- United States

- /

- Specialty Stores

- /

- NYSE:AZO

AutoZone (AZO): Has the 21% Three-Month Pullback Opened a Valuation Opportunity?

Reviewed by Simply Wall St

AutoZone (AZO) has quietly slipped about 10% over the past week and more than 20% over the past 3 months, even though revenue and earnings are still ticking higher year over year.

See our latest analysis for AutoZone.

Zooming out, that recent 21.44% 3 month share price pullback and softer 1 year total shareholder return of 2.35% come after a strong 5 year total shareholder return of 187.37%. This suggests momentum has cooled even as fundamentals keep improving.

If AutoZone’s shift in momentum has you reassessing your watchlist, it could be worth exploring other auto players via our screener of auto manufacturers.

With earnings still growing, shares trading nearly 30% below analyst targets, but a modest intrinsic value discount, is AutoZone now a mispriced compounder in a temporary slump, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 25.3% Undervalued

With AutoZone’s narrative fair value sitting well above the last close of $3,421.13, the spread hints at meaningful upside if the assumptions land.

The analysts have a consensus price target of $4,202.41 for AutoZone based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4,900.00, and the most bearish reporting a price target of $2,900.00.

Curious what powers that gap between price and fair value? The narrative leans on steady growth, sturdy margins, and a punchy future earnings multiple. Want the full playbook?

Result: Fair Value of $4,579.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several risks could derail that upside, including persistent margin pressure from inflation and tariffs, or weaker DIY demand if macro conditions soften.

Find out about the key risks to this AutoZone narrative.

Another Lens on Valuation

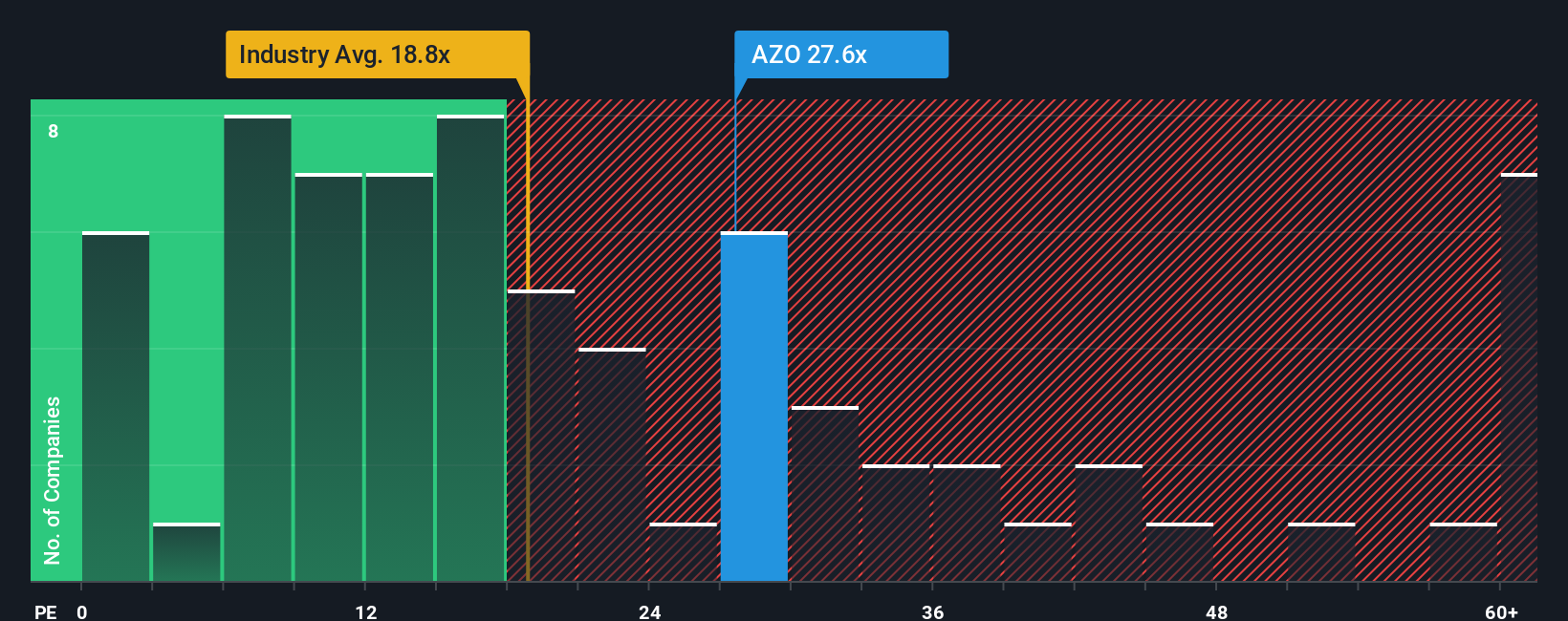

Step away from narratives and analyst targets, and the plain price earnings view looks less generous. AutoZone trades at 23 times earnings versus a 19.7 times industry average and a 19.9 times fair ratio, implying investors are already paying up for execution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AutoZone Narrative

If you see the story differently or want to dig into the numbers yourself, you can spin up a custom narrative in just a few minutes: Do it your way.

A great starting point for your AutoZone research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at AutoZone when you can quickly surface fresh, data backed opportunities across the market.

- Capture early stage potential by reviewing these 3607 penny stocks with strong financials that pair tiny market caps with surprisingly solid fundamentals and room for significant upside.

- Position yourself for the next wave of innovation by assessing these 25 AI penny stocks that harness artificial intelligence to support growth and reshape entire industries.

- Focus on quality at a compelling price by targeting these 909 undervalued stocks based on cash flows that cash flow analysis suggests may be trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZO

AutoZone

Operates as a retailer and distributor of automotive replacement parts and accessories in the United States, Mexico, and Brazil.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026