- United States

- /

- Specialty Stores

- /

- NasdaqGS:URBN

Does Chipotle Collaboration Signal a New Growth Avenue for Urban Outfitters (URBN)?

Reviewed by Simply Wall St

- Chipotle and Urban Outfitters announced a collaborative limited-edition "A Little Extra" Dorm Collection, inspired by Chipotle's menu, which launched on August 20, 2025, at select Urban Outfitters locations and online.

- This unique partnership aims to attract college students and brand enthusiasts, potentially bolstering Urban Outfitters' back-to-school sales and broadening its appeal through exclusive lifestyle products.

- We’ll examine how this high-profile launch with Chipotle could influence Urban Outfitters’ investment case and growth expectations.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Urban Outfitters Investment Narrative Recap

To be a shareholder in Urban Outfitters, you need to believe in the company's ability to drive steady retail growth and margin improvements, particularly through innovative brand collaborations and improved inventory management. The new Chipotle dorm collection is a creative tie-in with potential to boost back-to-school sales, but its impact on the most important short-term catalyst, sustained retail segment sales growth, may not be material, given the existing headwinds with North American 'comp' performance and inventory levels. Execution risks around sales consistency and effective markdown management remain the biggest areas to watch in the near term.

The most relevant recent announcement is Urban Outfitters’ confirmation of mid-single-digit sales growth targets for fiscal 2026, which sets clear expectations for improvements in core business segments. This commitment aligns with ongoing efforts to recapture positive 'comps' and stabilize performance, factors that may influence how collaborative launches like the Chipotle collection ultimately contribute to top-line momentum.

By contrast, investors should be aware of the risk that elevated inventory levels, if not managed well, could lead to...

Read the full narrative on Urban Outfitters (it's free!)

Urban Outfitters' outlook anticipates $6.4 billion in revenue and $443.4 million in earnings by 2028. This is based on analysts’ assumptions of 4.7% annual revenue growth and a $40.9 million increase in earnings from the current $402.5 million.

Uncover how Urban Outfitters' forecasts yield a $75.69 fair value, in line with its current price.

Exploring Other Perspectives

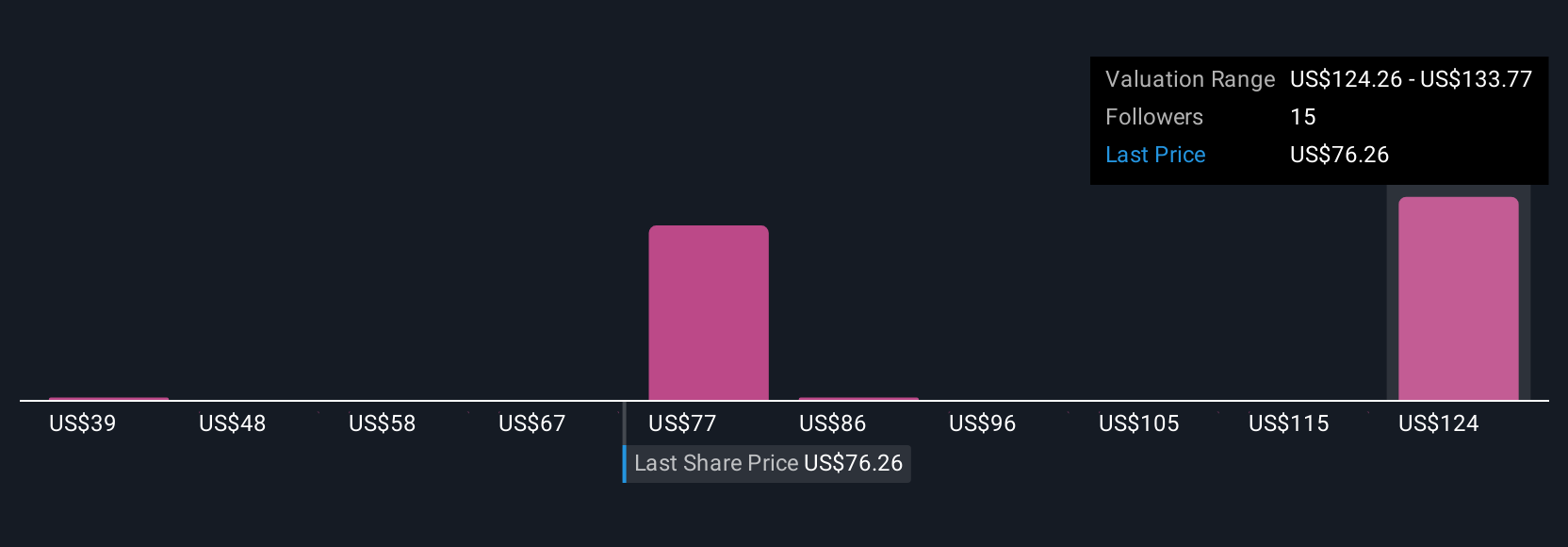

Four fair value estimates from the Simply Wall St Community span from US$38.76 to US$134.40, reflecting a broad spectrum of individual investor outlooks. Some see stronger fundamentals ahead with recent retail collaborations, while others may question whether ongoing inventory and sales growth challenges could hold back results, making it important to consider several viewpoints before taking a position.

Explore 4 other fair value estimates on Urban Outfitters - why the stock might be worth 50% less than the current price!

Build Your Own Urban Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Urban Outfitters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Urban Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Urban Outfitters' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:URBN

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives