- United States

- /

- Trade Distributors

- /

- NYSE:MSM

Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In the wake of recent market volatility, with major U.S. stock indexes experiencing sharp declines due to a tech sector pullback, investors are increasingly seeking stability and consistent returns. Dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option in uncertain economic times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| United Bankshares (UBSI) | 4.06% | ★★★★★☆ |

| Provident Financial Services (PFS) | 5.12% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.68% | ★★★★★★ |

| Interpublic Group of Companies (IPG) | 5.27% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.92% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.98% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.12% | ★★★★★★ |

| Ennis (EBF) | 5.89% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.36% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.74% | ★★★★★★ |

Click here to see the full list of 130 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

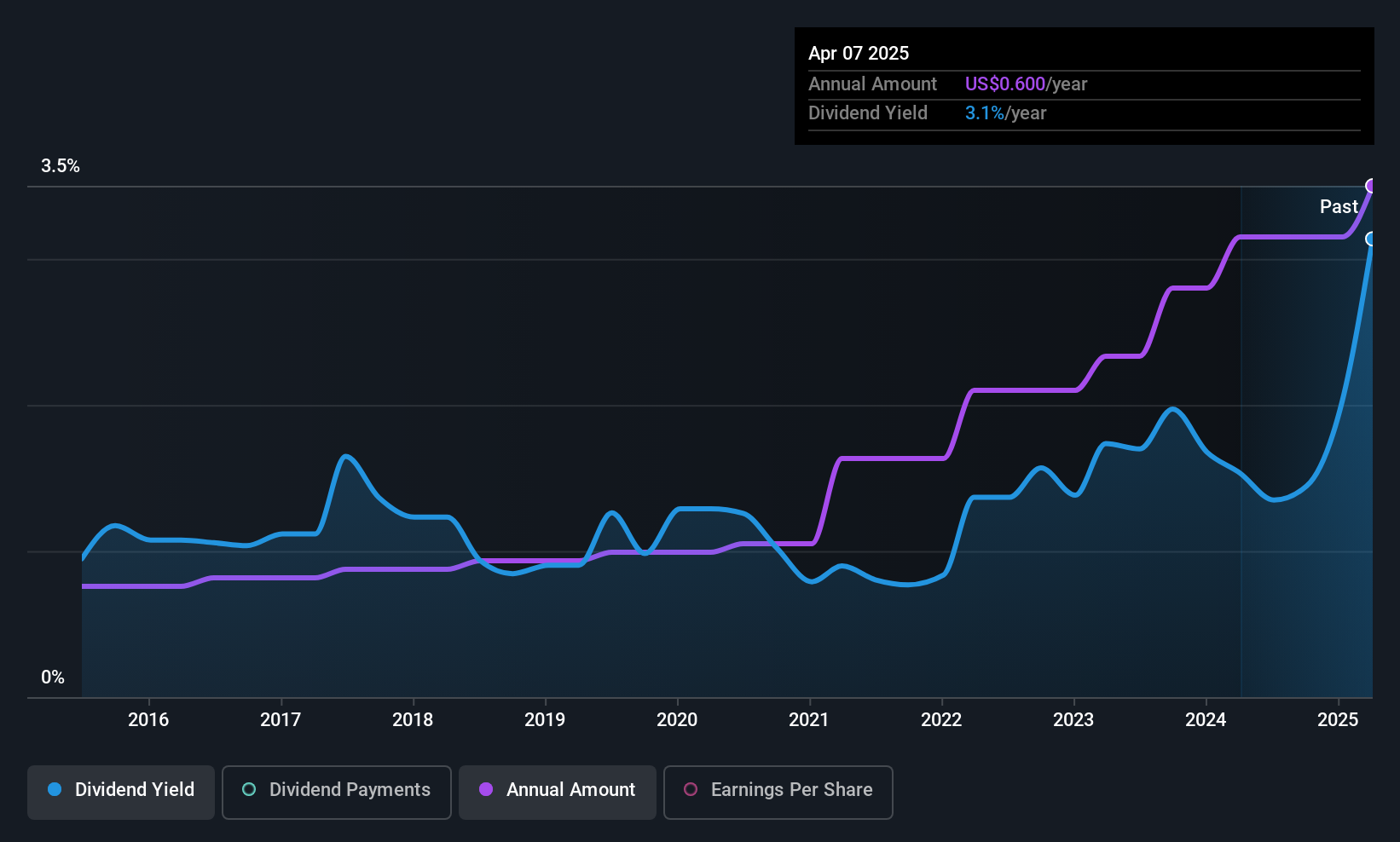

Shoe Carnival (SCVL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shoe Carnival, Inc. operates as a family footwear retailer in the United States with a market cap of $463.70 million.

Operations: Shoe Carnival generates revenue of $1.15 billion from selling footwear and related merchandise.

Dividend Yield: 3.4%

Shoe Carnival's dividend strategy appears robust, with consistent growth and stability over the past decade. The dividends are well-covered by earnings (24.8% payout ratio) and cash flows (69.4% cash payout ratio), suggesting sustainability. While the 3.42% yield is below top-tier US dividend payers, it remains attractive for investors seeking reliable income. Recent executive changes, including W. Kerry Jackson's return as CFO, may influence future financial strategies but don't directly impact current dividend reliability or coverage.

- Click to explore a detailed breakdown of our findings in Shoe Carnival's dividend report.

- The valuation report we've compiled suggests that Shoe Carnival's current price could be quite moderate.

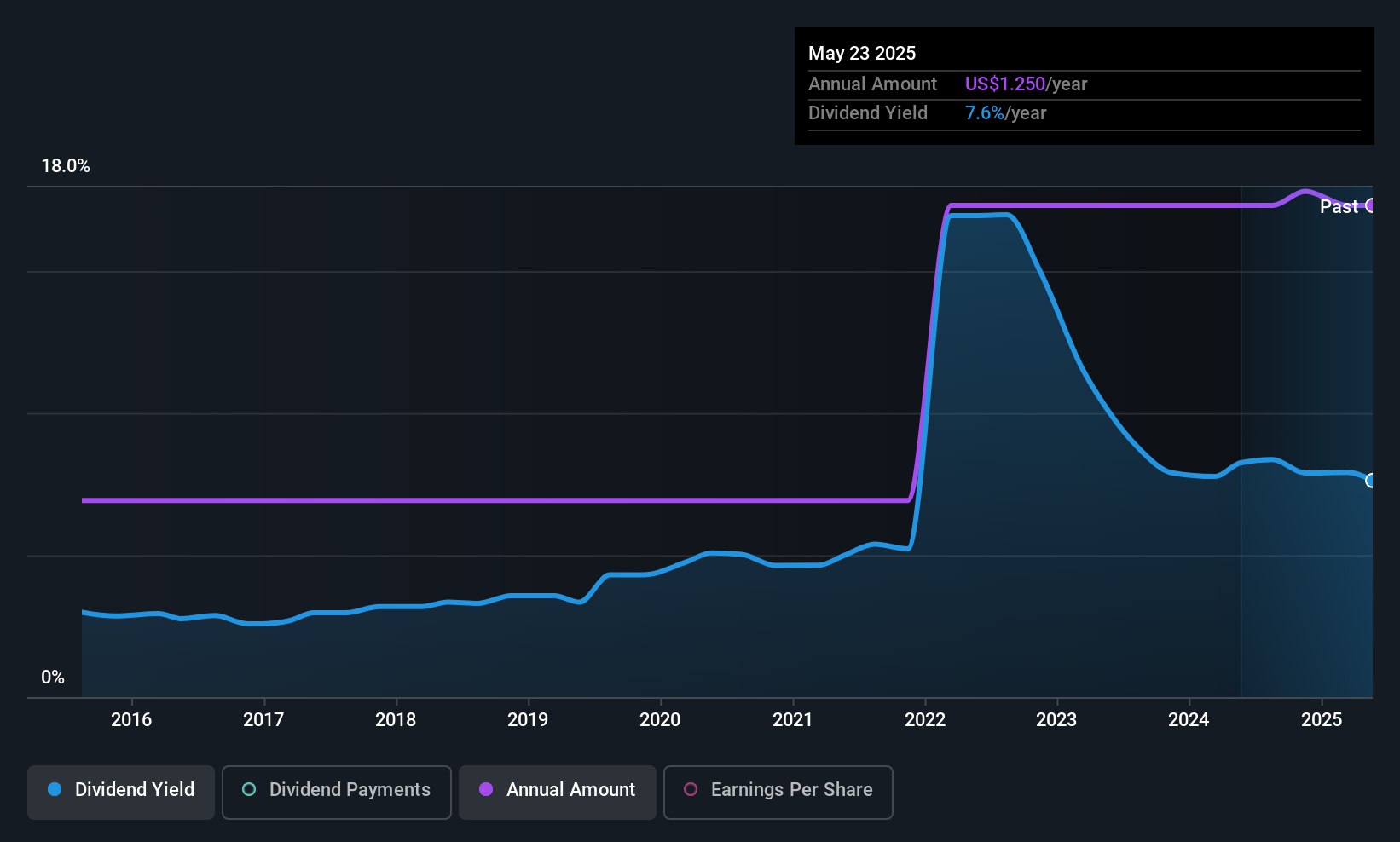

Spok Holdings (SPOK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spok Holdings, Inc., through its subsidiary Spok, Inc., offers healthcare communication solutions across various regions including the United States, Europe, Canada, Australia, Asia, and the Middle East with a market cap of $287.14 million.

Operations: Spok Holdings generates revenue primarily from its Clinical Communication and Collaboration Business, which amounted to $139.74 million.

Dividend Yield: 9%

Spok Holdings offers a high dividend yield of 9.04%, placing it among the top US dividend payers, but its sustainability is questionable due to a payout ratio of 154.2% and a cash payout ratio of 110.4%. Despite stable dividends over the past decade, recent insider selling raises concerns. The company reported Q3 revenue of US$33.87 million and net income of US$3.2 million, with earnings per share slightly down from last year, yet reiterated its full-year revenue guidance between US$138 million and US$143.5 million.

- Unlock comprehensive insights into our analysis of Spok Holdings stock in this dividend report.

- The analysis detailed in our Spok Holdings valuation report hints at an inflated share price compared to its estimated value.

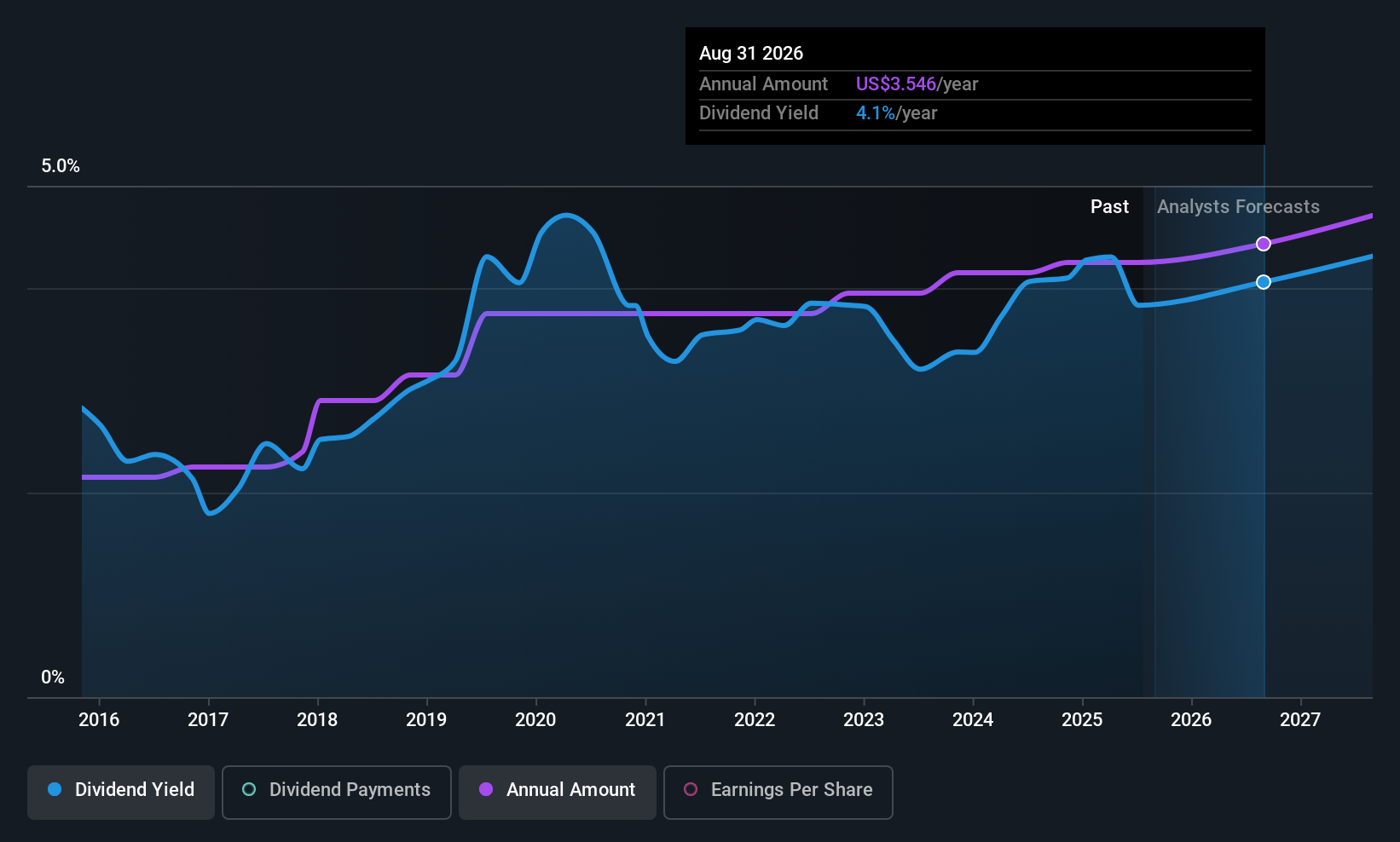

MSC Industrial Direct (MSM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MSC Industrial Direct Co., Inc. distributes metalworking and MRO products and services across North America, the United Kingdom, and internationally, with a market cap of approximately $4.99 billion.

Operations: MSC Industrial Direct Co., Inc.'s revenue primarily comes from its distribution of metalworking and MRO products and services, generating approximately $3.77 billion.

Dividend Yield: 3.9%

MSC Industrial Direct's dividend payments have been stable and growing over the past decade, though its yield of 3.88% is below the top quartile in the US market. Despite a recent increase to US$0.87 per share, sustainability concerns arise due to a high payout ratio of 95.7%, not fully covered by earnings or cash flows. Recent leadership changes may impact future strategies, with Martina McIsaac set to assume CEO duties in January 2026 following Erik Gershwind's resignation announcement.

- Delve into the full analysis dividend report here for a deeper understanding of MSC Industrial Direct.

- The valuation report we've compiled suggests that MSC Industrial Direct's current price could be inflated.

Key Takeaways

- Access the full spectrum of 130 Top US Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSM

MSC Industrial Direct

Engages in the distribution of metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, the United Kingdom, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives