- United States

- /

- Specialty Stores

- /

- NYSE:BKE

Buckle (BKE) Special Dividend Announced: How the 2026 Payout Shapes the Stock’s Valuation Today

Reviewed by Simply Wall St

Buckle (BKE) just handed income focused investors something extra to chew on: a $3.00 per share special dividend on top of its regular $0.35 payout, both scheduled for January 2026.

See our latest analysis for Buckle.

That move lands after a solid run, with Buckle’s share price up meaningfully year to date and supporting a strong 1 year total shareholder return of 18.12 percent and 5 year total shareholder return above 190 percent. This suggests momentum in investor confidence rather than any sharp re rating.

If generous dividends are on your radar, this could be a good moment to see what else is out there and explore pharma stocks with solid dividends as another income hunting ground.

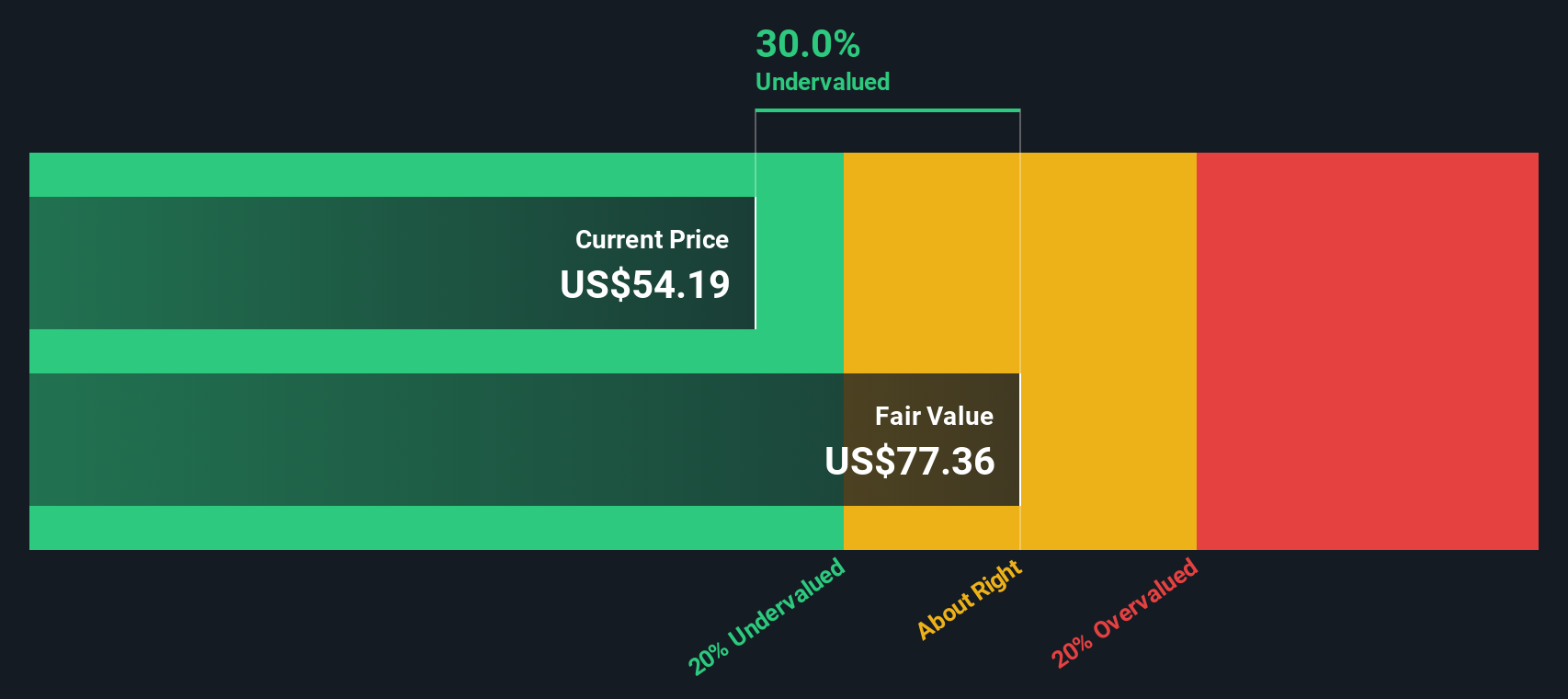

But with Buckle trading slightly above analyst targets while boasting a hefty intrinsic discount and robust sales growth, are investors still overlooking value here, or is the market already pricing in the next leg of its expansion?

Most Popular Narrative Narrative: 5.9% Overvalued

Compared with Buckle’s last close at $57.16, the most followed narrative pegs fair value slightly lower, framing a modest premium in today’s price.

Analysts expect earnings to reach $226.1 million (and earnings per share of $4.49) by about September 2028, up from $201.6 million today. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.5x on those 2028 earnings, up from 14.7x today.

Curious what kind of steady, mid single digit growth path and margin assumptions can support a richer future multiple than today, yet still call the stock only slightly expensive? The narrative spells out a detailed earnings runway, a disciplined discount rate, and a valuation bridge from here to 2028 that might surprise you. Want to see exactly how those moving parts add up to this fair value call? Read on to uncover the full playbook behind the numbers.

Result: Fair Value of $54 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent mall exposure and slower than hoped e commerce traction could pressure margins and challenge the steady growth path that underpins this fair value view.

Find out about the key risks to this Buckle narrative.

Another Lens On Value

While the consensus narrative sees Buckle as about 5.9 percent overvalued, our DCF model paints a very different picture, suggesting fair value closer to $86.57 versus the current $57.16. If both are using reasonable growth and margin assumptions, which one is misreading the future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Buckle Narrative

If this storyline does not quite match your view, or you would rather dig into the numbers yourself, you can shape a fresh narrative in just a few minutes, Do it your way.

A great starting point for your Buckle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single stock. Use the Simply Wall St Screener to uncover fresh opportunities that match your style before the market catches on.

- Capture potential mispricings by targeting companies trading below their estimated worth through these 899 undervalued stocks based on cash flows. Position yourself ahead of sentiment shifts.

- Capitalize on cutting edge innovation by filtering fast moving names in these 27 AI penny stocks. These may benefit most from accelerating adoption of artificial intelligence.

- Lock in reliable income streams with these 15 dividend stocks with yields > 3% and focus on businesses offering solid yields that can support long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Buckle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKE

Buckle

Operates as a retailer of casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)