- United States

- /

- Specialty Stores

- /

- NasdaqGM:WINA

How Rising Institutional Interest And An Upgrade At Winmark (WINA) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent months, Winmark has attracted increased institutional interest, including a new stake by Fisher Asset Management LLC and position changes by other large investors, alongside an upgrade from Weiss Ratings from hold to buy.

- This combination of fresh institutional capital and a more positive analyst stance points to a strengthening perception of Winmark’s long-term business quality among professional market participants.

- With rising institutional involvement as a backdrop, we’ll explore how these developments shape Winmark’s investment narrative and potential risk-reward profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Winmark's Investment Narrative?

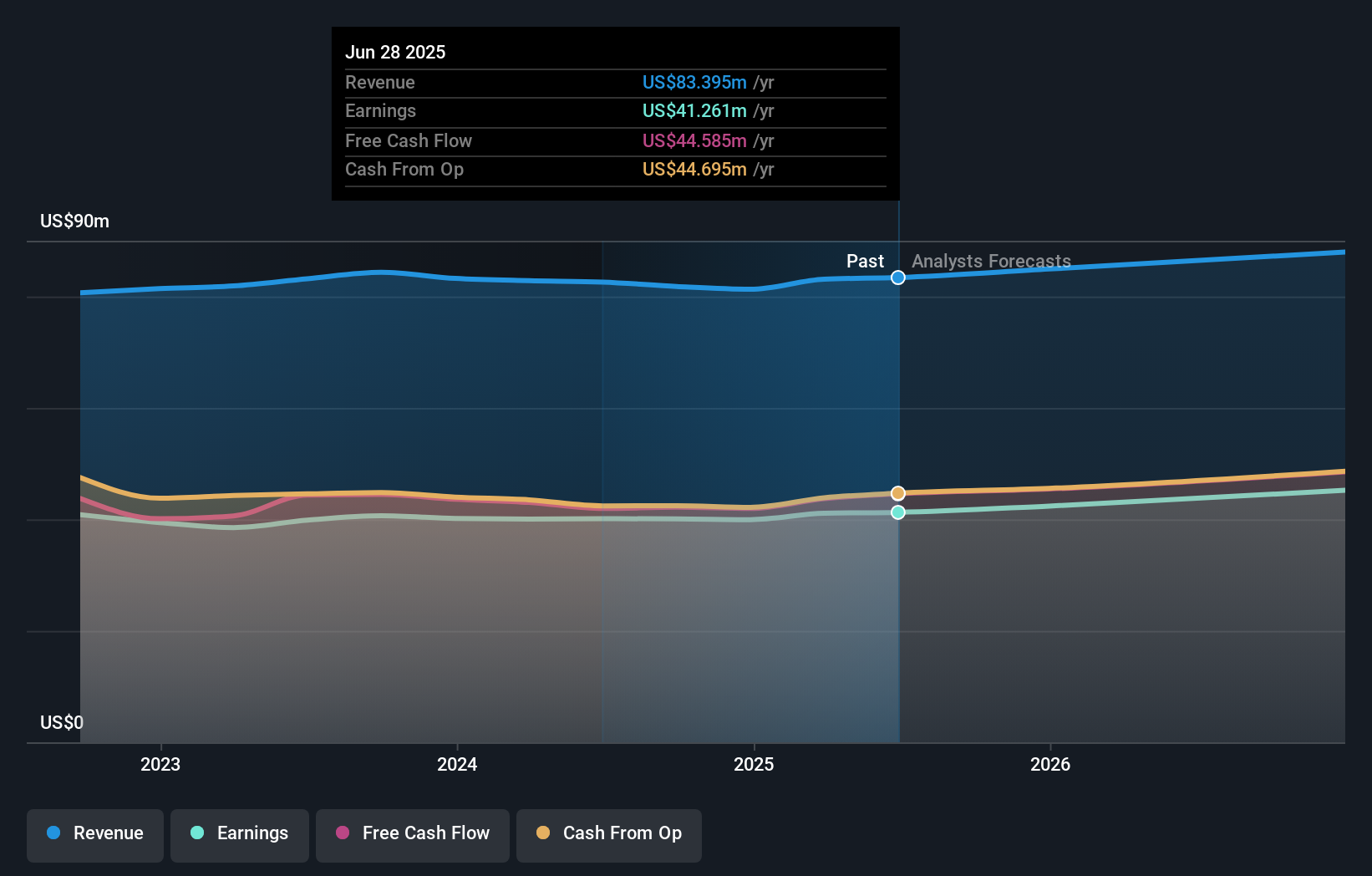

To own Winmark, you really have to believe in the durability of its franchise model, its disciplined capital return policy and its ability to keep growing earnings from a relatively mature base. Recent institutional buying, along with the Weiss Ratings upgrade, reinforces that story more than it changes it, especially after a year where returns lagged the broader US market but still comfortably beat the specialty retail peer group. The new interest may slightly improve liquidity and support sentiment around near term catalysts such as further dividend decisions and franchise expansion, but it does not alter the underlying issues investors still need to weigh: a rich earnings multiple, high leverage, negative equity and dividends that are not fully covered by free cash flow. The AI trading signals and neutral short term tone simply underline that the biggest risks remain fundamentally driven rather than purely technical.

However, one key balance sheet concern remains that investors should be aware of. Winmark's shares are on the way up, but they could be overextended by 41%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Winmark - why the stock might be worth as much as $304.80!

Build Your Own Winmark Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Winmark research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Winmark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Winmark's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WINA

Winmark

A resale company, operates as a franchisor for small business in the United States and Canada.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026