- United States

- /

- Specialty Stores

- /

- NasdaqGS:TDUP

US Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

As of December 2024, the U.S. stock markets are experiencing a remarkable upswing, with major indices like the Dow, S&P 500, and Nasdaq reaching record highs amid a surge in technology stocks. In such a vibrant market landscape, investors often seek opportunities beyond the well-trodden paths of large-cap stocks. Penny stocks—though an older term—still capture attention by representing smaller or less-established companies that can offer value and growth potential. By focusing on those with strong financials and clear growth prospects, investors may uncover promising opportunities in this niche segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.36 | $1.96B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.85 | $6.03M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $144.14M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.97 | $90.69M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $8.83M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.5309 | $51.48M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.83 | $2.39B | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9244 | $84.37M | ★★★★★☆ |

Click here to see the full list of 705 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

PLAYSTUDIOS (NasdaqGM:MYPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PLAYSTUDIOS, Inc. develops and publishes free-to-play casual games for mobile and social platforms globally, with a market cap of approximately $240.64 million.

Operations: The company's revenue is primarily derived from its Playgames segment, generating $298.75 million, with a minimal contribution of $0.005 million from the Playawards segment.

Market Cap: $240.64M

PLAYSTUDIOS, Inc., with a market cap of US$240.64 million, remains unprofitable despite generating US$298.75 million in revenue primarily from its Playgames segment. The company has a seasoned management team and board, with no debt and sufficient cash runway for over three years. However, it faces challenges as losses have increased at 63.5% annually over the past five years. Recent earnings showed a net loss of US$3.1 million in Q3 2024 compared to net income the previous year, yet it maintains its annual revenue guidance between US$285 to $295 million amidst ongoing share buybacks totaling US$24.49 million since 2021.

- Click here to discover the nuances of PLAYSTUDIOS with our detailed analytical financial health report.

- Gain insights into PLAYSTUDIOS' future direction by reviewing our growth report.

ThredUp (NasdaqGS:TDUP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ThredUp Inc. operates an online resale platform for secondhand clothing in the United States and internationally, with a market cap of approximately $196.80 million.

