- United States

- /

- Specialty Stores

- /

- NasdaqGS:URBN

Take Care Before Diving Into The Deep End On Urban Outfitters, Inc. (NASDAQ:URBN)

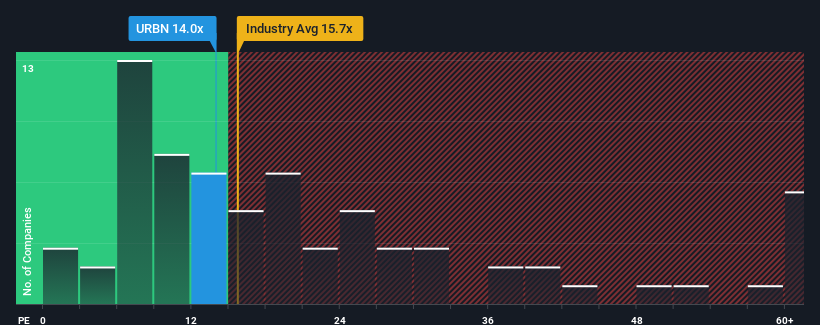

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider Urban Outfitters, Inc. (NASDAQ:URBN) as an attractive investment with its 14x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Urban Outfitters as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Urban Outfitters

How Is Urban Outfitters' Growth Trending?

In order to justify its P/E ratio, Urban Outfitters would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 81% gain to the company's bottom line. The latest three year period has also seen an excellent 24,304% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 10% per annum during the coming three years according to the analysts following the company. That's shaping up to be similar to the 10% each year growth forecast for the broader market.

With this information, we find it odd that Urban Outfitters is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Urban Outfitters' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Urban Outfitters' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Urban Outfitters you should be aware of.

If you're unsure about the strength of Urban Outfitters' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:URBN

Urban Outfitters

Engages in the retail and wholesale of general consumer products.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives