- United States

- /

- Specialty Stores

- /

- NYSE:BURL

Investors in Burlington Stores (NYSE:BURL) have seen notable returns of 52% over the past year

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the Burlington Stores, Inc. (NYSE:BURL) share price is 52% higher than it was a year ago, much better than the market return of around 26% (not including dividends) in the same period. So that should have shareholders smiling. Having said that, the longer term returns aren't so impressive, with stock gaining just 14% in three years.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

View our latest analysis for Burlington Stores

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

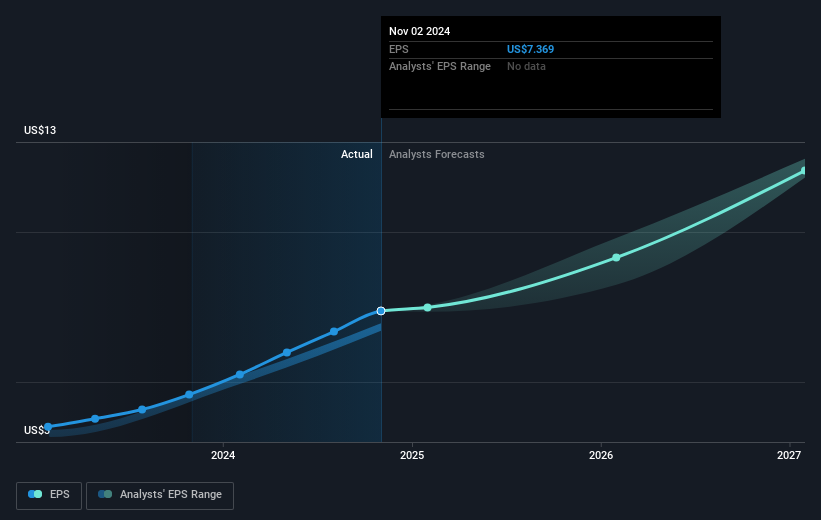

During the last year Burlington Stores grew its earnings per share (EPS) by 60%. We note that the earnings per share growth isn't far from the share price growth (of 52%). So this implies that investor expectations of the company have remained pretty steady. We don't think its coincidental that the share price is growing at a similar rate to the earnings per share.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Burlington Stores has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

We're pleased to report that Burlington Stores shareholders have received a total shareholder return of 52% over one year. That's better than the annualised return of 5% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Burlington Stores better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Burlington Stores .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Burlington Stores might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BURL

Burlington Stores

Operates as a retailer of branded merchandise in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives