- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

Tractor Supply (NasdaqGS:TSCO) Proposes Bylaw Changes; Share Price Moves 4%

Reviewed by Simply Wall St

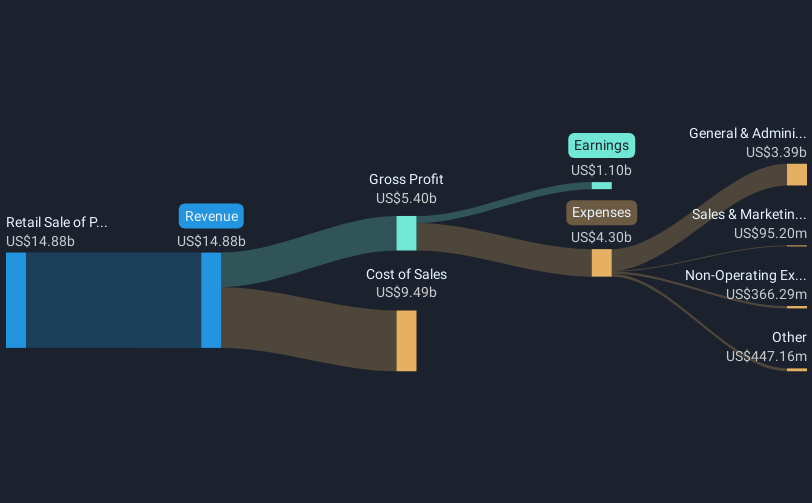

Tractor Supply (NasdaqGS:TSCO) proposed amendments to its certificate of incorporation aimed at improving officer protections and aligning with Delaware law, sparking interest ahead of the May 15 stockholders' meeting. During the same week, despite broader market pressures including 1% drops in major indexes like the S&P 500 due to high inflation readings and weak consumer sentiment, Tractor Supply's share price increased by 4%, suggesting market confidence in its governance reforms. This gain contrasts with sector declines, possibly highlighting investor optimism tied to the forthcoming changes and the company's resilience amid volatile market conditions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tractor Supply has significantly rewarded its shareholders with a total return of 247.87% over the past 5 years. This performance reflects strategic expansions and strong customer engagement initiatives, such as the Life Out Here strategy and the expansion of the Neighbor's Club. The inclusion of products like Weber grilling items in stores has also appealed to a broader customer base, strengthening revenue streams. Notably, the company's buyback plans increased share repurchases, enhancing shareholder value.

In the past year, however, Tractor Supply has underperformed the US market, which returned 8.5%, though it exceeded the US Specialty Retail industry's 1.5% decline. Despite slower growth predictions, the company has continued investing in infrastructure, with a new distribution center in Nampa, Idaho, aimed at enhancing operational efficiency. These growth and investment initiatives, alongside consistent dividend increases, underscore the company's commitment to shareholder returns beyond the immediate market dynamics.

Review our historical performance report to gain insights into Tractor Supply's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives