- United States

- /

- Specialty Stores

- /

- NYSE:BKE

Buckle (BKE): Evaluating Valuation After Strong Year-Over-Year Sales Growth and Improved Store Performance

Reviewed by Simply Wall St

Buckle (BKE) grabbed the spotlight this week after releasing new sales results that surpassed what many observers might have expected. The company posted a 13.4% surge in net sales for the most recent four-week period and a 7.2% lift in year-to-date sales compared to the same stretch last year. With comparable store sales also up strongly, the latest announcement signals rising demand and a clear step up in operating momentum. This trend can quickly attract investor attention.

This surge in sales has not gone unnoticed in Buckle’s share price. The stock logged a 13% gain over the past month and climbed 36% in the past three months, considerably outpacing broader retail benchmarks. Over the past year, Buckle’s stock has surged by 55% and has more than tripled over the last five years. That kind of steady upward momentum has many market watchers pausing to reconsider how they value Buckle today, especially as the most recent growth numbers land against a backdrop of consistent, modest gains in annual revenue and net income.

The question now is whether Buckle’s rapid sales growth means there is still room to run for the stock, or if investors are already factoring future gains into today’s elevated share price. Is Buckle undervalued after this strong rally, or is the market simply recognizing its long-term growth prospects?

Most Popular Narrative: 9.9% Overvalued

According to the most widely followed narrative, Buckle is currently trading at a premium to its fair value based on expectations for future earnings, profit margins, and modest growth in revenues.

The rise of digital commerce and Buckle's recent investments in improving the online and omnichannel experience (for example, year-over-year online sales growth of 17.7% in Q2, nonrecurring digital investment costs now lapping) position the company to expand its reach and capture incremental digital sales, positively impacting both revenue and operating margins.

Could Buckle’s digital push and store upgrades unlock new value, or is the price already running far ahead of its fundamentals? The answer may hinge on a core set of bold and closely watched forecasts around future sales, profit margins, and what multiple investors are willing to pay if the plan works. Want to know the assumptions steering this valuation debate? The numbers behind the fair value threshold may surprise you.

Result: Fair Value of $54.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slowdown in digital sales or an uptick in inventory markdowns could quickly call these upbeat forecasts into question.

Find out about the key risks to this Buckle narrative.Another View: A Different Way to Look at Value

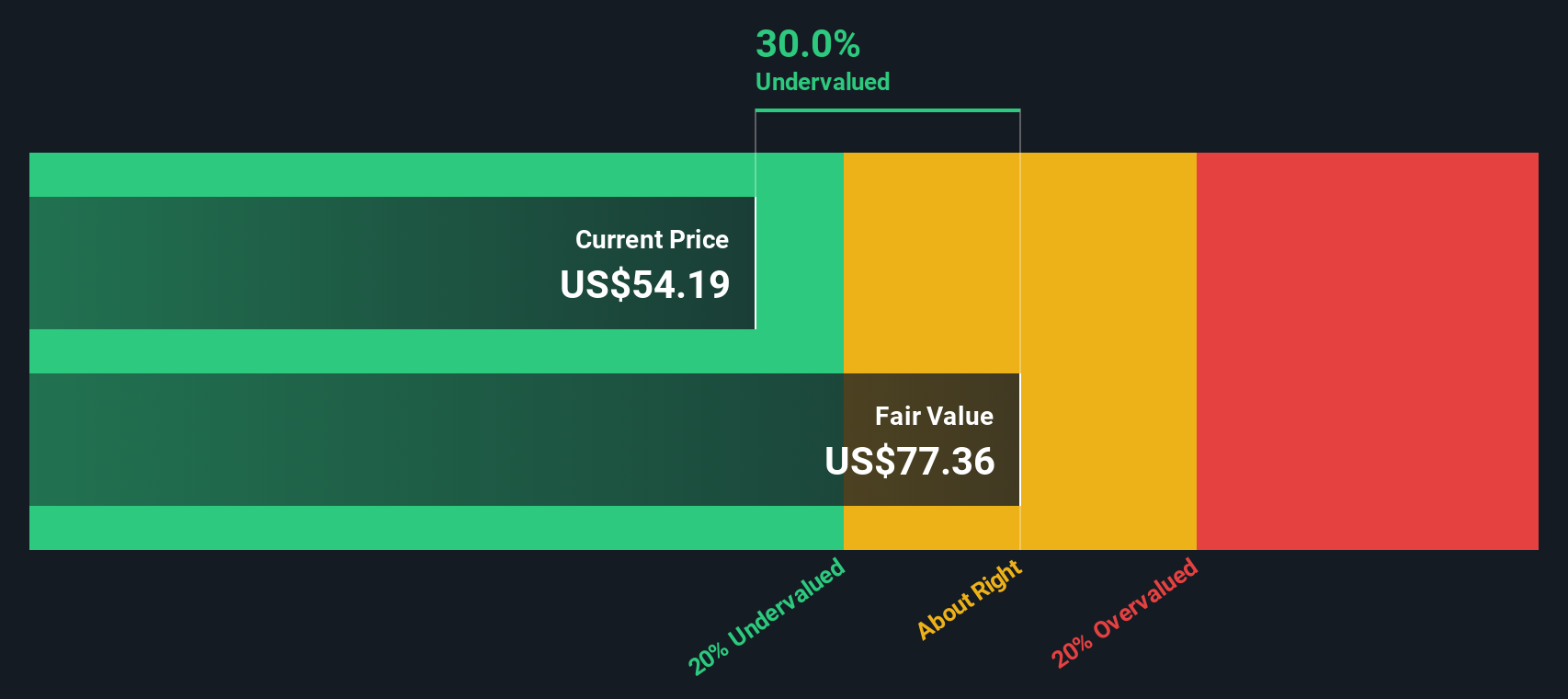

Switching gears, using our DCF model instead reveals a far more optimistic reading compared to the earlier method. This approach suggests Buckle could be undervalued, providing a contrasting picture. Which lens seems clearer to you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Buckle Narrative

If you want a different take or prefer to dig into the details yourself, you can put together your own view in just a few minutes. Do it your way

A great starting point for your Buckle research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

You do not have to wait for the next headline to uncover great opportunities. Move ahead of the crowd and see how these powerful screens can connect you to the next big thing.

- Boost potential returns by checking out stocks trading well below their cash flow value in our undervalued stocks based on cash flows list.

- Add high-yielding companies to your watchlist, starting with picks offering yields above 3% at dividend stocks with yields > 3%.

- Tap into the future of medicine by reviewing groundbreaking artificial intelligence leaders in healthcare via healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Buckle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:BKE

Buckle

Operates as a retailer of casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)