- United States

- /

- Specialty Stores

- /

- NasdaqGS:URBN

Could Urban Outfitters’ (URBN) Dunkin' Collaboration Reveal a New Approach to Brand Relevance?

Reviewed by Simply Wall St

- Urban Outfitters and Dunkin' recently launched a limited-edition capsule collection, blending coffee culture and campus fashion, in select stores from September 22, 2025, with a wider online debut set for National Coffee Day.

- This collaboration not only highlights Urban Outfitters' focus on experiential retail and cultural partnerships but also shows its intent to attract younger consumers through creative brand engagement.

- We'll explore how this exclusive partnership with Dunkin' strengthens Urban Outfitters' brand relevance and supports its evolving investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

Urban Outfitters Investment Narrative Recap

To own Urban Outfitters shares, you need to believe that its brand innovation and focus on younger consumers will translate to sustainable growth despite ongoing pressures in North America. The Dunkin' collaboration underscores Urban Outfitters' commitment to experiential retail, but this type of brand partnership is unlikely to materially impact the most important short-term catalyst: expanded omnichannel capabilities. However, the biggest risk, margin pressure from increased tariff rates and marketing spend, remains unchanged and should be monitored closely.

Of recent corporate events, the "A Little Extra" Dorm Collection with Chipotle demonstrates a continued pattern of experiential and culturally resonant partnerships. Such initiatives align with the company's focus on attracting Gen Z consumers, which could contribute incremental store traffic and digital engagement, both vital for improving sales productivity and operating leverage if these collaborations scale successfully.

By contrast, investors should be aware of ongoing headwinds from marketing cost pressures and the risk that...

Read the full narrative on Urban Outfitters (it's free!)

Urban Outfitters is projected to reach $7.2 billion in revenue and $508.4 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 7.1% and represents a $33 million increase in earnings from the current $475.4 million.

Uncover how Urban Outfitters' forecasts yield a $79.67 fair value, a 10% upside to its current price.

Exploring Other Perspectives

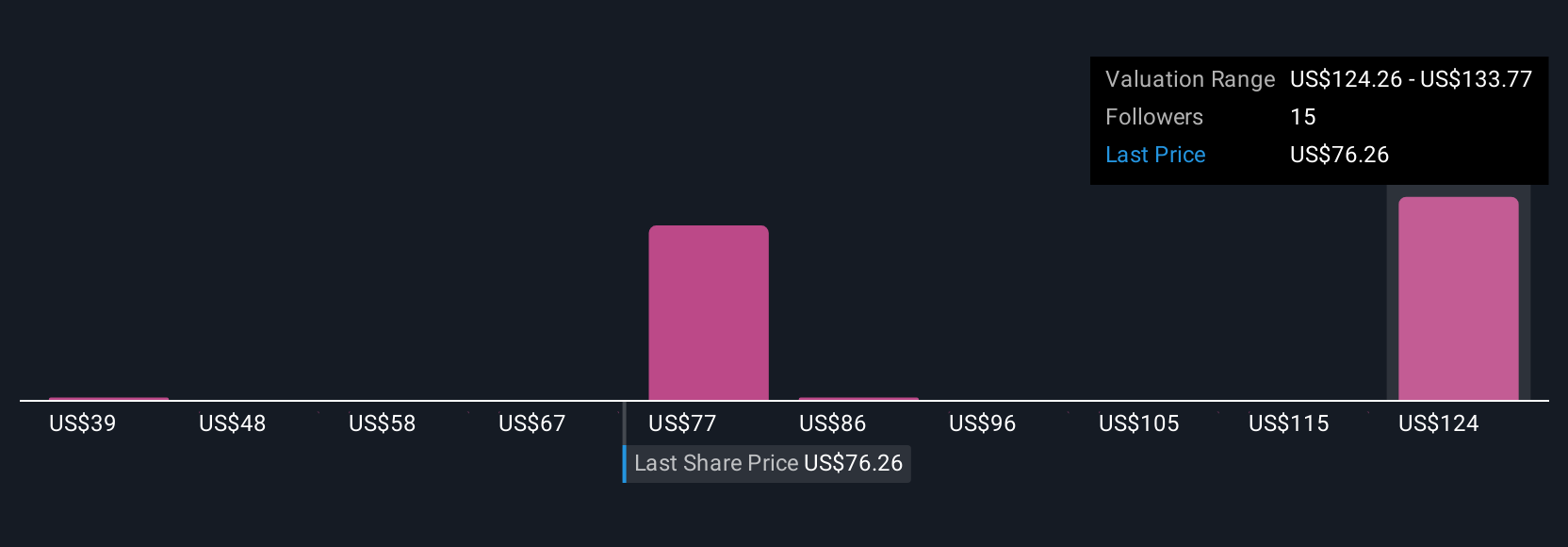

Simply Wall St Community members submitted four fair value estimates for Urban Outfitters, spanning a wide US$38.76 to US$108.61 per share. While the crowd sees value across the spectrum, persistent gross margin risks from tariffs could drive diverging opinions about near-term performance.

Explore 4 other fair value estimates on Urban Outfitters - why the stock might be worth 46% less than the current price!

Build Your Own Urban Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Urban Outfitters research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Urban Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Urban Outfitters' overall financial health at a glance.

No Opportunity In Urban Outfitters?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:URBN

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives