- United States

- /

- Specialty Stores

- /

- NYSE:AN

AutoNation (NYSE:AN) shareholders have earned a 52% CAGR over the last three years

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. To wit, the AutoNation, Inc. (NYSE:AN) share price has flown 249% in the last three years. How nice for those who held the stock! In the last week the share price is up 2.4%.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for AutoNation

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

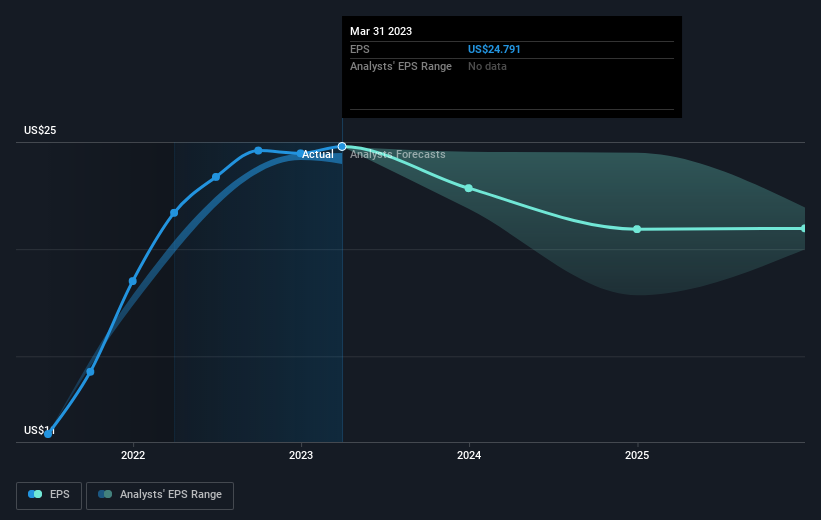

AutoNation was able to grow its EPS at 173% per year over three years, sending the share price higher. The average annual share price increase of 52% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 4.80.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how AutoNation has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that AutoNation has rewarded shareholders with a total shareholder return of 12% in the last twelve months. However, the TSR over five years, coming in at 24% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for AutoNation (1 is a bit unpleasant!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AN

AutoNation

Through its subsidiaries, operates as an automotive retailer in the United States.

Undervalued with questionable track record.

Similar Companies

Market Insights

Community Narratives