- United States

- /

- Specialty Stores

- /

- NYSE:AN

A Look at AutoNation (AN) Valuation as Investors Anticipate Q3 2025 Earnings Results

Reviewed by Kshitija Bhandaru

AutoNation (AN) is drawing attention as it gears up to release third quarter results on October 23, 2025. Investors are watching this date closely, given the company’s track record of outperforming earnings expectations.

See our latest analysis for AutoNation.

AutoNation’s stock has made some big moves this year. After an impressive rally earlier in 2025 and a recent bump in anticipation of the upcoming earnings, momentum has held steady, with the share price up 30.7% year-to-date and a standout 1-year total shareholder return of 33.4%. While there has been the usual drift around news like the company’s Subaru dealership charity events and growing industry discussions at automotive symposiums, investor optimism largely comes from AutoNation’s consistent record of outpacing earnings expectations and delivering long-term value, with an eye-catching 246% total return over the past five years.

If AutoNation’s growth streak has piqued your curiosity, this could be the perfect moment to see what other auto companies are catching investor attention. See the full list for free.

But with shares rallying and expectations running high, is AutoNation’s current price an undervaluation waiting to be seized, or is the market already factoring in the company’s next phase of growth?

Most Popular Narrative: 1.7% Undervalued

With the narrative’s estimated fair value just above AutoNation’s recent close, the price gap is razor thin. This sets the stage for a deeper look at the drivers shaping sentiment.

AutoNation's robust growth in After-Sales (service, parts, and collision), which delivered record revenue and expanding gross margins, positions the company to benefit from the long-term increase in vehicle age and a growing car parc in the U.S. This secular shift is likely to underpin resilient, recurring high-margin revenue and support future earnings stability and growth.

Curious what bold projections power this tight fair value? The narrative hinges on margin expansion, recurring revenues, and a future earnings profile that defies industry norms. Want to see the full financial playbook?

Result: Fair Value of $221.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing competition from direct-to-consumer auto retailers and accelerating electric vehicle adoption could put pressure on AutoNation's margins and long-term growth story.

Find out about the key risks to this AutoNation narrative.

Another View: How Does Market Pricing Stack Up?

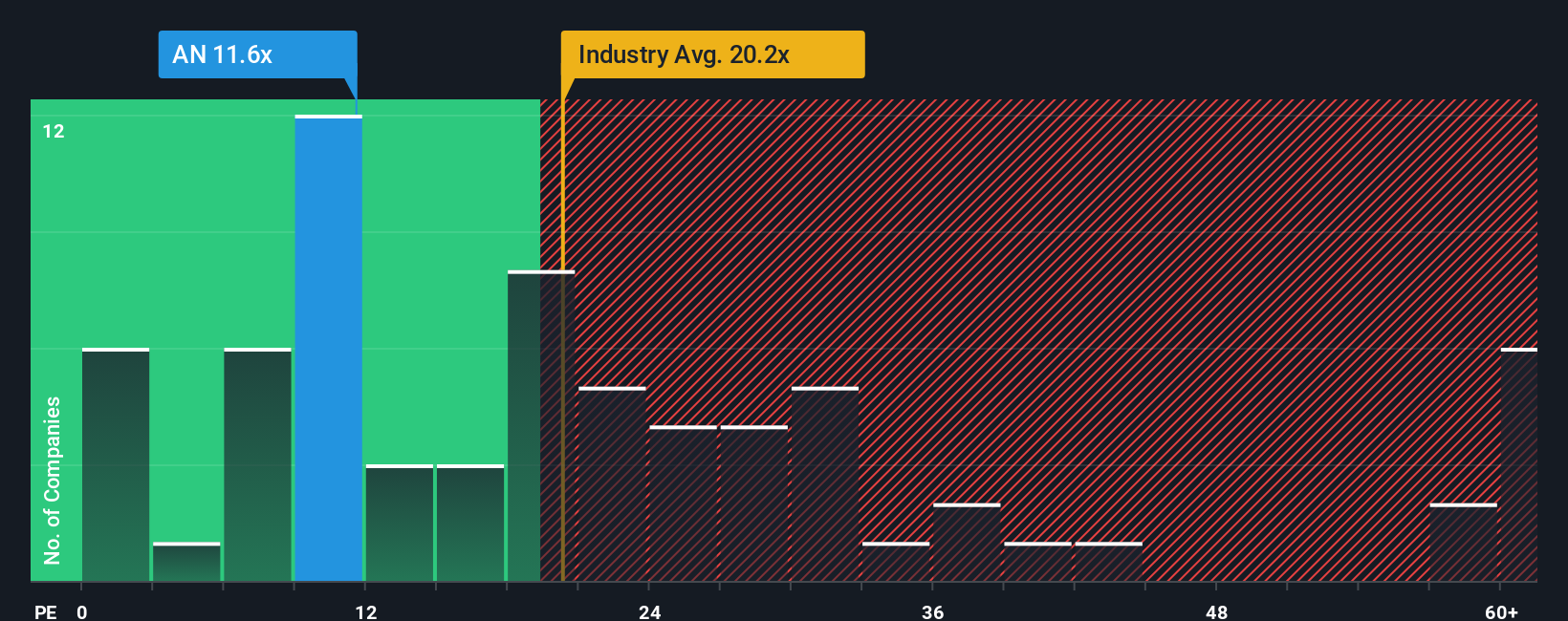

Looking through a different lens, market-based valuation tells a slightly different story. AutoNation’s price-to-earnings ratio sits at 13x, just above the peer average of 11.8x and comfortably below the industry’s 16.7x. Interestingly, the fair ratio is estimated at 16x, which suggests room for price moves if sentiment shifts. Is this a sign of hidden value or a caution flag for buyers chasing recent gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AutoNation Narrative

If you see things differently or want to back your own take with the numbers, you can put together a custom narrative in just a few minutes. Do it your way

A great starting point for your AutoNation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their options open. If you only watch the usual stocks, you risk missing tomorrow’s biggest winners in fast-moving or overlooked markets.

- Capitalize on artificial intelligence breakthroughs and see which innovators are outpacing the crowd in this AI boom with these 25 AI penny stocks.

- Lock in consistent income by targeting attractive yields and robust payouts using these 18 dividend stocks with yields > 3%.

- Seize opportunities others miss by zeroing in on value gems trading below their fair worth with these 894 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AN

AutoNation

Through its subsidiaries, operates as an automotive retailer in the United States.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives