- United States

- /

- Specialty Stores

- /

- NYSE:ANF

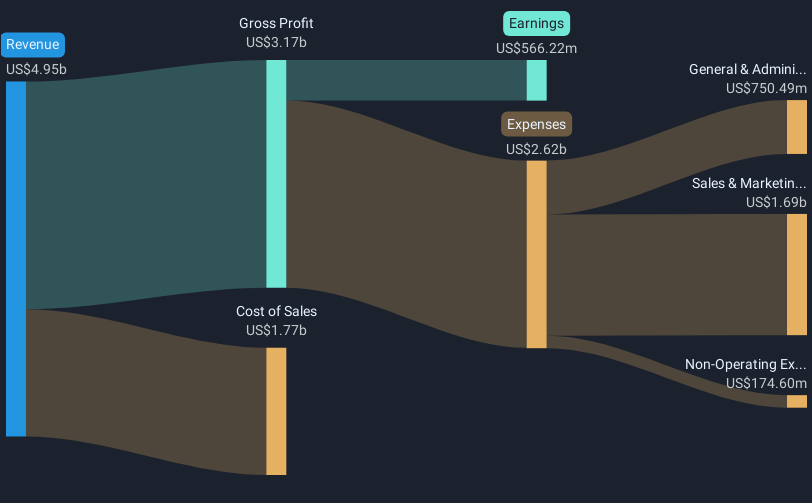

Abercrombie & Fitch (NYSE:ANF) Reports Strong Q4 With Sales Up To US$1.6B And Net Income Rising To US$187M

Reviewed by Simply Wall St

Abercrombie & Fitch (NYSE:ANF) reported robust fourth quarter and full-year financial performance with notable increases in sales and net income, alongside a strong rise in earnings per share. Despite these positive results, the company's stock price declined by 5% over the past week. This decline occurred amid a broader market environment marked by investor caution surrounding tariffs and economic data releases, contributing to a 3% drop in market indexes. The mixed market signals, including uncertainty over trade measures and expected economic impacts, may have overshadowed Abercrombie & Fitch's impressive earnings, influencing its recent negative stock performance. Additionally, the ongoing market volatility, as evidenced by fluctuating major indexes, likely affected investor sentiment toward the company.

Get an in-depth perspective on Abercrombie & Fitch's performance by reading our analysis here.

Over the past five years, Abercrombie & Fitch's total shareholder returns have been exceptionally large, reflecting a significant combination of share price appreciation and dividend payouts. Throughout this period, the company benefited from consistent profit growth—evidenced by a robust annual profit increase of 48.5%. Key to this performance was its compelling price-to-earnings valuation, with ANF shares trading at a ratio of 9x against an industry average of 14x, signaling strong market value recognition.

Several strategic actions contributed to these returns. The company expanded its market presence through partnerships, notably with India’s Myntra Jabong in December 2024, enhancing its reach into new geographies. Furthermore, a robust share buyback program, including repurchases totaling US$398.05 million by November 2024, supported stock performance. However, despite these favorable longer-term dynamics, it's worth noting that ANF underperformed relative to the specialty retail industry and broader market over the past year.

- See whether Abercrombie & Fitch's current market price aligns with its intrinsic value in our detailed report

- Assess the potential risks impacting Abercrombie & Fitch's growth trajectory—explore our risk evaluation report.

- Is Abercrombie & Fitch part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Abercrombie & Fitch, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the United States, Europe, the Middle East, Asia, the Asia-Pacific, Canada, and internationally.

Outstanding track record with flawless balance sheet.