- United States

- /

- Specialty Stores

- /

- NYSE:BBY

Best Buy (NYSE:BBY) Reports US$698 Million Sales Dip And US$343 Million Net Income Decline

Reviewed by Simply Wall St

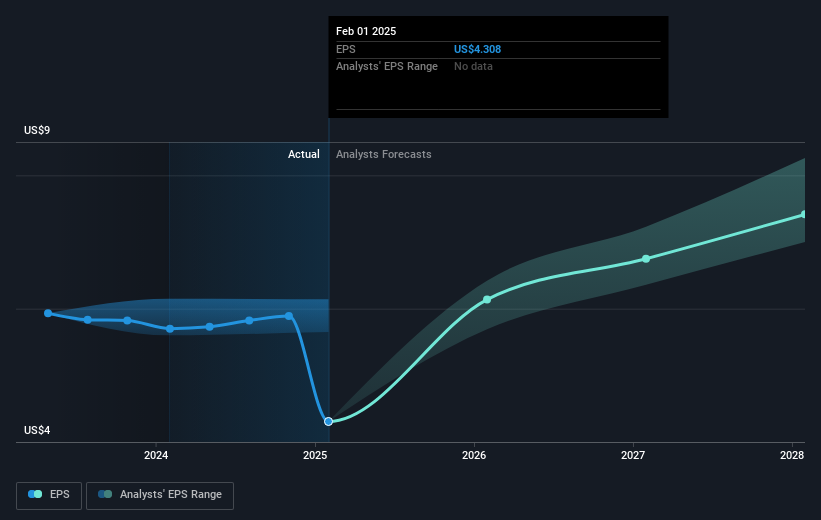

Best Buy (NYSE:BBY) recently reported a challenging fourth quarter, with significant declines in sales, net income, and earnings per share compared to last year. Though these figures show a drop, the company experienced a 1% increase in its stock price over the past month. This could be partly attributed to market trends, despite the S&P 500's recent 2.5% drop due to concerns over new tariffs and inflation impacting global trade. Best Buy, like other retailers, cited the potential impact of tariffs on its operations, warning that price increases could affect consumer demand. The company's stock was notably impacted, plunging 15% at the news of its earnings report. While the broader market was up 13% over the past year, the uncertainties around tariffs and inflation have clouded the outlook for many companies, including Best Buy, making any price movement a mixed signal in volatile times.

Get an in-depth perspective on Best Buy's performance by reading our analysis here.

Over the last five years, Best Buy (NYSE:BBY) achieved a total shareholder return of 56.49%, reflecting a combination of share price appreciation and dividends. This performance stands against the backdrop of recent challenges, yet provides a long-term perspective for investors. During this period, Best Buy consistently offered a reliable dividend, including a recent quarterly cash dividend of US$0.94. Despite past year declines in earnings, BBY maintained robust financial management with actions like its share buyback program, completing substantial repurchases since 2022. Such initiatives might have contributed to steady shareholder returns.

Additional factors included BBY's ability to exceed the US Specialty Retail industry’s performance over the past year. This outperformance demonstrated resilience amidst broader market uncertainties. Despite negative earnings growth in recent times and warnings about prospective sales declines, Best Buy’s strategic partnerships and retail expansions, such as the introduction of products like MANSCAPED in Canada, underscore its adaptability in maintaining its competitive edge and shareholder value over the long term.

- Get the full picture of Best Buy's valuation metrics and investment prospects—click to explore.

- Gain insight into the risks facing Best Buy and how they might influence its performance—click here to read more.

- Hold shares in Best Buy? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Buy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBY

Best Buy

Engages in the retail of technology products in the United States, Canada, and international.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives