- United States

- /

- Biotech

- /

- NasdaqGS:SPRO

ATA Creativity Global And Two Other Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. market experiences fluctuations, with major indices like the S&P 500 and Dow Jones retreating from record highs amid tech sector challenges, investors are keenly observing opportunities that may arise in different corners of the market. Though "penny stocks" might seem like a term from yesteryear, they still hold significant potential for growth by offering access to smaller or newer companies at lower price points. When these companies possess strong financials and fundamentals, they can present an appealing opportunity for investors seeking hidden value in emerging businesses.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.06 | $441.47M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.72 | $622.06M | ✅ 4 ⚠️ 0 View Analysis > |

| VTEX (VTEX) | $4.08 | $742.41M | ✅ 3 ⚠️ 1 View Analysis > |

| WM Technology (MAPS) | $1.24 | $212.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.94M | ✅ 3 ⚠️ 1 View Analysis > |

| Table Trac (TBTC) | $4.85 | $22.5M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.95 | $6.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.95 | $89.5M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.70 | $626.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 375 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

ATA Creativity Global (AACG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ATA Creativity Global, along with its subsidiaries, offers educational services in China and internationally with a market cap of $68.70 million.

Operations: The company generated CN¥279.85 million in revenue from its operations in the People's Republic of China (PRC).

Market Cap: $68.7M

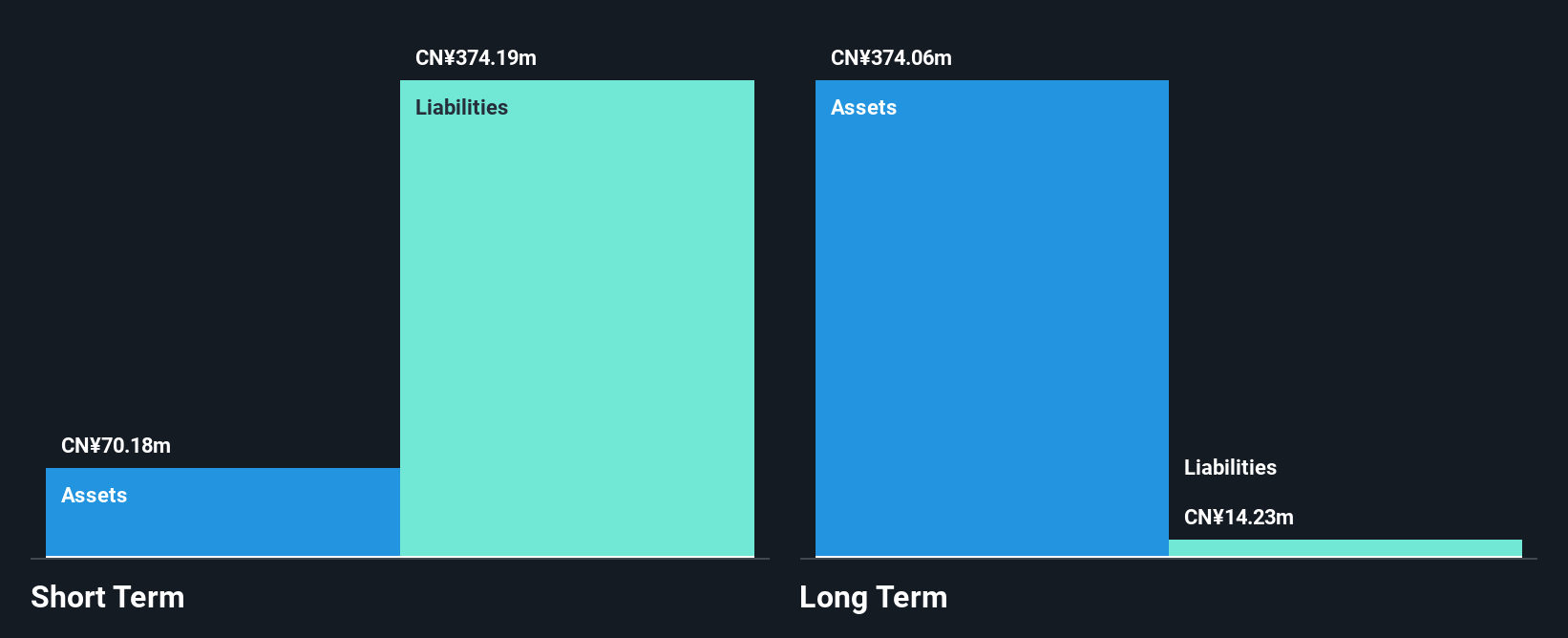

ATA Creativity Global, with a market cap of $68.70 million, operates in China and internationally. Despite being unprofitable, it has reduced losses by 31.2% annually over five years and expects modest revenue growth for 2025. The company reported increased sales of CN¥111.68 million for the first half of 2025 but still incurred a net loss of CN¥24.11 million. Short-term liabilities exceed short-term assets significantly; however, it maintains more cash than total debt and has secured potential funding through private placements worth up to $30 million with Baby BTC Strategic Capital Limited at $0.4365 per share.

- Jump into the full analysis health report here for a deeper understanding of ATA Creativity Global.

- Understand ATA Creativity Global's track record by examining our performance history report.

Spero Therapeutics (SPRO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Spero Therapeutics, Inc. is a clinical-stage biopharmaceutical company dedicated to developing innovative treatments for multi-drug resistant bacterial infections and rare diseases in the United States, with a market cap of $116.49 million.

Operations: Spero Therapeutics generates revenue primarily from its novel treatments for multi-drug resistant bacterial infections, totaling $48.58 million.

Market Cap: $116.49M

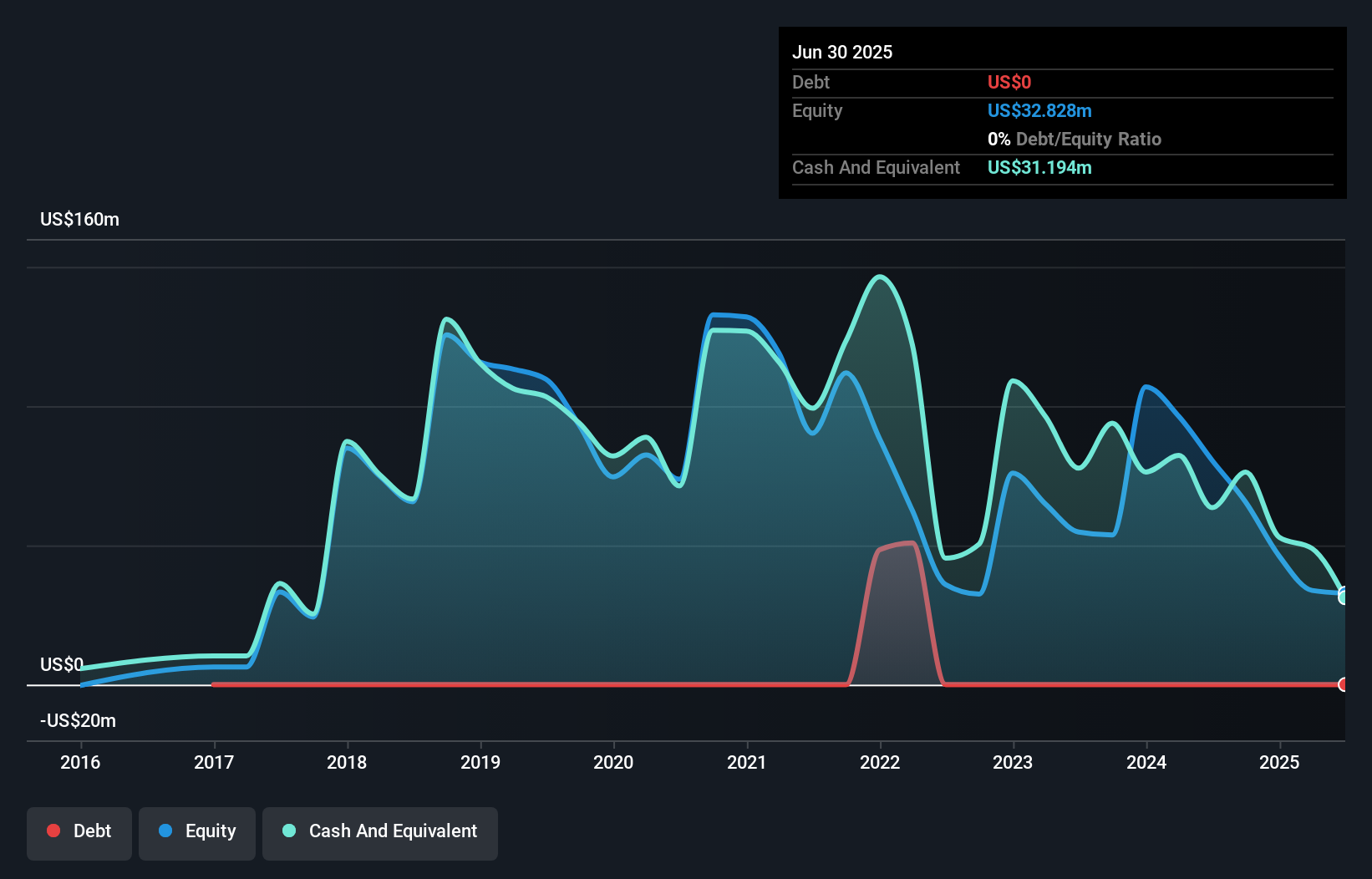

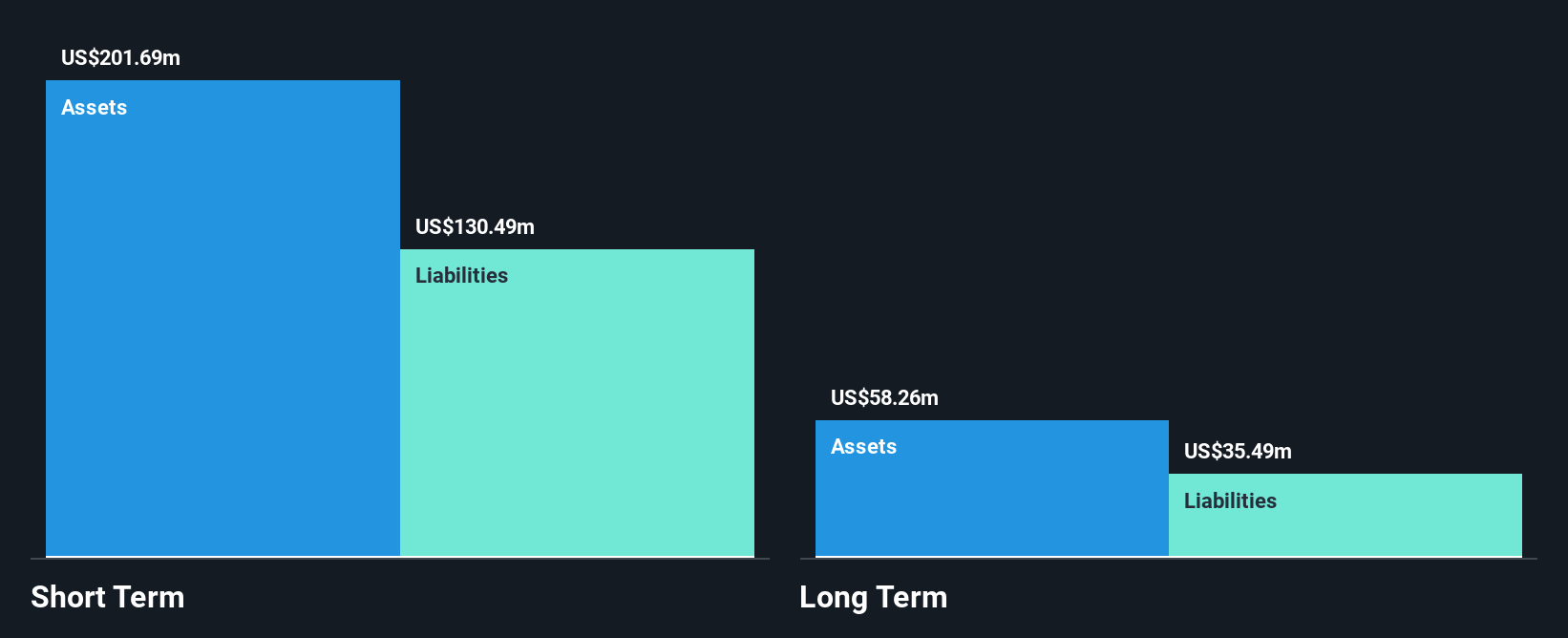

Spero Therapeutics, a clinical-stage biopharmaceutical company, reported second-quarter revenue of US$14.19 million, up from US$10.2 million the previous year, with a reduced net loss of US$1.7 million compared to US$17.86 million previously. Despite being unprofitable and having less than a year of cash runway, it has no debt and its short-term assets cover both short- and long-term liabilities comfortably at $59.4M against $29.2M combined liabilities. Recent board changes included appointing Esther Rajavelu as director until 2028's annual meeting; however, the management team remains relatively inexperienced with an average tenure of 1.4 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Spero Therapeutics.

- Gain insights into Spero Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

BARK (BARK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BARK, Inc. is a dog-centric company offering products, services, and content for dogs with a market cap of $153.29 million.

Operations: The company's revenue is derived from two main segments: Commerce, contributing $72.88 million, and Direct to Consumer, generating $397.95 million.

Market Cap: $153.29M

BARK, Inc. recently launched "BARK in the Belly," a premium dog food line with profits dedicated to fighting canine hunger, reflecting its commitment to social causes. Despite this positive initiative, BARK faces challenges such as non-compliance with NYSE's minimum stock price standards and ongoing unprofitability. The company reported first-quarter sales of US$102.86 million but incurred a net loss of US$7.03 million, though it has reduced losses over five years by 0.4% annually. BARK's short-term assets surpass liabilities significantly, offering some financial stability amidst volatility and strategic efforts like share buybacks to bolster investor confidence.

- Click to explore a detailed breakdown of our findings in BARK's financial health report.

- Review our growth performance report to gain insights into BARK's future.

Key Takeaways

- Embark on your investment journey to our 375 US Penny Stocks selection here.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPRO

Spero Therapeutics

A clinical-stage biopharmaceutical company, focuses on identifying and developing novel treatments for multi-drug resistant (MDR) bacterial infections and rare diseases in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)