- United States

- /

- Specialty Stores

- /

- NasdaqGM:WINA

How Winmark’s (WINA) New CMO Could Shape Its Brand Strategy and Franchise Growth

Reviewed by Simply Wall St

- Winmark Corporation announced that Lisa Hake will join as its Chief Marketing Officer effective October 1, 2025, bringing over 25 years of marketing leadership experience from prominent brands like Great Clips, Best Buy, 3M, and The Pillsbury Company.

- This is Winmark's first appointment to the newly created Chief Marketing Officer role, reflecting a heightened emphasis on brand strategy and marketing innovation amid the company's ongoing growth.

- We'll explore how the creation of this CMO position and Hake's franchise expertise may influence Winmark's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Winmark's Investment Narrative?

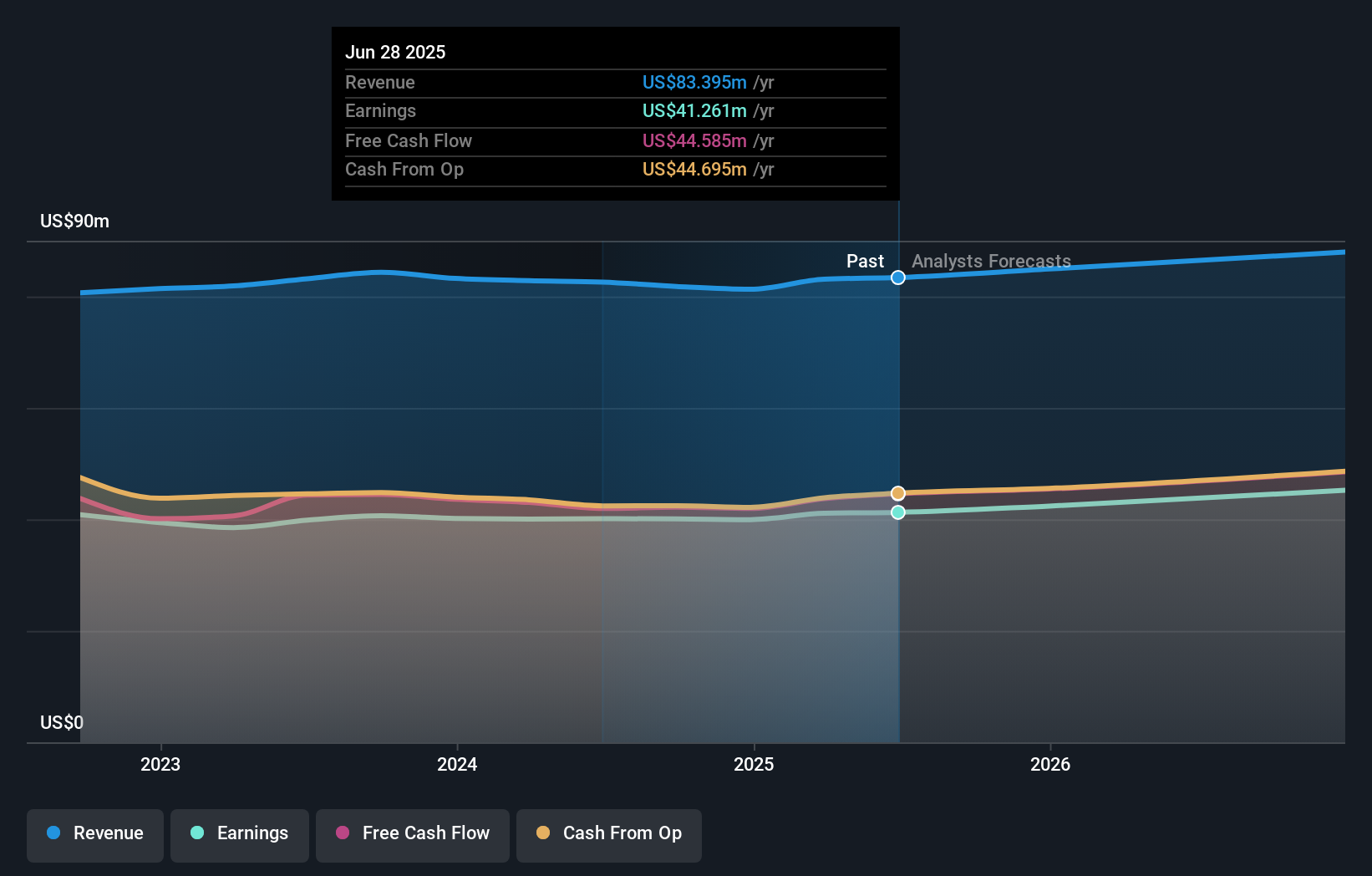

For shareholders, the Winmark story often hinges on belief in the company’s ability to maintain consistent profitability through its franchise-focused retail brands and disciplined capital allocation. The recent appointment of Lisa Hake as Chief Marketing Officer is the company’s first step to centralize and elevate its marketing strategy, signaling leadership’s commitment to refreshing brand visibility and supporting long-term franchisee success. While this structural shift could open new growth opportunities and help address slower revenue growth, in the short term, it is not likely to materially impact the main near-term catalysts or risks. Key factors still guiding sentiment include the perceived premium valuation, limited analyst data, signs of insider selling, and concerns around negative equity and dividend sustainability. However, Hake’s experience could, over time, influence how Winmark addresses these vulnerabilities, especially as competition for consumer attention intensifies.

Still, the company’s high debt and questions on dividend coverage remain key issues investors should be aware of.

Exploring Other Perspectives

Explore another fair value estimate on Winmark - why the stock might be worth as much as $279.73!

Build Your Own Winmark Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Winmark research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Winmark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Winmark's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WINA

Winmark

A resale company, operates as a franchisor for small business in the United States and Canada.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives