- United States

- /

- Specialty Stores

- /

- NasdaqGS:UXIN

Uxin (NasdaqGS:UXIN) Annual Losses Narrow 26.4% as Revenue Growth Narrative Faces Skepticism

Reviewed by Simply Wall St

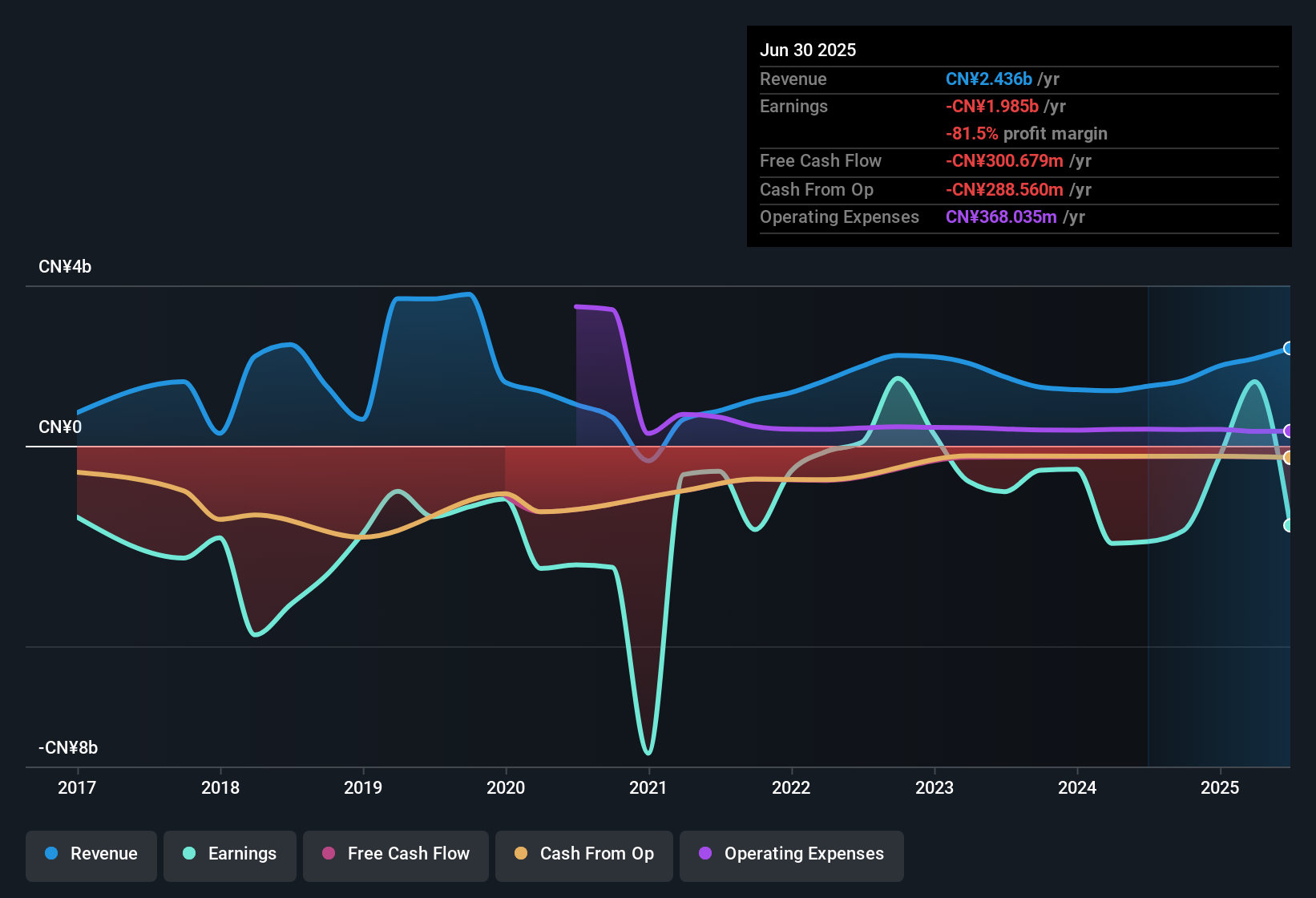

Uxin (NasdaqGS:UXIN) has managed to shrink its annual losses by an average of 26.4% each year over the past five years, while revenue is on track to surge 91.6% per year, far outpacing the US market’s forecasted 10% growth rate. While the company’s price-to-sales ratio sits notably above industry peers, investors are likely weighing its breakneck revenue projections against ongoing unprofitability and share price volatility.

See our full analysis for Uxin.Next up, we’ll set these headline results against the broader narratives tracked by the market to see which stories are holding up and which ones might get reconsidered.

Curious how numbers become stories that shape markets? Explore Community Narratives

Loss Reduction Rate Signals Gradual Progress

- Annual losses at Uxin have decreased by an average of 26.4% each year for five years, indicating ongoing efforts to narrow unprofitability rather than a rapid turnaround.

- Bulls highlight the shrinking annual losses as a foundation for a broader recovery narrative, seeing operational improvements as a key catalyst for future momentum.

- This steady reduction in losses is viewed as increasing management credibility among optimists, but there is still no confirmation that earnings will shift to positive territory soon.

- Some supporters argue that the company's tightening cost controls and loss reduction trend could eventually pave the way for profitability. Patience will be critical given the lack of clear earnings growth guidance.

Financial Stability Remains a Core Risk

- Uxin is not considered to be in a strong financial position, and its share price has seen significant volatility over the past three months.

- Bears point to the unstable financial footing and unpredictable share movement as core reasons to remain cautious.

- Unprofitability persists, so critics argue that recent improvements in losses are not yet enough to overcome the fundamental financial risks.

- With ongoing share price swings and weak balance sheet signals, skeptics question whether the business can weather additional industry shocks.

Valuation Premium Under Investor Microscope

- The company’s price-to-sales ratio stands at 1.9x, notably higher than the US specialty retail industry average of 0.4x and peer average of 0.6x. This may indicate expensive shares relative to sector norms.

- The prevailing market analysis notes that much of the current valuation premium seems anchored on faith in projected revenue growth rather than on profits achieved so far.

- The tension for investors is whether Uxin will justify its higher multiple through sustainable progress or whether ongoing financial risks will eventually weigh down the stock's appeal.

- This places pressure on management to deliver consistent results that support a re-rating. Future volatility could erode the premium if anticipated growth fails to materialize.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Uxin's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Uxin’s persistent unprofitability and volatile share price reflect ongoing financial instability, which continues to raise red flags for many investors.

If financial strength matters most to you, check out solid balance sheet and fundamentals stocks screener (1983 results) for companies with balanced books and the resilience to ride out tougher times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UXIN

Uxin

An investment holding company, operates as a used car retailer in the People’s Republic of China.

Limited growth with very low risk.

Similar Companies

Market Insights

Community Narratives