- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

HATCH Mama Launches At Ulta Beauty (NasdaqGS:ULTA) Bringing Maternity Skincare To A Wider Audience

Reviewed by Simply Wall St

Ulta Beauty (NasdaqGS:ULTA) has experienced a significant price increase of 14% over the last month. This movement coincides with the launch of HATCH Mama products at Ulta locations, a strategic expansion that caters to maternity needs just before Mother's Day, potentially boosting consumer interest and sales. Additionally, the appointment of Lauren Brindley as the new Chief Merchandising and Digital Officer is poised to strengthen their merchandising strategy. Amidst these developments, the broader market also saw upward trends, supported by easing trade tensions and a reduction in inflation. These factors collectively provided a supportive environment for ULTA's recent performance.

Buy, Hold or Sell Ulta Beauty? View our complete analysis and fair value estimate and you decide.

The introduction of HATCH Mama products at Ulta Beauty alongside strategic leadership changes could significantly enhance the company’s narrative. These initiatives are likely to attract new customers and boost store foot traffic, aligning with efforts to broaden market appeal. This momentum could complement the launch of Beyoncé's hair care brand, further driving increased customer engagement and aiding revenue growth. Over the longer term, Ulta Beauty’s total shareholder return was 96.09% over five years, a figure that illustrates robust long-term shareholder value creation. However, the company underperformed the US market by returning less than the market's 11.5% over the past year.

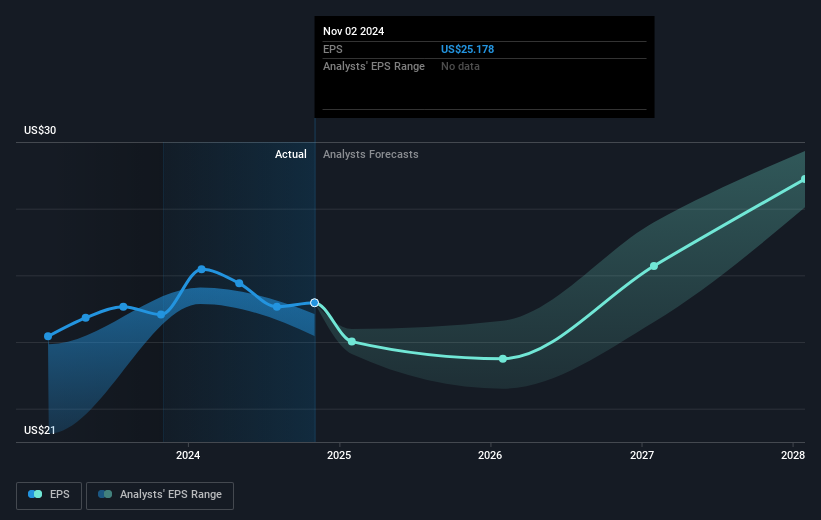

The recent news and organizational strategies could positively impact Ulta Beauty's revenue and earnings forecasts. With these new offerings and digital enhancements, analysts anticipate improved customer retention and spending, potentially contributing to sustained revenue growth estimated at 4.4% annually over the next three years. However, the challenges posed by macroeconomic pressures and competitive dynamics remain. Despite the recent share price increase, ULTA's current price of US$387.14 remains slightly below the consensus analyst price target of US$411.39, suggesting a small upside potential of around 5.9%. This price movement in context to the price target could indicate that investors are cautiously optimistic about the company's prospects.

Learn about Ulta Beauty's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives