- United States

- /

- Specialty Stores

- /

- NYSE:AKA

Optimistic Investors Push a.k.a. Brands Holding Corp. (NYSE:AKA) Shares Up 26% But Growth Is Lacking

a.k.a. Brands Holding Corp. (NYSE:AKA) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 208% in the last year.

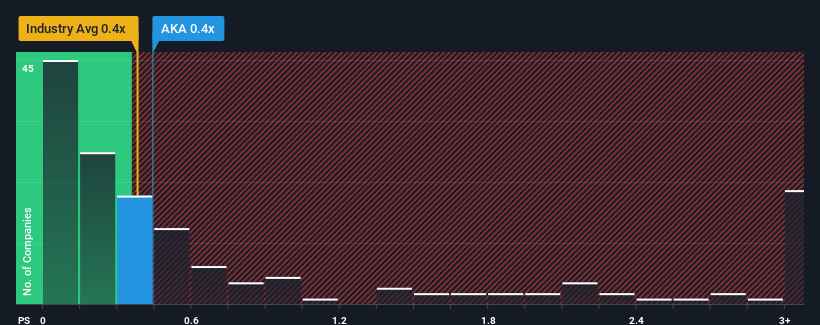

Even after such a large jump in price, it's still not a stretch to say that a.k.a. Brands Holding's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for a.k.a. Brands Holding

What Does a.k.a. Brands Holding's Recent Performance Look Like?

While the industry has experienced revenue growth lately, a.k.a. Brands Holding's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on a.k.a. Brands Holding.How Is a.k.a. Brands Holding's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like a.k.a. Brands Holding's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.1%. Still, the latest three year period has seen an excellent 58% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 2.7% per annum as estimated by the five analysts watching the company. With the industry predicted to deliver 5.9% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that a.k.a. Brands Holding is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

a.k.a. Brands Holding's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that a.k.a. Brands Holding's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

You always need to take note of risks, for example - a.k.a. Brands Holding has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade a.k.a. Brands Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AKA

a.k.a. Brands Holding

Operates a portfolio of online fashion brands in the United States, Australia, New Zealand, and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives