Alibaba Group (BABA) Is Up 12.7% After US Eases Nvidia AI Chip Sales to China

Reviewed by Simply Wall St

- In recent days, the US government eased export restrictions by allowing Nvidia to resume sales of H20 AI chips to China, a move expected to benefit Alibaba Group's cloud computing business.

- This development suggests a shift in US-China trade relations and has renewed investor confidence in Chinese technology companies like Alibaba.

- We'll explore how improved access to advanced AI chips could impact Alibaba's investment narrative and business outlook.

What Is Alibaba Group Holding's Investment Narrative?

To be comfortable as an Alibaba shareholder, you generally need to believe in the company’s potential to sustain growth across its e-commerce and cloud divisions, despite moderating industry growth rates and headline risks. The recent easing of US export restrictions on Nvidia’s H20 AI chips, with Alibaba’s shares jumping as a result, could shift short-term catalysts by enabling its cloud unit to access cutting-edge chips and fuel AI product ambitions. This development may soften immediate concerns around technology sourcing and competitive pressures just as Alibaba’s earnings and cash dividends signal improving financial health. Yet, the bigger picture hasn’t changed overnight: consensus still calls for only modest top-line growth versus the wider market, and caution arises from past consensus earnings downgrades. Whether this policy shift meaningfully rebalances the near-term risks and return outlook remains a question that investors need to watch. On the other hand, shifting analyst sentiment poses a risk to be aware of.

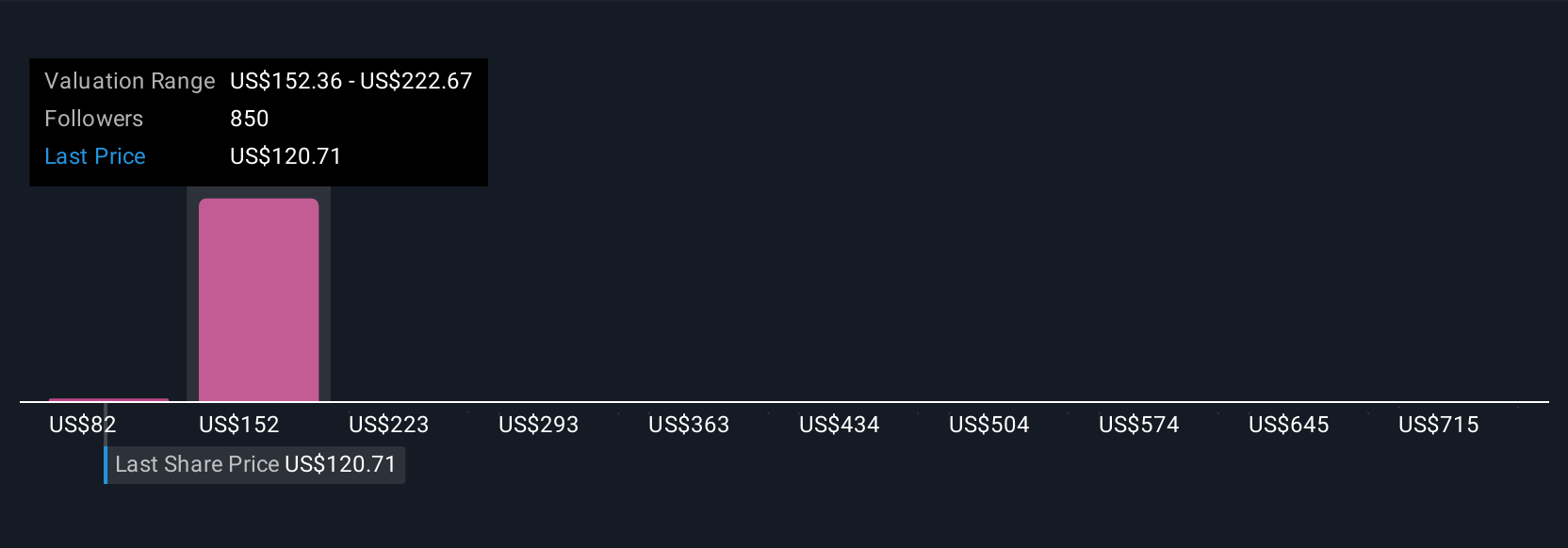

Alibaba Group Holding's shares have been on the rise but are still potentially undervalued by 38%. Find out what it's worth.Exploring Other Perspectives

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives