- United States

- /

- Specialty Stores

- /

- NYSE:BOOT

Boot Barn (BOOT) Valuation Check After Goldman Sachs Buy Rating and Store Expansion Growth Story

Reviewed by Simply Wall St

Boot Barn Holdings, Inc. saw its shares climb about 4% after Goldman Sachs kicked off coverage with a positive view, spotlighting the retailer’s expanded store opening plans as a key engine for future sales growth.

See our latest analysis for Boot Barn Holdings.

The upbeat reaction to Goldman’s coverage comes on top of a strong run, with Boot Barn’s 30 day share price return of 18.24% and five year total shareholder return of 396.87% suggesting momentum is still building rather than fading.

If this kind of growth story has your attention, it is also worth exploring fast growing stocks with high insider ownership for more companies where insiders are backing the upside.

With shares already up strongly this year and the stock now trading just below Wall Street’s targets, the key question is whether Boot Barn is still mispriced or if the market is already baking in its next leg of growth.

Most Popular Narrative Narrative: 9.9% Undervalued

With Boot Barn last closing at $204.71 against a narrative fair value near $227, the story frames today’s price as leaving upside still on the table.

Increasing penetration of higher margin exclusive brands (now exceeding 40% of sales, with a target of 50% in coming years) is supporting merchandise margin expansion. This transition to exclusive brands supported by targeted marketing initiatives and new sourcing strategies positions the company for improved net margins and long term profitability.

Want to see how this margin play justifies a premium earnings multiple? The narrative leans on brisk top line growth and surprisingly resilient profitability. Curious which future mix and expansion assumptions are doing the heavy lifting in that fair value math? Read on to unpack the full blueprint behind this price target.

Result: Fair Value of $227.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained double digit comps and margin expansion are not guaranteed, as both overexpansion and shifting fashion trends are capable of quickly challenging this upbeat scenario.

Find out about the key risks to this Boot Barn Holdings narrative.

Another Lens on Valuation

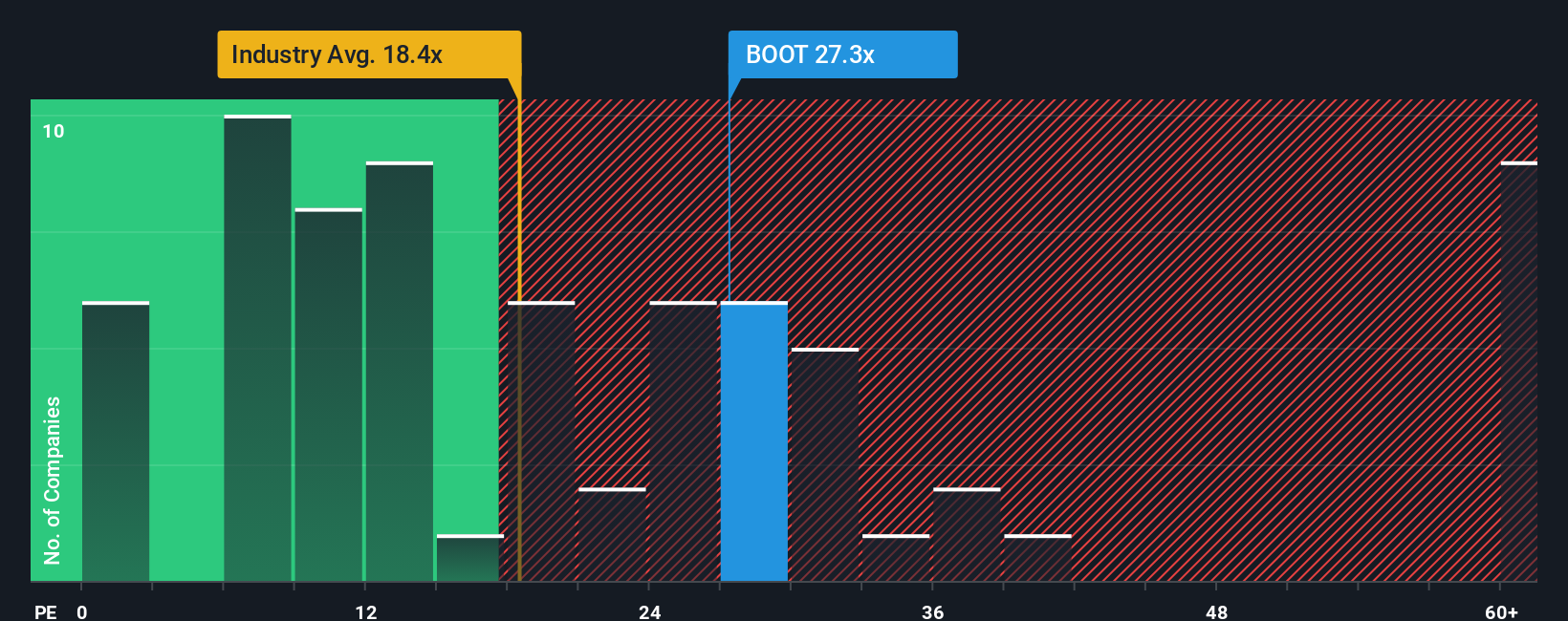

While the narrative fair value suggests Boot Barn is about 10% undervalued, our earnings based yardstick tells a different story. At roughly 30 times earnings, the shares trade far richer than both the US specialty retail average of 20.2 times and peers at 17.8 times, and well above a fair ratio of 18.5 times, which hints at real de rating risk if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boot Barn Holdings Narrative

If you see the numbers differently or want to stress test your own assumptions, you can create a personalized Boot Barn view in just minutes: Do it your way.

A great starting point for your Boot Barn Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at Boot Barn when fresh opportunities are just a few clicks away. Use the Simply Wall St screener now or risk missing the next winner.

- Capture trends in automation and data by targeting fast growing innovators through these 26 AI penny stocks that are reshaping how entire industries operate.

- Seek potential income and stability by focusing on proven businesses via these 13 dividend stocks with yields > 3% that can strengthen the backbone of your portfolio.

- Explore emerging financial infrastructure by scanning these 80 cryptocurrency and blockchain stocks that are contributing to blockchain and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOOT

Boot Barn Holdings

Operates specialty retail stores in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)