- United States

- /

- Specialty Stores

- /

- NasdaqGS:ROST

How Investors Are Reacting To Ross Stores (ROST) Broad Store Openings and Community Investments

Reviewed by Sasha Jovanovic

- Ross Stores recently opened a wave of new Ross Dress for Less locations across numerous states, including Texas, Michigan, California, and Arizona, with each store creating around 55 to 60 jobs and supporting local community organizations via charitable donations.

- This expansion not only increases the company's national footprint but also highlights its commitment to job creation and local community engagement as it enters both established and underpenetrated markets.

- We'll explore how this broad-based store expansion may influence Ross Stores' growth outlook and investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Ross Stores Investment Narrative Recap

At its core, the Ross Stores investment story rests on faith in the continued strength of the value retail model, the company’s ability to drive incremental revenue from expanding into new geographic markets, and effective cost discipline to manage margin pressures. The recent nationwide wave of new store openings across more than a dozen states reinforces the company’s expansion catalyst, but does not materially remove near-term concerns about operating margins and the sustainability of this growth if cost headwinds persist.

Among the latest developments, Ross Stores’ entry into several new Michigan markets stands out. This move expands the company’s footprint in underpenetrated regions and highlights management’s focus on finding growth beyond core geographies, an important signal as investors watch for meaningful revenue gains from the 90-plus new stores planned this year, while also monitoring closely for market saturation and margin dilution.

By contrast, investors should be aware of the risks if continued cost pressure begins to outweigh the benefits of further expansion...

Read the full narrative on Ross Stores (it's free!)

Ross Stores' outlook anticipates $25.0 billion in revenue and $2.4 billion in earnings by 2028. This projection implies a 5.1% annual revenue growth rate and a $0.3 billion increase in earnings from the current $2.1 billion.

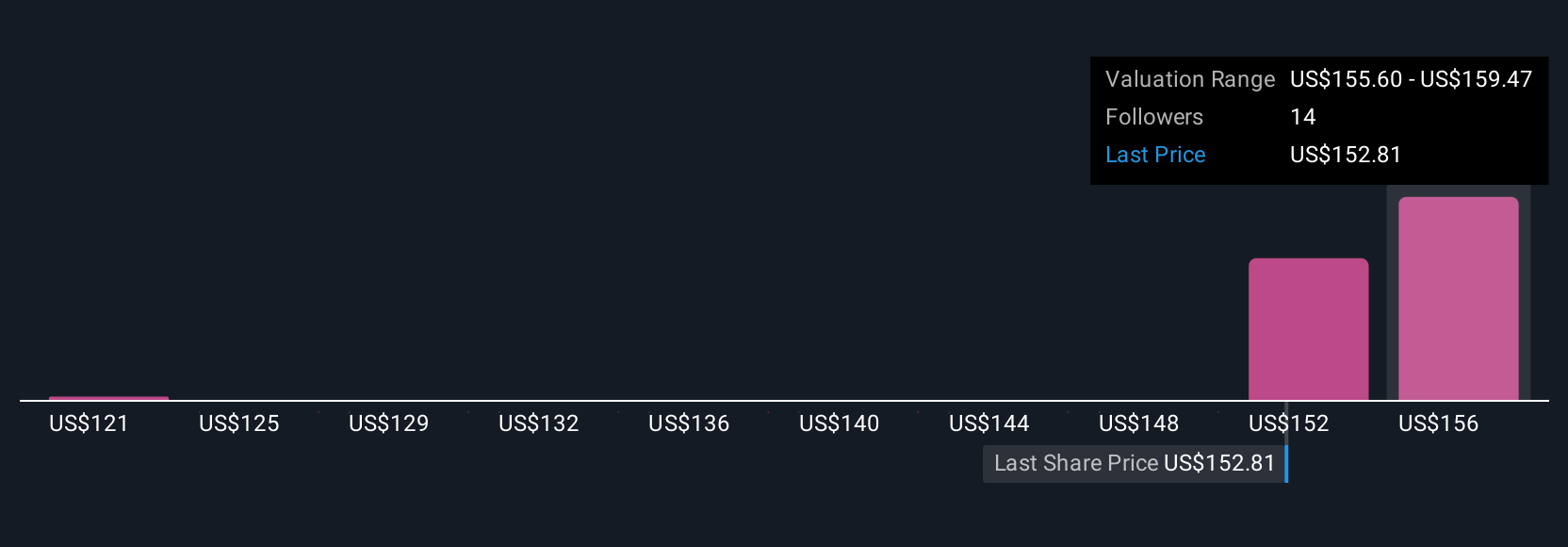

Uncover how Ross Stores' forecasts yield a $159.47 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate Ross Stores’ fair value from as low as US$10.84 to as high as US$159.47. As Ross ramps up store expansion, ongoing cost pressure remains a key factor that could shape future performance, so consider diverse viewpoints when reviewing these estimates.

Explore 5 other fair value estimates on Ross Stores - why the stock might be worth less than half the current price!

Build Your Own Ross Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ross Stores research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ross Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ross Stores' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROST

Ross Stores

Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brands in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives