- United States

- /

- Specialty Stores

- /

- NYSE:AZO

AutoZone’s $1.5 Billion Buyback and Global Push Might Change The Case For Investing In AZO

Reviewed by Sasha Jovanovic

- AutoZone’s Board of Directors recently approved an additional US$1.5 billion for its share repurchase program and announced ongoing domestic and international expansion initiatives, including new Mega-Hub locations and an ambitious international store rollout plan aimed at Brazil and Mexico.

- Since launching its buyback program in 1998, AutoZone has authorized a cumulative total of over US$40.7 billion in share repurchases, highlighting the company's consistent prioritization of shareholder returns along with investment in future growth.

- We'll examine how AutoZone's expanded share repurchase program could impact its investment narrative and long-term shareholder value.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

AutoZone Investment Narrative Recap

To be a shareholder in AutoZone, you generally need to believe in the company's ability to maintain its strong position in auto parts retail while expanding both domestically and internationally. The new US$1.5 billion buyback authorization supports AutoZone's consistent focus on returning capital to shareholders as a key catalyst in the near term; however, persistent inflation, foreign exchange headwinds, and margin pressures from aggressive expansion remain important risks. The latest news does not appear to materially alter the short-term catalysts or the primary risks faced by the business at this point.

Among recent announcements, the company's plan to open at least 19 new Mega-Hub locations in the next two quarters is particularly relevant. This initiative directly supports AutoZone's efforts to increase inventory availability and delivery speed, which are considered some of the most important drivers for sustaining Commercial and retail growth amidst ongoing competitive and operating challenges.

By contrast, investors should not overlook the risk that continued expansion and inflation could put additional pressure on margins if sales growth does not keep up...

Read the full narrative on AutoZone (it's free!)

AutoZone's narrative projects $22.5 billion revenue and $3.1 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $0.5 billion earnings increase from $2.6 billion today.

Uncover how AutoZone's forecasts yield a $4556 fair value, a 11% upside to its current price.

Exploring Other Perspectives

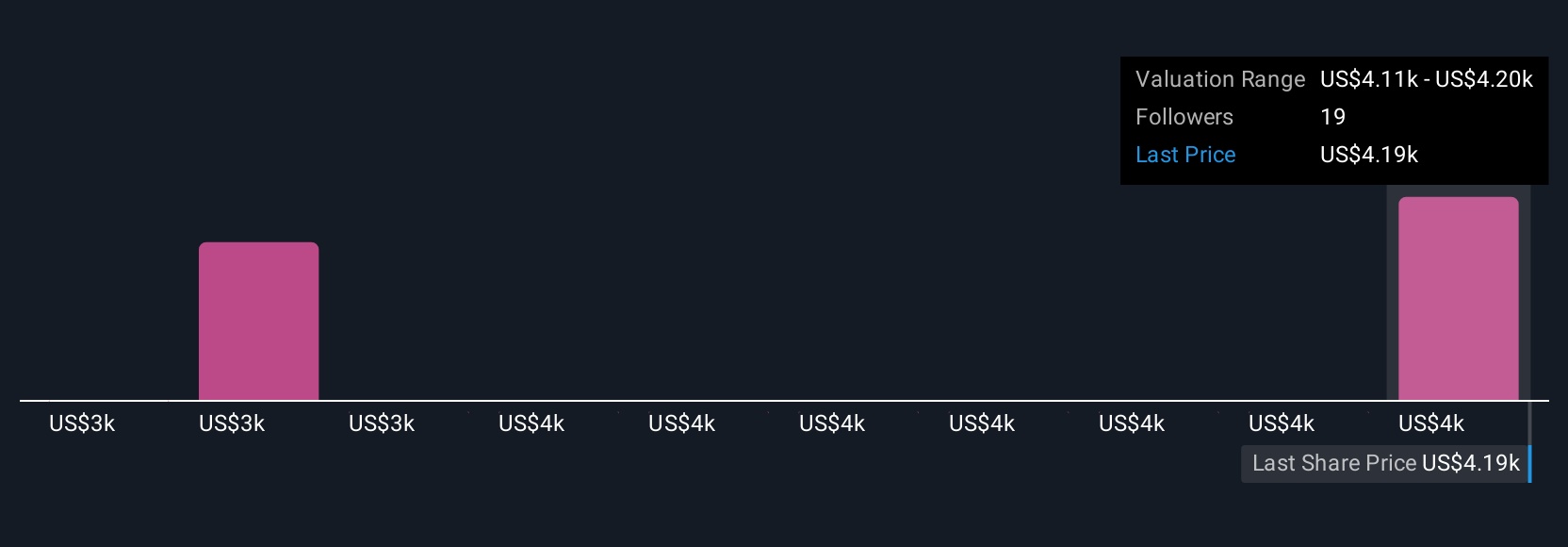

Fair value estimates from the Simply Wall St Community span from US$3,230 to US$4,556, based on four independent perspectives. Ongoing concerns about inflation and cost pressures mean investors should consider a variety of views when evaluating AutoZone's path forward.

Explore 4 other fair value estimates on AutoZone - why the stock might be worth as much as 11% more than the current price!

Build Your Own AutoZone Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AutoZone research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free AutoZone research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AutoZone's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZO

AutoZone

AutoZone, Inc. retails and distributes automotive replacement parts and accessories in the United States, Mexico, and Brazil.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives