- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Ulta Beauty (ULTA): Evaluating Valuation After Exclusive Fenty Skin Launch and Technical Outage

Reviewed by Kshitija Bhandaru

Ulta Beauty (ULTA) has been in the spotlight this week, thanks to the exclusive launch of the Fenty Skin Body Collection and collaborations with brands like PAUME and Squishmallows Fragrances. At the same time, a technical outage during a key promotion created a unique mix of opportunity and challenge for the retailer.

See our latest analysis for Ulta Beauty.

This wave of new partnerships and exclusive launches has kept Ulta Beauty in the spotlight, helping build strong retail momentum even as a recent technical outage briefly weighed on sentiment. Over the past year, Ulta’s total shareholder return hit an impressive 48.2%, and its share price is up nearly 28% so far in 2025. This signals continued enthusiasm despite short-term bumps.

If you’re watching Ulta’s moves and want to see which other fast-rising companies insiders are betting on, now’s the time to discover fast growing stocks with high insider ownership

With such strong performance on the surface, investors may wonder if Ulta Beauty’s stock still presents a buying opportunity or if the market has already priced in all the expected future growth.

Most Popular Narrative: 4.4% Undervalued

Compared to Ulta Beauty's last close of $549.28, the most widely followed narrative pegs fair value slightly higher. This sets the stage for a closer look at the logic driving that consensus.

Enhanced investment in digital infrastructure, including new personalization and automation tools, as well as omnichannel fulfillment with half of e-commerce orders being fulfilled by stores, supports increased e-commerce penetration and customer retention. These factors directly drive growth in revenue and improved operating leverage.

Want to know the differentiator analysts are betting on? This fair value is anchored to a tech-forward transformation, bold digital paths, and changes in how shoppers interact with Ulta. Ready to uncover which future shifts and membership moves fuel that price point? Dive deeper to reveal the full story behind this valuation strategy.

Result: Fair Value of $574.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, margin pressure from rising costs and the upcoming end of the Target partnership could present challenges to the bullish outlook and future growth story for Ulta Beauty.

Find out about the key risks to this Ulta Beauty narrative.

Another View: Market Ratios Tell a Different Story

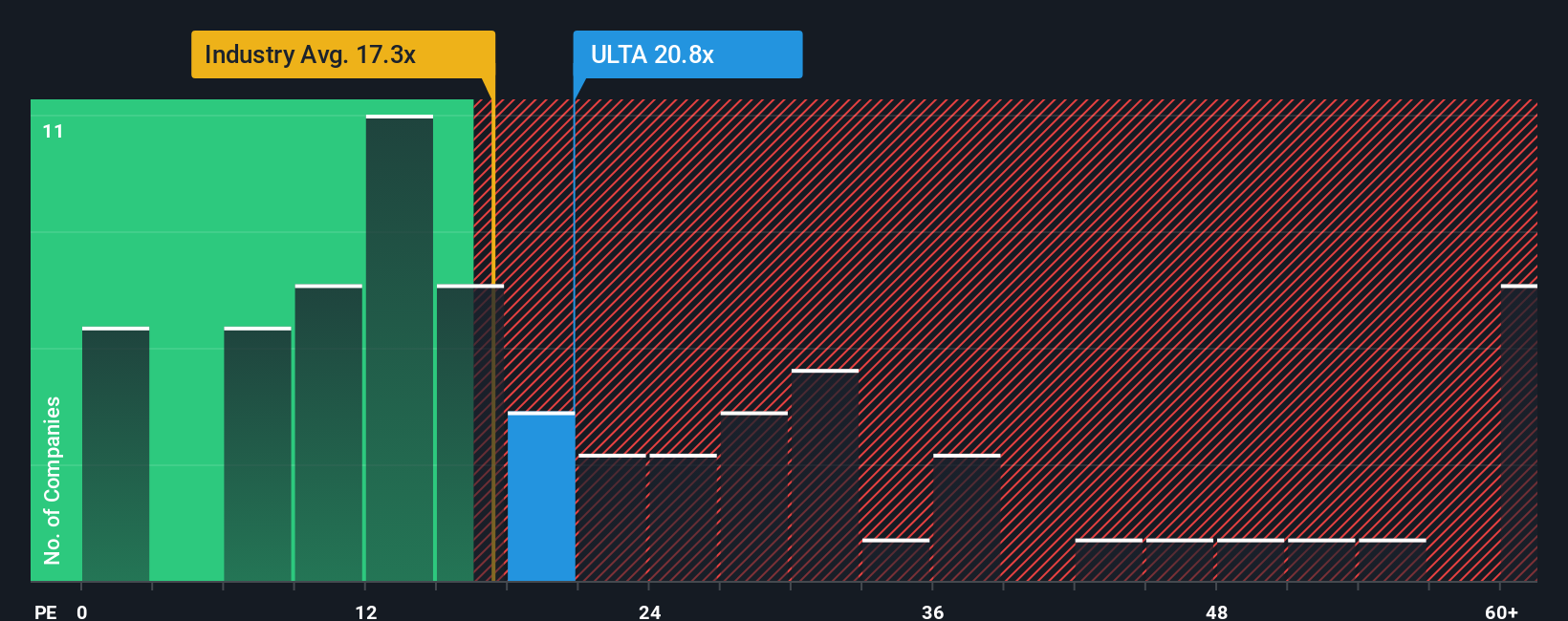

Looking through the lens of market price-to-earnings, Ulta Beauty trades at 20.5 times earnings. That is higher than both the US Specialty Retail sector average of 15.8x and its peer average of 44x, but it is still above the estimated fair ratio of 17.3x. This premium suggests the market is already pricing in continued strength, yet it leaves less margin for error if expectations are missed. Will investors continue to pay up, or could this gap narrow?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ulta Beauty Narrative

If you want to take the analysis in your own direction or dig deeper into Ulta Beauty’s fundamentals, you can craft a story tailored to your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ulta Beauty.

Looking for more investment ideas?

Don’t let your next big winner slip by. The right screens cut through market noise and help uncover overlooked gems and sector leaders you might otherwise miss.

- Unlock income opportunities and tap into stocks yielding over 3% with these 19 dividend stocks with yields > 3%. This is perfect for building steady returns in a turbulent market.

- Catch the next wave in technology by checking out these 24 AI penny stocks, where AI-driven businesses are rapidly reshaping entire industries and creating fresh growth prospects.

- Access undervalued stocks trading below fair value using these 891 undervalued stocks based on cash flows and seize your chance at smart entries before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States and Mexico.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives