- United States

- /

- Specialty Stores

- /

- NasdaqGS:ROST

Can Ross Stores’ (ROST) Capital Return Strategy Outweigh Softer Profit Guidance?

Reviewed by Simply Wall St

- On August 21, 2025, Ross Stores released updated earnings guidance projecting third and fourth quarter comparable store sales growth of 2% to 3%, but with earnings per share expected to be below last year's levels, and also reported second quarter results showing sales growth to US$5.53 billion alongside a small year-on-year decrease in net income and earnings per share.

- An interesting aspect is Ross Stores' continued commitment to shareholder returns through buybacks and dividend payments, with 1.9 million shares repurchased for US$262 million and a quarterly dividend affirmed, despite softer profit guidance.

- We will explore how the revised earnings outlook, featuring modest sales gains but lower earnings forecasts, shapes Ross Stores' investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ross Stores Investment Narrative Recap

To be a shareholder in Ross Stores, you need confidence in the company's ability to grow its value-oriented retail model through sustained store expansion and resilient consumer demand, even as profit margins face pressure. The recent guidance confirming modest sales growth but softer earnings does not dramatically alter the central catalyst, broadening market reach, though it puts a spotlight on margin risks. The biggest near-term risk continues to be pressures on operating margins from tariffs and distribution costs, which remain a concern given the current trend in profitability.

Among recent announcements, the company's decision to repurchase 1.9 million shares for US$262 million stands out against the backdrop of earnings pressure. This continued focus on returning value to shareholders, even as earnings per share guidance was revised lower, underscores management's ongoing commitment to capital allocation and may support sentiment until margin trends improve.

In contrast, investors should keep a close eye on margin compression, especially if elevated distribution costs persist and cannot be offset by other initiatives...

Read the full narrative on Ross Stores (it's free!)

Ross Stores' outlook anticipates $25.0 billion in revenue and $2.4 billion in earnings by 2028. This reflects a 5.1% annual revenue growth rate and a $0.3 billion increase in earnings from the current $2.1 billion level.

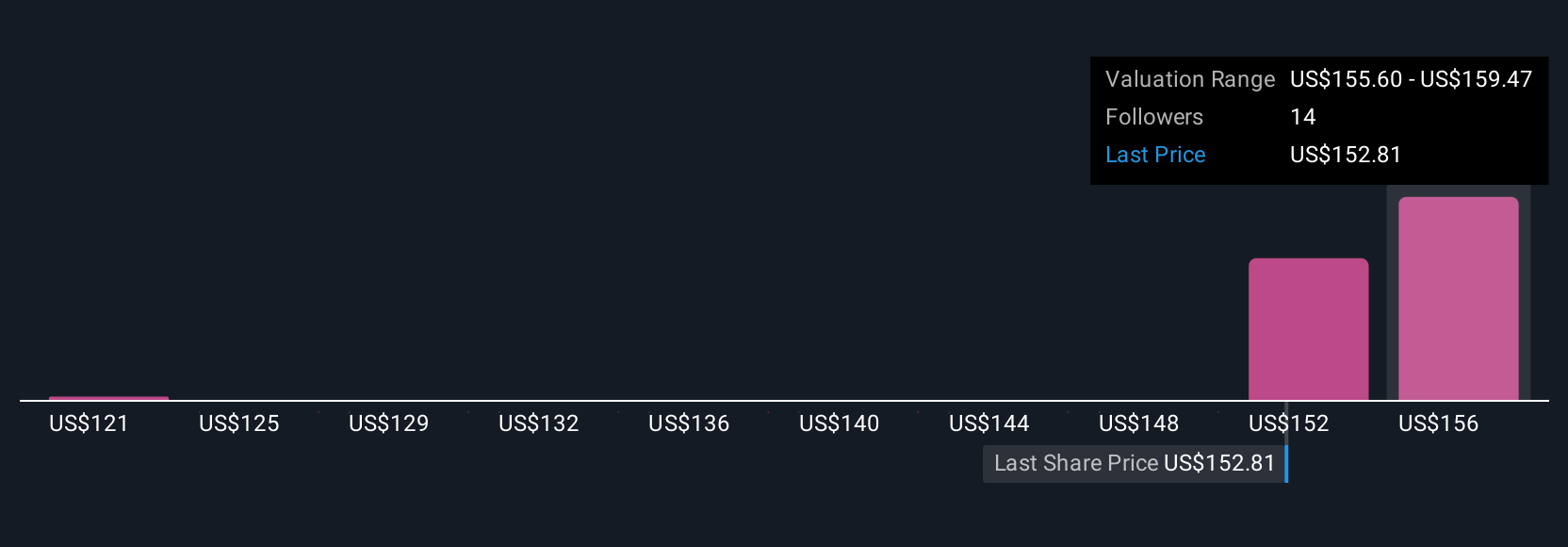

Uncover how Ross Stores' forecasts yield a $158.88 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value Ross Stores between US$120.81 and US$158.88 based on four individual forecasts. While opinions vary, keep in mind that margin pressure from rising costs may weigh on future profitability, shaping the company's outlook beyond headline sales results.

Explore 4 other fair value estimates on Ross Stores - why the stock might be worth as much as 5% more than the current price!

Build Your Own Ross Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ross Stores research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ross Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ross Stores' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROST

Ross Stores

Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brands in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives