- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Abercrombie & Fitch (NYSE:ANF) Plummets 19% Despite Positive Earnings Report

Reviewed by Simply Wall St

Abercrombie & Fitch (NYSE:ANF) reported notable improvements in its fourth-quarter and full-year results, with sales and net income showing year-over-year growth. Despite these positive figures, the company's share price experienced a decline of 19% last week. This price movement coincided with broader market conditions, where the Dow Jones and S&P 500 also faced downturns amidst heightened tariff tensions and fears of economic recession after new U.S. tariffs on Canadian imports were announced. Furthermore, ANF introduced a substantial share buyback plan, enhancing its strategy for shareholder returns. While Abercrombie & Fitch's earnings report and optimistic guidance underscored potential future growth, the external market pressures and general investor sentiment likely compounded the sharp week-on-week decline in ANF's share price. With the market itself down 4.6%, similar challenges faced other sectors, highlighting the interconnectedness of company-specific performance with broader economic developments.

Dig deeper into the specifics of Abercrombie & Fitch here with our thorough analysis report.

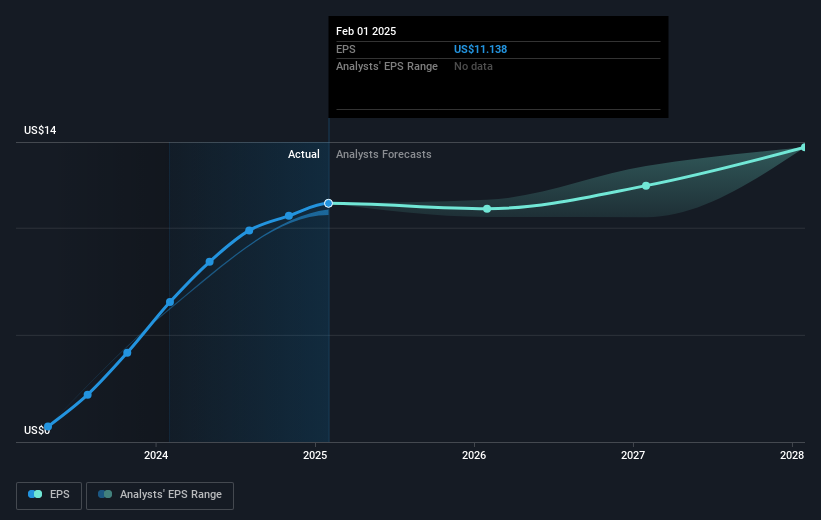

The last five years have seen Abercrombie & Fitch deliver a very large total return of approximately 698% to its shareholders. Significant earnings growth over this period, with profits growing at an impressive annual rate, has substantially contributed to this performance. Recent highlights reinforce the company's commitment to growth and shareholder value. Notably, a new share repurchase program has been authorized, allowing for up to US$1.30 billion in buybacks, while nearly 10.45 million shares have already been repurchased since late 2021.

Despite its robust five-year trajectory, Abercrombie & Fitch underperformed compared to the US Specialty Retail industry and the broader market over the past year. The company has maintained a strong value proposition, trading significantly below its estimated fair value, and has achieved high quality earnings. Leadership changes and a strategic partnership in India further bolster its expansion efforts, ensuring continued interest in its growth story.

- Discover whether Abercrombie & Fitch is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the potential risks impacting Abercrombie & Fitch's growth trajectory—explore our risk evaluation report.

- Already own Abercrombie & Fitch? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the United States, Europe, the Middle East, Asia, the Asia-Pacific, Canada, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives