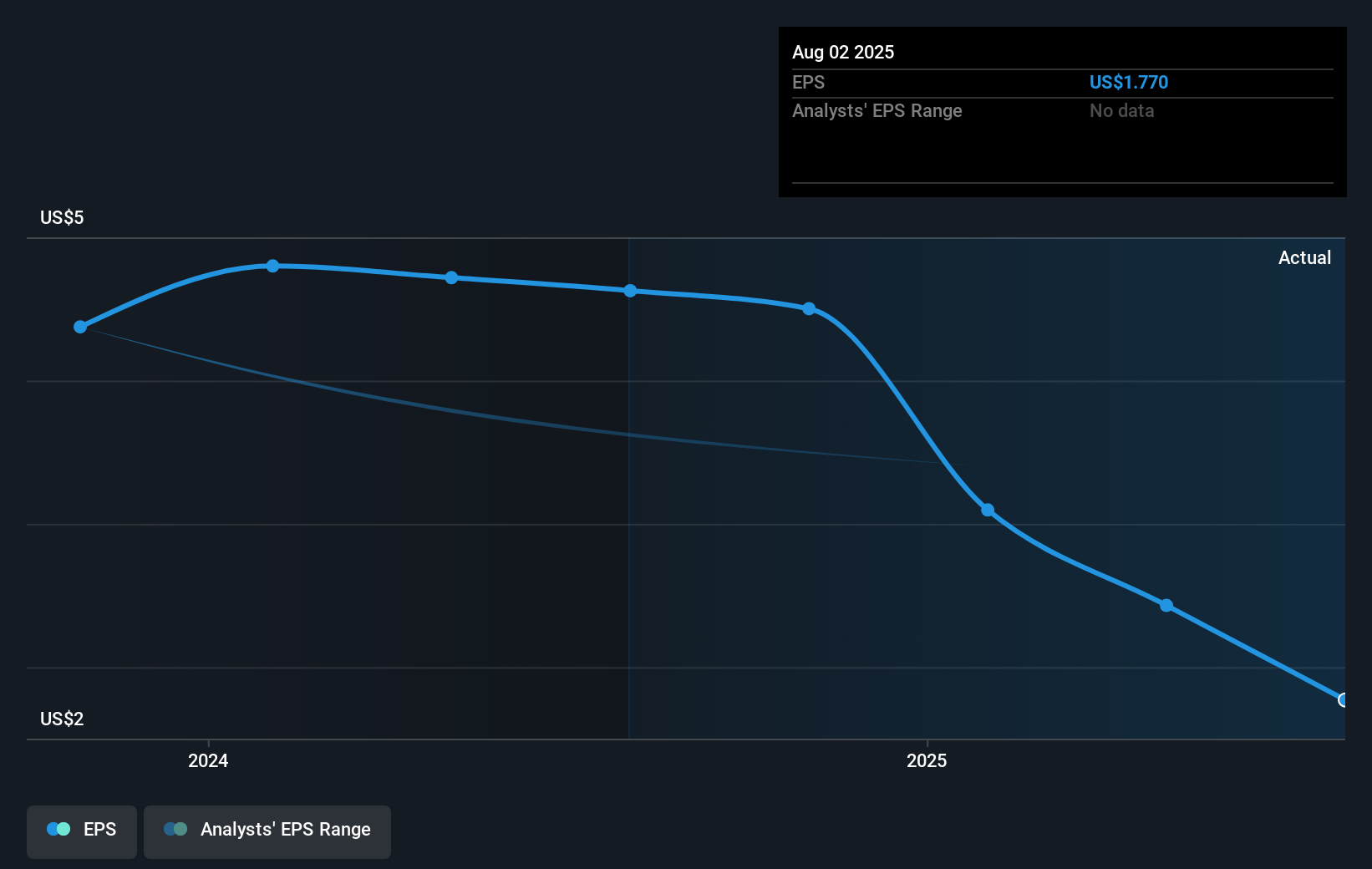

Unhappily, Caleres had to report a 62% decline in EPS over the last year. Remarkably, he share price decline of 62% per year is particularly close to the EPS drop. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Rather, the share price is remains a similar multiple of the EPS, suggesting the outlook remains the same.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Caleres' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Caleres had a tough year, with a total loss of 61% (including dividends), against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Caleres better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Caleres you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CAL

Caleres

Engages in the designs, develops, sources, manufactures, and distributes footwear in the United States, Canada, East Asia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.