- United States

- /

- Specialty Stores

- /

- NYSE:BBY

Should Intensifying Competition and Weak Sales Require Action From Best Buy (BBY) Investors?

Reviewed by Sasha Jovanovic

- Recently, Best Buy has been challenged by lagging same-store sales, commoditized inventory, and rising competition, limiting its growth prospects.

- Investor attention has focused on the retailer’s operational headwinds, especially as peers pursue digital innovation and efficiency improvements, highlighting competitive gaps.

- Given these operational challenges, we will assess how heightened competition and weak same-store sales may influence Best Buy's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Best Buy Investment Narrative Recap

To take a positive stance on Best Buy, investors need confidence that the company can reignite growth through digital initiatives, service expansion, and premium product demand, offsetting headwinds in same-store sales and tightening margins. The latest news showing Target’s advances in omnichannel innovation and digital sales growth underscores the competitive gap; while this heightens short-term pressure on Best Buy, it does not immediately alter the near-term catalyst of a large computing upgrade cycle, nor does it materially shift the biggest risk of declining profitability from margin compression.

Best Buy's recently announced tenfold increase in marketplace offerings for the 2025 holiday season is particularly relevant. This move directly supports the company's catalyst around scaling its online marketplace to broaden product assortment and increase participation in profitable retail media, countering risks from rising digital and third-party competition.

However, as competitors gain ground with digital innovation and heightened pricing transparency, investors should not overlook the evolving risk of...

Read the full narrative on Best Buy (it's free!)

Best Buy's outlook anticipates $44.5 billion in revenue and $1.5 billion in earnings by 2028. This scenario is based on a 2.3% annual revenue growth and a $722 million increase in earnings from the current $778.0 million.

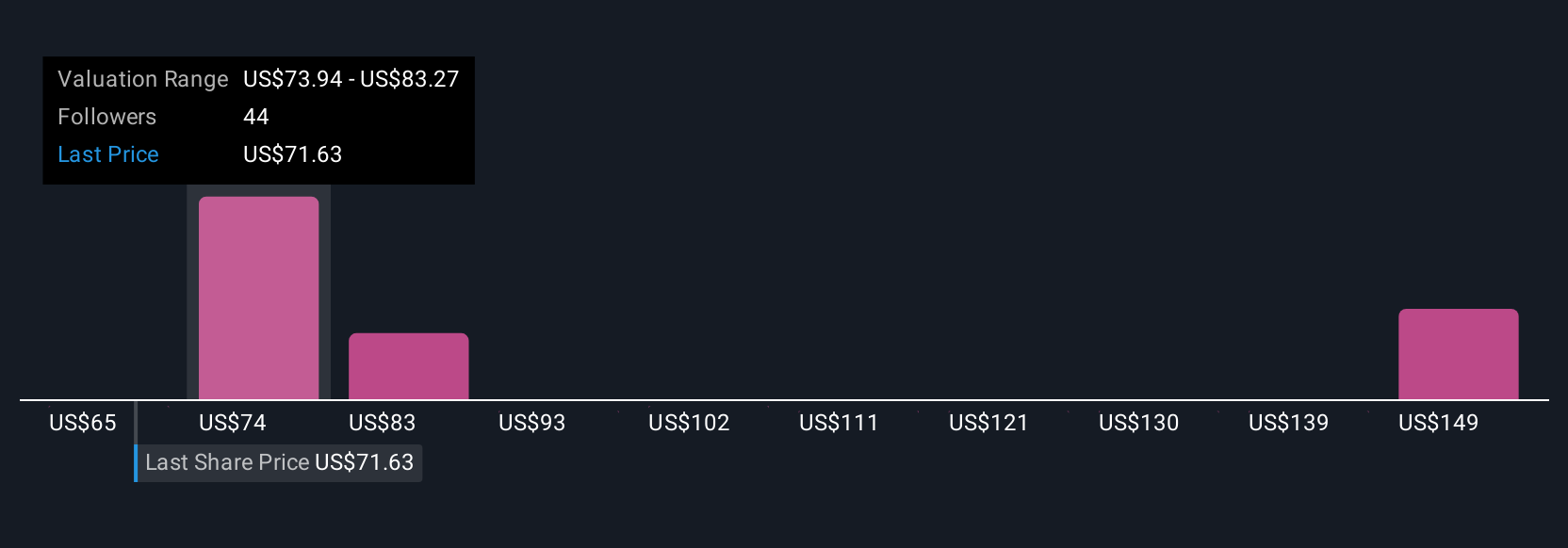

Uncover how Best Buy's forecasts yield a $79.76 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have estimated Best Buy’s fair value between US$64.62 and US$165.68 across 6 analyses. While some see deep value, recent news about increased online competition highlights how opinions and outcomes for Best Buy can sharply differ.

Explore 6 other fair value estimates on Best Buy - why the stock might be worth over 2x more than the current price!

Build Your Own Best Buy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Best Buy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Best Buy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Best Buy's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Buy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBY

Best Buy

Offers technology products and solutions in the United States, Canada, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives