- United States

- /

- Specialty Stores

- /

- NYSE:AKA

a.k.a. Brands Holding Corp. (NYSE:AKA) Stock Rockets 36% As Investors Are Less Pessimistic Than Expected

a.k.a. Brands Holding Corp. (NYSE:AKA) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 65% share price drop in the last twelve months.

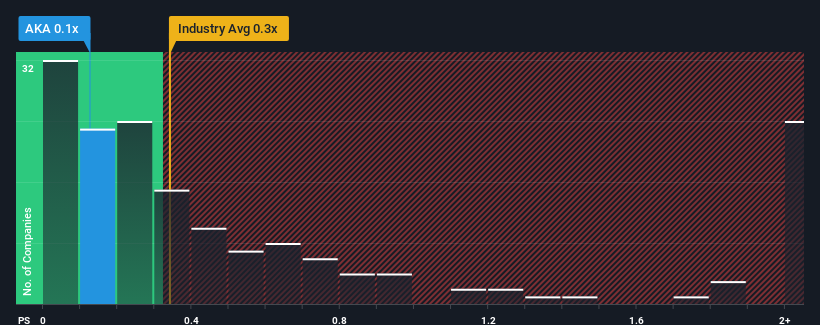

Even after such a large jump in price, you could still be forgiven for feeling indifferent about a.k.a. Brands Holding's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in the United States is also close to 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for a.k.a. Brands Holding

How a.k.a. Brands Holding Has Been Performing

a.k.a. Brands Holding could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on a.k.a. Brands Holding.Is There Some Revenue Growth Forecasted For a.k.a. Brands Holding?

The only time you'd be comfortable seeing a P/S like a.k.a. Brands Holding's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. Even so, admirably revenue has lifted 153% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 4.6% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 7.1% per annum, which is noticeably more attractive.

With this information, we find it interesting that a.k.a. Brands Holding is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

a.k.a. Brands Holding appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of a.k.a. Brands Holding's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with a.k.a. Brands Holding (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AKA

a.k.a. Brands Holding

Operates a portfolio of online fashion brands in the United States, Australia, New Zealand, and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives