- United States

- /

- Specialty Stores

- /

- NasdaqGS:UPBD

Can Upbound Group's (UPBD) Dividend Strategy Reveal Deeper Insights Into Its Capital Allocation Approach?

Reviewed by Sasha Jovanovic

- Upbound Group has increased its dividend four times over the last five years, resulting in a dividend yield currently well above the industry average.

- This pattern of consistent dividend growth, amid expectations for strong upcoming earnings, has positioned the company as a leading dividend play even through periods of rising interest rates.

- We'll explore how Upbound Group's ongoing dividend increases impact its status as a strong option for income-focused investors.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Upbound Group Investment Narrative Recap

To invest in Upbound Group, you need to believe in the company’s ability to drive recurring growth from its lease-to-own model and expanding financial products, while maintaining operational resilience through changing economic cycles. The recent dividend increase underscores management’s confidence, but doesn’t materially alter the most immediate risk: potential regulatory and legal pressures from ongoing litigation, which could affect operational flexibility or raise costs.

One relevant recent announcement is Upbound’s decision to raise its quarterly dividend to US$0.39. This increase follows several previous hikes, reinforcing the company’s identity as an income-focused investment and aligning with themes of shareholder return as a short-term catalyst, especially attractive for investors seeking steady cash flow despite a challenging retail market.

Yet, on the other hand, investors should be aware of ongoing regulatory uncertainties and litigation that could impact future profitability and...

Read the full narrative on Upbound Group (it's free!)

Upbound Group's narrative projects $4.8 billion in revenue and $278.5 million in earnings by 2028. This requires 3.9% yearly revenue growth and a $197.3 million increase in earnings from $81.2 million today.

Uncover how Upbound Group's forecasts yield a $36.38 fair value, a 69% upside to its current price.

Exploring Other Perspectives

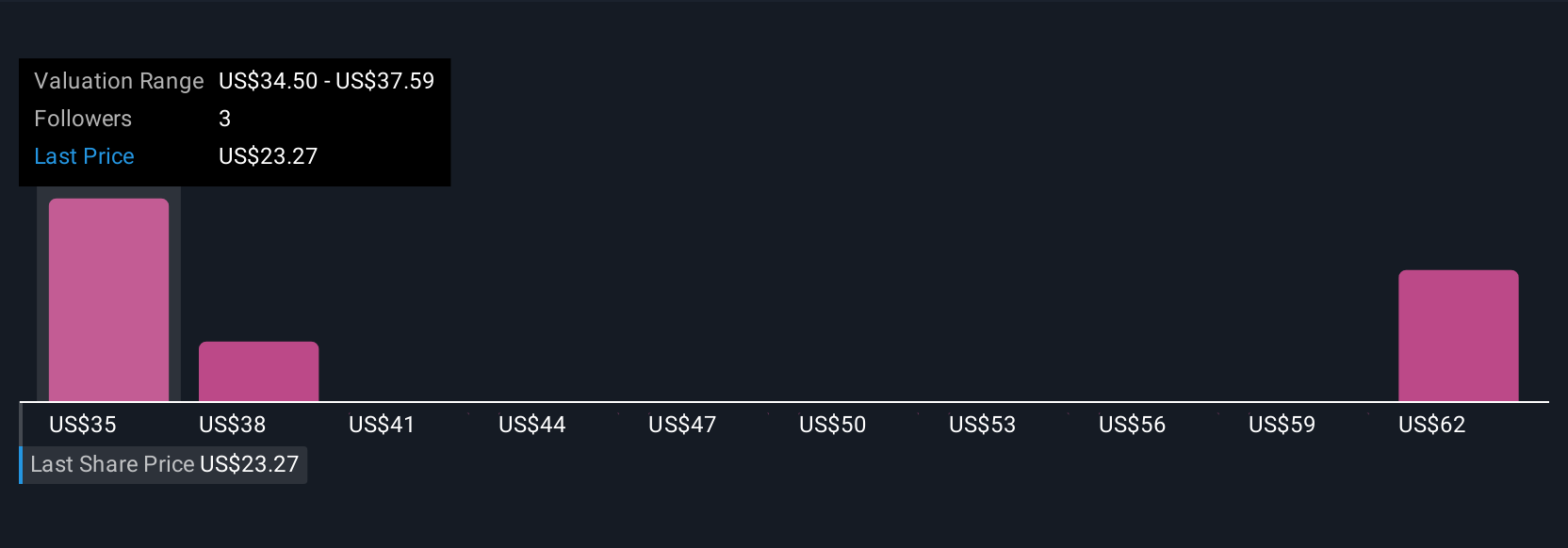

Four fair value estimates from the Simply Wall St Community put Upbound Group’s worth between US$36.38 and US$61.24 per share. With such varied views, consider how upcoming legal and regulatory challenges could weigh into the company’s future results, these different opinions invite you to explore more perspectives.

Explore 4 other fair value estimates on Upbound Group - why the stock might be worth over 2x more than the current price!

Build Your Own Upbound Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upbound Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Upbound Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upbound Group's overall financial health at a glance.

No Opportunity In Upbound Group?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPBD

Upbound Group

Upbound Group, Inc. leases household durable goods to customers on a lease-to-own basis in the United States, Puerto Rico, and Mexico.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives