- United States

- /

- Specialty Stores

- /

- NasdaqGS:SCVL

Investors Don't See Light At End Of Shoe Carnival, Inc.'s (NASDAQ:SCVL) Tunnel

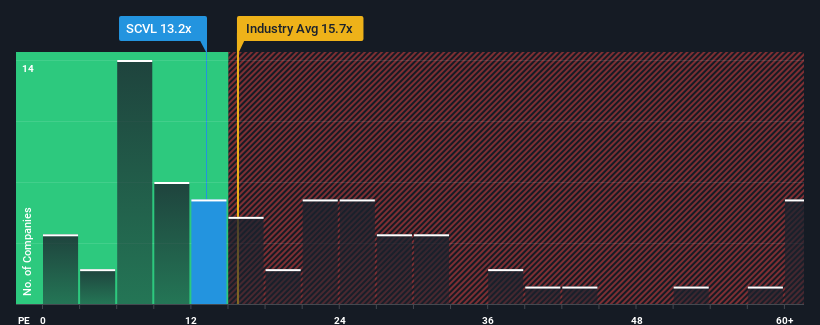

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider Shoe Carnival, Inc. (NASDAQ:SCVL) as an attractive investment with its 13.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Shoe Carnival has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Shoe Carnival

Is There Any Growth For Shoe Carnival?

In order to justify its P/E ratio, Shoe Carnival would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 376% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 6.9% each year as estimated by the two analysts watching the company. That's shaping up to be materially lower than the 10% per year growth forecast for the broader market.

With this information, we can see why Shoe Carnival is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Shoe Carnival's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Shoe Carnival's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Shoe Carnival with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Shoe Carnival. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SCVL

Shoe Carnival

Operates as a family footwear retailer in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives