- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Advance Auto Parts (AAP): Evaluating Valuation After First Brands Bankruptcy and Growing Supply Chain Concerns

Reviewed by Kshitija Bhandaru

Advance Auto Parts (AAP) is under the microscope as First Brands, one of its main suppliers, recently filed for Chapter 11 bankruptcy. Investors are now worried because required funds failed to make it to partner companies, raising fresh questions about supply chain stability and the company’s financial footing.

See our latest analysis for Advance Auto Parts.

Shares of Advance Auto Parts have been whipsawed lately, jumping 9.24% in a single day after the First Brands bankruptcy news but still nursing a 13.38% decline over the past three months. While the one-year total shareholder return sits at an impressive 40.05%, long-term holders remain well underwater due to a 65.81% total loss over three years. This highlights how recent momentum is a sharp reversal from deeper challenges.

If supply chain uncertainty has you rethinking your watchlist, now is the perfect moment to discover fast growing stocks with high insider ownership.

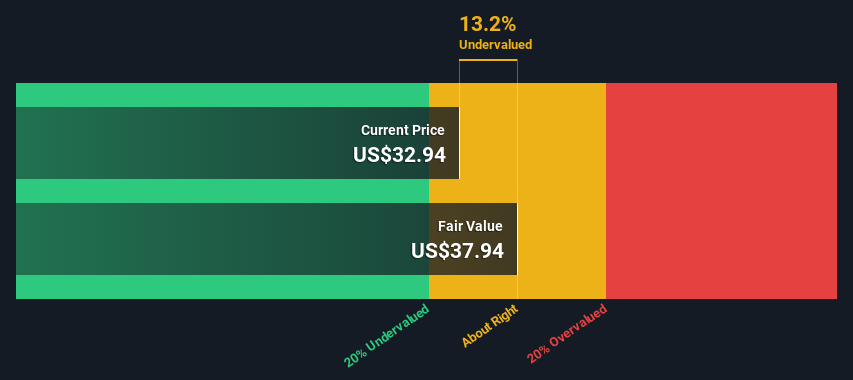

With conflicting signals from recent momentum and deeper operational concerns, investors are now left to wonder: is Advance Auto Parts trading at a bargain, or has the market already accounted for all the upside ahead?

Most Popular Narrative: Fairly Valued

The narrative's fair value estimate for Advance Auto Parts lands within 2% of the last closing price, signaling a consensus that the stock is trading near its worth. This view is informed by ongoing operational changes and strategic initiatives that could be significant catalysts for future returns.

“Advance Auto Parts is executing a 3-year strategic plan focused on improving profitability. Initiatives such as optimizing its asset base and divesting noncore operations are expected to deliver adjusted operating margins of approximately 7% by 2027. This could enhance net margins and earnings.”

Want to know what’s fueling this price target? This narrative is driven by bold bets on operating margin expansion, elusive profit targets, and ambitious sales recovery. The linchpin for these forecasts is a transformation plan that only a few in retail have ever pulled off. Don’t miss the extraordinary forecast details behind this razor-close valuation.

Result: Fair Value of $53.20 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent store closures and weaker-than-expected sales trends may still disrupt profitability improvements and challenge the company’s turnaround narrative.

Find out about the key risks to this Advance Auto Parts narrative.

Another View: Discounted Cash Flow Suggests Undervaluation

While the market and analysts see Advance Auto Parts as fairly priced using traditional ratios, a fresh look using our SWS DCF model tells a different story. The DCF approach values the company at $75.33 per share, which is about 28% higher than the recent share price. Could the market be underestimating its recovery potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Advance Auto Parts Narrative

If you think there is a story the consensus has missed, or you prefer to investigate the numbers firsthand, crafting your own assessment takes just a few minutes. Do it your way

A great starting point for your Advance Auto Parts research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want more than just one turnaround story, let Simply Wall Street steer you to powerful stock ideas that could reshape your portfolio. Don’t miss your chance to find tomorrow’s standout winners before the crowd catches on.

- Boost your hunt for high yield by checking out these 18 dividend stocks with yields > 3%, and spot companies offering robust dividends with attractive yields above 3%.

- Accelerate your strategy with these 25 AI penny stocks, which highlights emerging businesses at the edge of artificial intelligence innovation and disruption.

- Strengthen your portfolio with smart picks using these 891 undervalued stocks based on cash flows to uncover hidden gems trading below their intrinsic value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives