- United States

- /

- Specialty Stores

- /

- NYSE:BOOT

We Ran A Stock Scan For Earnings Growth And Boot Barn Holdings (NYSE:BOOT) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Boot Barn Holdings (NYSE:BOOT). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Boot Barn Holdings

How Quickly Is Boot Barn Holdings Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Boot Barn Holdings has achieved impressive annual EPS growth of 58%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

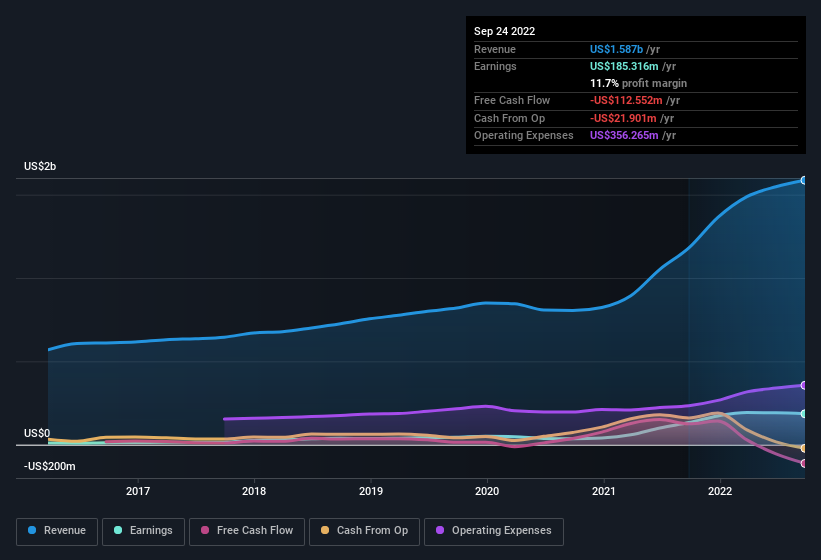

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Boot Barn Holdings maintained stable EBIT margins over the last year, all while growing revenue 35% to US$1.6b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Boot Barn Holdings.

Are Boot Barn Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The US$97k worth of shares that insiders sold during the last 12 months pales in comparison to the US$957k they spent on acquiring shares in the company. This adds to the interest in Boot Barn Holdings because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Independent Chairman of the Board Peter Starrett for US$284k worth of shares, at about US$70.88 per share.

Is Boot Barn Holdings Worth Keeping An Eye On?

Boot Barn Holdings' earnings per share have been soaring, with growth rates sky high. Growth investors should find it difficult to look past that strong EPS move. And may very well signal a significant inflection point for the business. If this is the case, then keeping a watch over Boot Barn Holdings could be in your best interest. We should say that we've discovered 1 warning sign for Boot Barn Holdings that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, Boot Barn Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BOOT

Boot Barn Holdings

Operates specialty retail stores in the United States and internationally.

Flawless balance sheet and fair value.