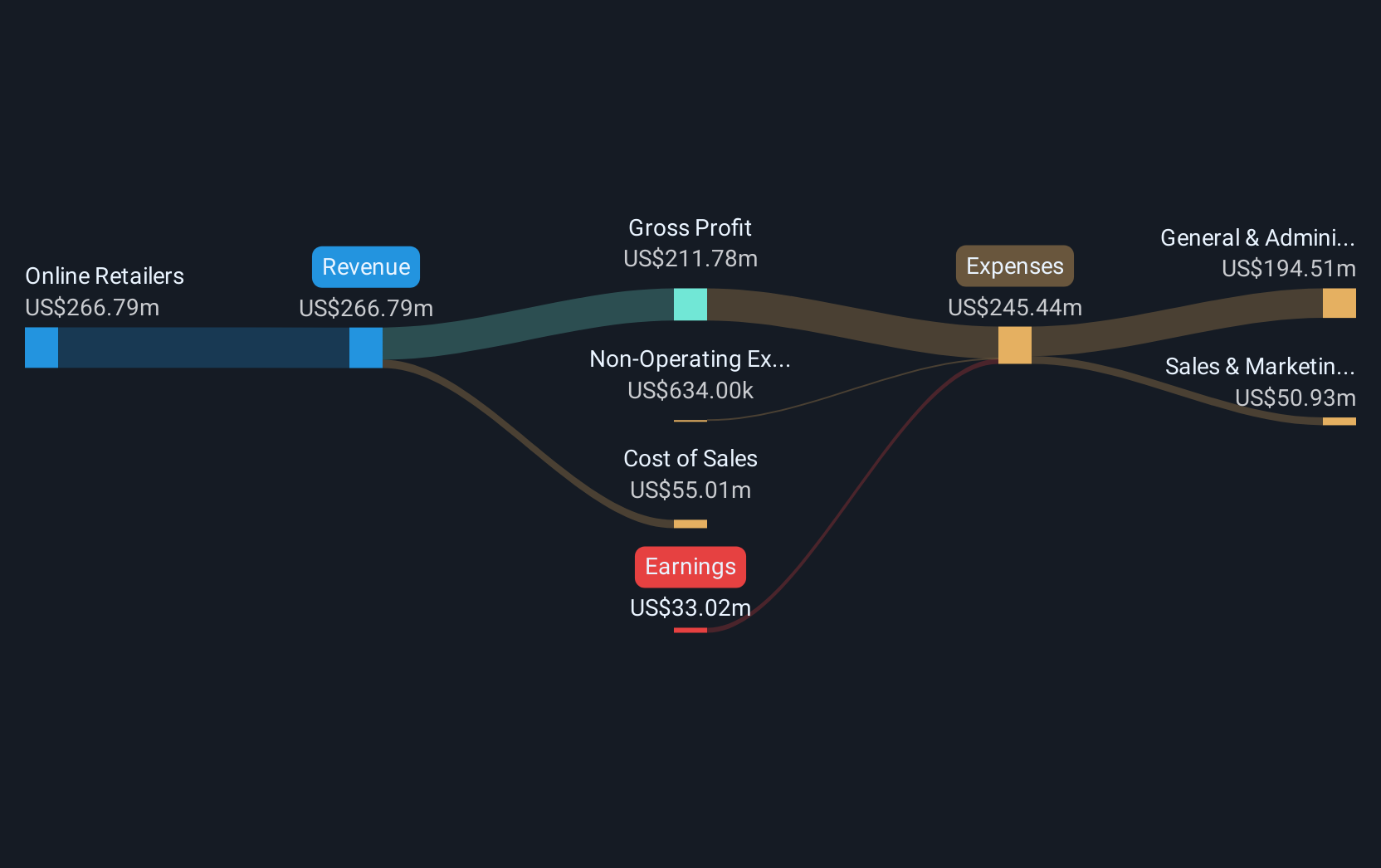

Operations: ThredUp Inc.'s revenue is primarily derived from its online retail segment, totaling $313.76 million.

Market Cap: $196.8M

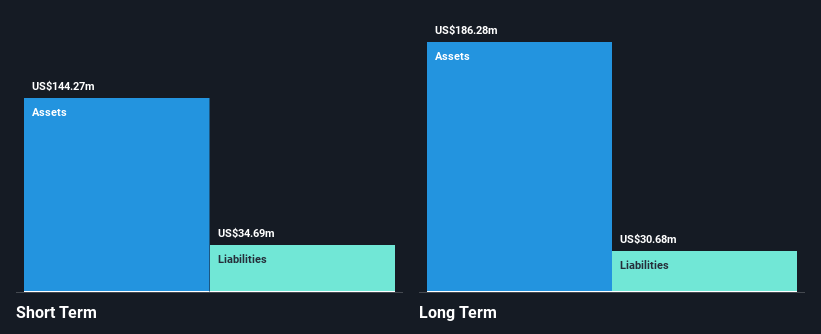

ThredUp Inc., with a market cap of US$196.80 million, operates in the online resale sector but remains unprofitable, with recent revenue of US$73.02 million for Q3 2024 and a net loss of US$24.77 million. The company faces potential delisting from Nasdaq and LTSE due to its stock price falling below the minimum bid requirement, though it plans to address this issue possibly through a reverse stock split. Despite these challenges, ThredUp has over three years of cash runway and recently appointed Danielle Vermeer as Head of Social Commerce to enhance its resale platform's engagement and accessibility.

- Click to explore a detailed breakdown of our findings in ThredUp's financial health report.

- Learn about ThredUp's future growth trajectory here.

trivago (NasdaqGS:TRVG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: trivago N.V., along with its subsidiaries, operates a hotel and accommodation search platform across various countries including the United States, Germany, and Japan, with a market cap of approximately $176.94 million.

Operations: The company's revenue is primarily derived from three geographical segments: Developed Europe (€192.69 million), the Americas (€170.90 million), and the Rest of World (€87.92 million).

Market Cap: $176.94M

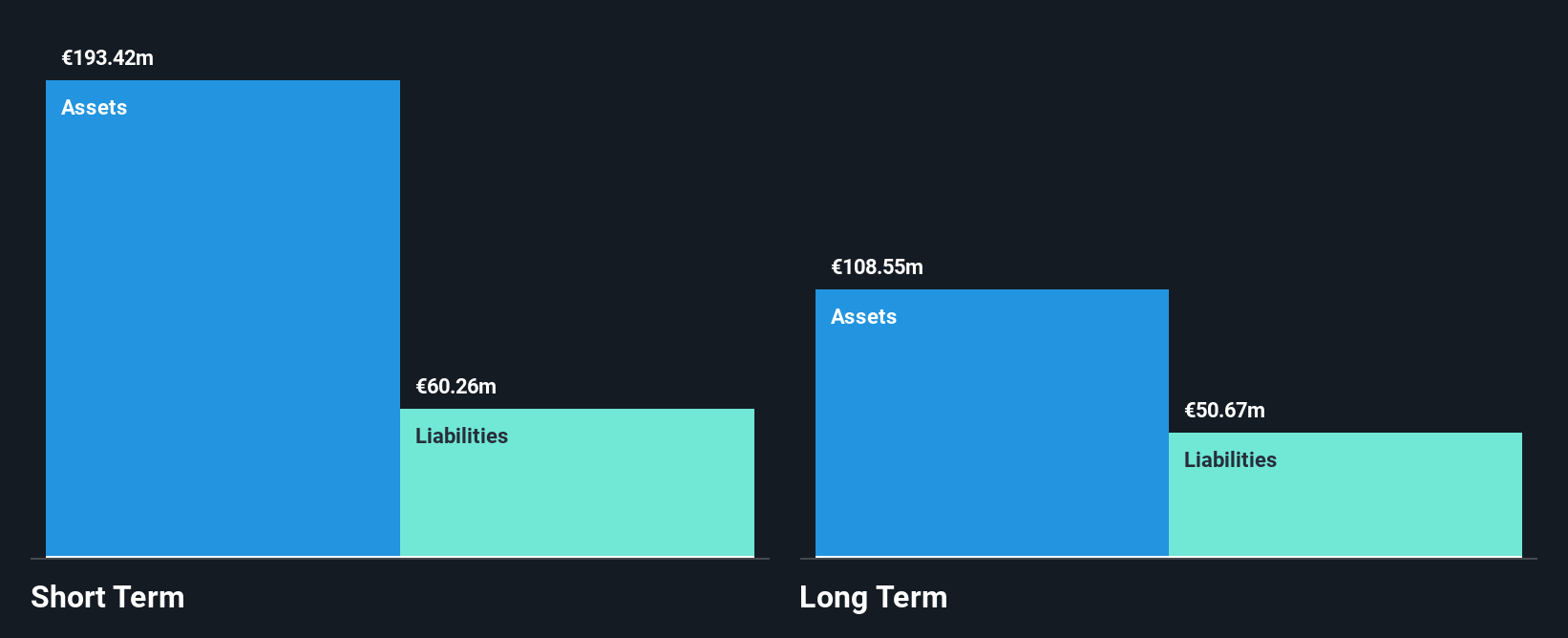

trivago N.V., with a market cap of approximately €176.94 million, operates in the hotel search platform space and faces challenges typical of penny stocks, including unprofitability and recent impairments of €30 million. Despite these hurdles, the company boasts a solid cash position with short-term assets (€182.6M) exceeding liabilities and no debt burden. Revenue for Q3 2024 was €146.09 million, down from last year, yet net losses have significantly narrowed to €15.43 million from €182.63 million year-over-year. Although management is relatively inexperienced with an average tenure of 1.6 years, trivago trades at a good relative value compared to peers.

- Unlock comprehensive insights into our analysis of trivago stock in this financial health report.

- Examine trivago's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Click here to access our complete index of 705 US Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ThredUp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TDUP

ThredUp

Operates an online resale platform in the United States and internationally.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives